[ad_1]

Christine McCann/iStock Editorial by way of Getty Photographs

Foreword

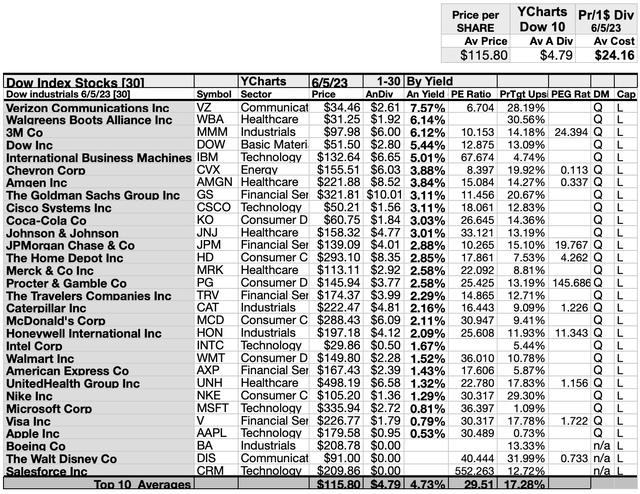

Whereas greater than half this assortment of Dow Industrials is just too expensive and divulges solely skinny dividends, three of the 5 lowest priced Canine of the Dow are prepared to purchase. This month, Verizon Communications Inc (VZ), Walgreens Boots Alliance (WBA), and Dow Inc (DOW) stay as much as the dogcatcher perfect of annual dividends from $1K invested exceeding their single share costs. Nevertheless, 4 extra, 3M Co (MMM), Cisco (CSCO), Coca-Cola Co (KO), and Worldwide Enterprise Machines Corp (IBM), confirmed costs inside $39 of assembly that purpose. The opposite three, Chevron (CVX), Amgen Inc (AMGN), and The Goldman Sachs Group (GS) want costs to drop $78 to $222 earlier than they attain the dogcatcher perfect degree.

With renewed draw back market stress of 69%, it might be attainable for all ten to turn into elite fair-priced canines with their annual yield (from $1K invested) assembly or exceeding their single share costs by yr’s finish.

[See a summary of top ten fair-priced May Dow Dogs in Actionable Conclusion 21 near the middle of this article].

Actionable Conclusions (1-10): Brokers Count on 17.45% To 35.7% Internet Good points From Prime-Ten Dow Canine By June 2024

Six of ten high dividend-yielding Dow canines (tinted grey within the chart under) had been among the many high ten gainers for the approaching yr based mostly on analyst 1-year goal costs. So, this June, 2023 yield-based forecast for Dow canines, as graded by Wall St. wizard estimates, was 60% correct.

Estimated dividend returns from $1000 invested within the ten highest-yielding shares and their mixture one-year analyst median goal costs, as reported by YCharts, created the 2023-24 information factors for the projections under. (Word: one-year goal costs estimated by lone analysts weren’t utilized). Ten possible profit-generating trades projected to June, 2024 had been:

Walgreens Boots Alliance was projected to internet $357.00, based mostly on the median of goal costs estimated by 15 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 28% lower than the market as a complete.

Verizon Communications Inc was projected to internet $348.35, based mostly on dividends, plus the median of goal worth estimates from 23 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 63% lower than the market as a complete.

The Walt Disney Co (DIS) was projected to internet $309.78, based mostly on the median of goal worth estimates from 27 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 30% larger than the market as a complete.

Nike Inc (NKE) was projected to internet $294.73, based mostly on dividends, plus the median of goal worth estimates from 33 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 11% larger than the market as a complete.

Chevron Corp (CVX) was projected to internet $228.08, based mostly on the median of goal worth estimates from 25 analysts, plus the estimated annual dividend, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 17% larger than the market as a complete.

The Goldman Sachs Group was projected to internet $227.71, based mostly on the median of goal estimates from 24 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 41% over the market as a complete.

3M Co was forecast to internet $193.27, based mostly on the median of goal worth estimates from 17 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 5% lower than the market as a complete.

United Well being Group Inc (UNH) netted $181.47 based mostly on the median of goal worth estimates from 24 analysts, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 32% lower than the market as a complete.

Visa Inc (V) was projected to internet $175.75 based mostly on the median of goal worth estimates from 34 analysts, plus dividends, much less dealer charges. The Beta quantity confirmed this estimate topic to danger/volatility 3% lower than the market as a complete.

Dow Inc was projected to internet $174.50, based mostly on dividends, plus median goal worth estimates from 23 analysts, much less dealer charges. A Beta quantity remains to be not out there for Dow.

