[ad_1]

New Deal Democrat suggests normalizing on 2023M01 as an alternative of to 2022M11. Right here’re the NBER BCDC indicators, plus month-to-month GDP, in addition to a slew of others, since then.

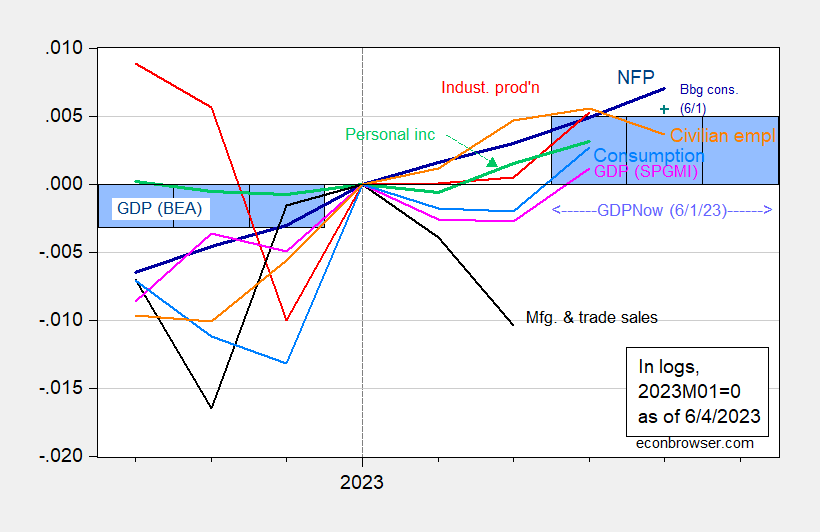

Determine 1: Nonfarm payroll employment, NFP (darkish blue), Bloomberg consensus of 6/1 (blue +), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding transfers in Ch.2012$ (inexperienced), manufacturing and commerce gross sales in Ch.2012$ (black), consumption in Ch.2012$ (mild blue), and month-to-month GDP in Ch.2012$ (pink), GDP (blue bars), 2023Q1 is GDPNow of 6/1, all log normalized to 2023M01=0. Bloomberg consensus degree calculated by including forecasted change to earlier unrevised degree of employment out there at time of forecast. Supply: BLS, Federal Reserve, BEA 2023Q1 2nd launch by way of FRED, Atlanta Fed, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (6/1/2023 launch), and creator’s calculations.

As New Deal Democrat factors out, NFP and private revenue are usually not as clearly rising as when normalized to 2022M01. They’re, nonetheless, nonetheless rising (CPS sequence civilian employment is falling Could, however as famous elsewhere, one shouldn’t put an excessive amount of weight on this sequence given its volatility). Notice GDPNow development as of 6/1 (so utilizing information from 2/3 of quarter 2) is optimistic, at 2% q/q SAAR.

And different sequence.

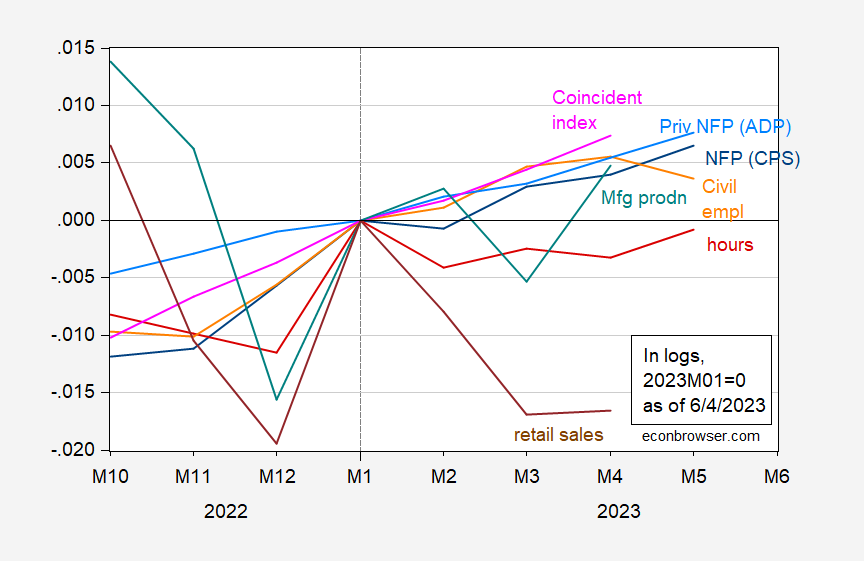

Determine 2: Civilian employment adjusted to nonfarm payroll employment idea (darkish blue), personal nonfarm payroll employment from ADP (sky blue), civilian employment (orange), combination weekly hours for manufacturing and nonsupervisory staff (crimson), manufacturing manufacturing (teal), coincident index (teal), retail gross sales ex-food providers deflated by CPI (brown), all log normalized to 2023M01=0. Bloomberg consensus degree calculated by including forecasted change to earlier unrevised degree of employment out there at time of forecast. Supply: BLS, Federal Reserve, and Philadelphia Fed by way of FRED, and creator’s calculations.

Combination hours are certainly down barely. Retail gross sales too, though that sequence is sort of risky. This sequence has been trending downward since 2022M04.

So, a shorter interval, one would possibly have the ability to infer a deceleration extra clearly.

[ad_2]