[ad_1]

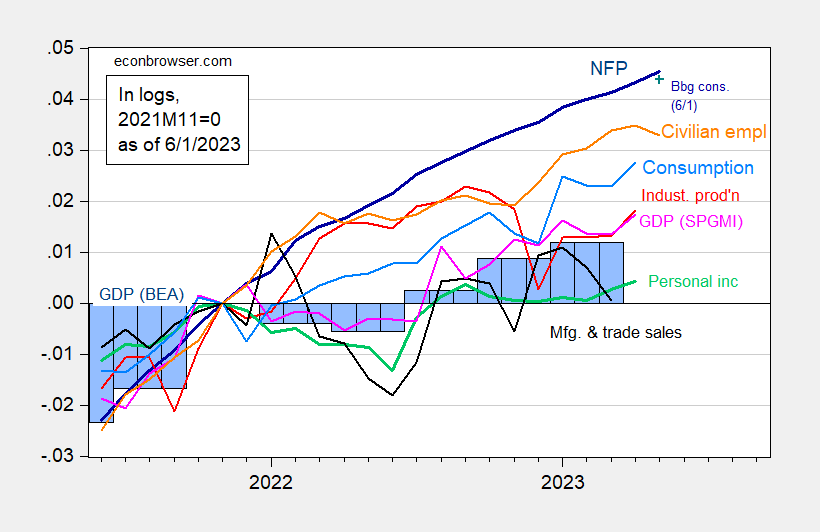

Nonfarm payroll employment progress far exceeded consensus, at 339K vs 180K. With April’s month-to-month GDP from SPGMI, we have now the next image of indicators adopted by the NBER BCDC (together with month-to-month GDP):

Determine 1: Nonfarm payroll employment, NFP (darkish blue), Bloomberg consensus of 6/1 (blue +), civilian employment (orange), industrial manufacturing (pink), private earnings excluding transfers in Ch.2012$ (inexperienced), manufacturing and commerce gross sales in Ch.2012$ (black), consumption in Ch.2012$ (gentle blue), and month-to-month GDP in Ch.2012$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Bloomberg consensus stage calculated by including forecasted change to earlier unrevised stage of employment out there at time of forecast. Supply: BLS, Federal Reserve, BEA 2023Q1 2nd launch through FRED, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (6/1/2023 launch), and writer’s calculations.

Nonfarm payroll employment within the newest launch exceeds the implied stage partly due to the shock on employment progress and upward revisions to earlier months’ ranges.

GDPNow (at present’s launch) for Q2 is 2.0% SAAR. So GDP progress appears to be sustaining momentum. Nevertheless, as famous in this post, different measures of combination output have trended sideways or downward.

[ad_2]