The common internet achieve in dividend and worth was estimated at 24.91% on $10k invested as $1k in every of those high ten Dow Index shares. This achieve estimate was topic to common danger/volatility 13% lower than the market as a complete.

Supply: Open supply canine artwork from dividenddogcatcher.com

The Dividend Canine Rule

Shares earned the “canine” moniker by exhibiting three traits: (1) paying dependable, repeating dividends, (2) their costs fell to the place (3) yield (dividend/worth) grew increased than their friends. Thus, the best yielding shares in any assortment turned often called “canines.” Extra exactly, these are, actually, finest known as, “underdogs.”

The June, 2023 Dow 30 By Yield

Actionable Conclusions (11-20): 10 Prime Dow Dividend Shares By Yield Ranged 3.03% To 7.57% Per YCharts

Prime ten Dow canines as of 6/5/23 represented seven of 11 Morningstar sectors.

The lone communication companies sector member took first place, Verizon (VZ)[1]. This was adopted by two healthcare shares in second and seventh locations, Walgreens Boots Alliance [2] and Amgen Inc [7].

Then, a lone industrials canine was third, 3M Co [3]. In fourth place was the lone primary supplies canine, Dow Inc[5].

Know-how sector canines took the fifth, and ninth positions, Worldwide Enterprise Machines [5], and Cisco Techniques Inc [9].

One other loner from the power sector was sixth, Chevron [6]. Eighth place belonged to the monetary companies consultant, The Goldman Sachs Group [8], and eventually, in tenth, the shopper defensive stalwart, Coca-Cola Co [10] accomplished the incoming June Canine of the Dow by yield.

Dividend Vs. Value Outcomes

A graph above exhibits the relative strengths of the highest ten Dow canines by dividend and worth as of market shut 6/5/2023.

This month seven of the top-ten Dow canines present a lower than perfect standing as a result of the costs of these seven exceed projected annual dividends from $10k invested as $1k every). A dividend dogcatcher precedence is to pick shares whose dividends from $1K invested are larger than their single share worth. As talked about above, that situation was reached by three of the 5 lowest priced Canine of the Dow. Verizon Communications, Walgreens Boots Alliance, and Dow Inc, all stay as much as the dogcatcher perfect of annual dividends from $1K invested exceeding their single share costs. Moreover, 4 extra, confirmed costs inside $39 of assembly that perfect purpose as of June 5. These 4 outliers are: Worldwide Enterprise Machines Corp (IBM) $51.09 away, 3M Co (MMM) $20.52 off purpose, Coca-Cola Co (KO) $18.09 out, and Cisco Techniques Inc (CSCO) $10.72 away.

Actionable Conclusion (21): Two of Twenty-Seven Dow Dividend Canine Are Overbought

A damaging hole between dividend yield and free money movement yield defines an overbought (or oversold) inventory. That’s, their dividend payout exceeds their money readily available to pay dividends. They’re Intel (INTC), and Walgreens Boots Alliance.

Two lower their dividends within the 2020 Ides of March despair instances, The Boeing Firm (BA), and The Walt Disney Co (DIS). Yet one more snuck onto the Dow index and not using a dividend, the latest of the three newest no-dividend shares within the index, Salesforce Inc (CRM). All 5, two quick on money and three non-dividend payers, usually are not stockholder pleasant.

Keep in mind this dogcatcher yield-based stock-picking technique is contrarian. Meaning rooting for (shopping for) the underdog is productive when you do not already personal these shares. Should you do maintain these shares, then you need to search for opportune pull-backs in worth so as to add to your place to finest enhance your dividend yield. Loads of pull-back alternatives look like forward.

Value Drops or Dividend Will increase Might Get All Ten Dow Canine Again to “Honest Value” Charges For Buyers

The charts above retain the present dividend quantity and alter share worth to supply a yield (from $1K invested) to equal or exceed the only share worth of every inventory. As the highest illustration exhibits, three are ideally priced. Beside Verizon Communications, Walgreens Boots Alliance, and Dow Inc are already within the perfect zone; 4 extra low-priced shares are inside $50.10 of getting there as famous above.

The choice, after all, might be that these firms increase their dividends. That nonetheless seems to be an excessive amount of to ask in these extremely disrupted, inflationary, recessionary, but cash-rich instances. Mr. Market is far more efficient at transferring costs up or all the way down to acceptable quantities, simply watch and purchase when the focused inventory worth strikes to a candy spot.

Actionable Conclusions: (22-31) Dealer 1-Yr. Targets Confirmed 14.4% To 31.98% Prime Ten Dow Index Upsides To June, 2024; (32) No Downsides Had been Revealed

To quantify high canine rankings, analyst median worth goal estimates offered a “market sentiment” gauge of upside potential. Added to the straightforward high-yield “canine” metrics, analyst median worth goal estimates offered one other software to dig out bargains.

Analysts Forecast A 13.64% Benefit For five Highest-Yield, Lowest-Priced of 10 Dow Canine As Of June 5, 2024

Ten high Dow canines had been culled by yield for his or her month-to-month replace. Yield (dividend / worth) outcomes as verified by YCharts did the rating.

As famous above, top-ten Dow canines chosen 6/5/23 by yield, represented eight of the eleven sectors. The Shopper Cyclical sector went lacking. (Actual Property shouldn’t be reported and Utilities has its personal Dow Index).

Actionable Conclusions: Analysts Anticipated 5 Lowest-Priced of the Ten Highest-Yield Dow Canine (34) To Ship 23.89% Vs. (35) 21.02% Internet Good points by All Ten Come June 5, 2024

$5000 invested as $1k in every of the 5 lowest-priced shares within the high ten Dow Dividend kennel by yield had been predicted by analyst 1-year targets to ship 13.64% extra achieve than from $5,000 invested in all ten. The very lowest-priced high ten yielding inventory, Walgreens Boots Alliance, confirmed high analyst-estimated good points of 35.70%.

The 5 lowest-priced Dow top-yield canines for June 5 had been: Walgreens Boots Alliance Inc; Verizon Communications Inc; Cisco Techniques Inc; Dow Inc; Coca-Cola Co, with costs starting from $31.25 to $60.75.

5 higher-priced Dow top-yield canines as of June 5 had been: 3M Co; Worldwide Enterprise Machines Corp; Chevron Corp; Amgen Inc; The Goldman Sachs Group, whose costs ranged from 97.98 to $321.81.

The excellence between 5 low-priced dividend canines and the overall subject of ten mirrored Michael B. O’Higgins’ “primary technique” for beating the Dow. The dimensions of projected good points based mostly on analyst targets added a novel component of “market sentiment” gauging upside potential. It offered a here-and-now equal of ready a yr to search out out what may occur available in the market.

Warning is suggested, since analysts are traditionally solely 15% to 85% correct on the course of change and simply 0% to fifteen% correct on the diploma of change. (In 2017, the market considerably adopted analyst sentiment. In 2018, analysts estimates had been contrarian indicators of market efficiency, they usually continued to be opposite for the primary two quarters of 2019 however switched to conforming for the final two quarters). In 2020, analyst projections had been fairly contrarian.

The primary half of 2021 most dividend inventory worth actions exceeded all analyst expectations. The final half of 2021 was nonetheless gangbusters. The 2022 September-December droop freed-up 5 or extra Dow canines, sending them into the perfect zone the place returns from $1k invested equal (or exceed) their single-share worth.

Because the Fed-fueled slide good points momentum in 2023, search for a lot of the ten Dow Canine to turn into Honest-priced… slowly, however certainly.

Afterword

Lest there be any doubt concerning the suggestions on this article, this month there have been two Dow Index shares exhibiting dividends for $1k invested exceeding single share worth: Verizon Communications, and Walgreens Boots Alliance, nonetheless, each are overbought with dividend yield exceeding free money movement yield.

The dogcatcher hands-off suggestions are nonetheless in place referring to a few suspects. One which lower its dividend in March, 2020, being Boeing has, in the meantime, re-learned (and is licensed in sure nations) to fly, it nonetheless has to coax prospects to purchase planes once more. BA faces sturdy headwinds to remain on the Dow index (regardless of analyst optimism for the lone U.S. business air-crafter).

Additionally hold fingers off the latest non-dividend member of the Dow, Salesforce.com Inc, till it declares a dividend from $1K invested larger than its single share worth, maybe new management will assist.

Whereas subscriptions hold the ship afloat, Disney wants audiences to get strapped again into shopping for tickets to observe and journey and can possible by no means resume a dividend. In the meantime, DIS has Apple, Amazon, Netflix, and Paramount, TikTok, and quite a few different content material suppliers pouring out streamable content material. Will the mouse home ever roar once more, not to mention, pay dividends?

The online achieve/loss estimates above didn’t consider any international or home tax issues ensuing from distributions. Seek the advice of your tax advisor concerning the supply and penalties of “dividends” from any funding.

Shares listed above had been recommended solely as attainable reference factors to your Dow dividend canine inventory buy or sale analysis course of. These weren’t suggestions.

[ad_2]