[ad_1]

Summary: We take a second have a look at the price variations between precise Bitcoin blocks produced by miners and the charges one could count on, based mostly on a neighborhood Bitcoin Core node. We discover the idea of out of band charges as a possible clarification for these variations. We have now detected proof that the latest obvious enhance in these variations will not be as important as some individuals could suspect and the proof for will increase in out of band charges could subsequently be restricted.

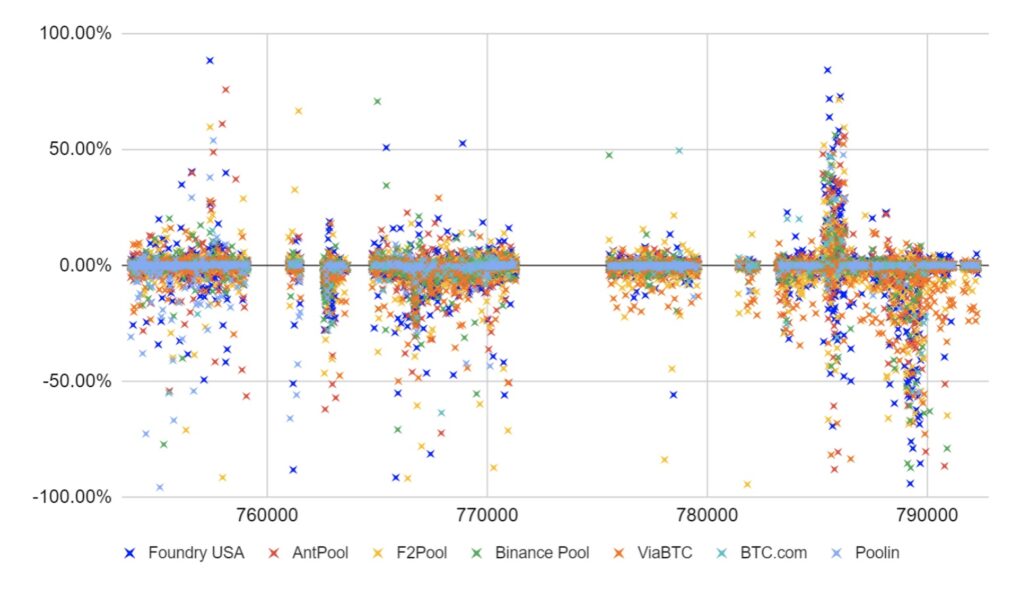

Miner charges by pool – Precise blocks vs block templates (Variations) – Proportion of whole charges

Notice: Optimistic quantity signifies precise block charges are increased than the block template charges. Block template knowledge is from one Bitcoin node run by Sjors Provoost. Gaps are the durations the node was not producing templates. The chart is constructed by Google Sheets in layers, with Poolin on the high and Foundry USA on the backside.

Overview

This piece needs to be thought-about an replace to our January 2021 piece entitled “Bitcoin Miner Transaction Fee Gathering Capability”. The unique piece was impressed by Marathon mining pool asserting a coverage of transaction censorship (The pool not has this coverage). This new piece, which collects the identical sort of information over a newer interval, is impressed by latest feedback from analysts, which point out that miners could in some way be making more cash in charges than one would count on, given the transactions obtainable within the reminiscence pool.

Out of band charges

Charges could possibly be paid to miners “out of band”, which implies the charges are usually not paid by the traditional open reminiscence pool system. This terminology originates from telecommunications and refers to messages being despatched exterior the first communication channel. One instance of this are “transaction accelerator providers”, which have been round for a few years in Bitcoin. These are providers the place customers pays a price to an organization, together with a Bitcoin TXID. The corporate would then cross on a few of this cost to mining swimming pools who join this service. The transaction could then get mined sooner and the price could be paid “out of band”. One other instance is an ordinals inscriber immediately offering their very massive transaction to the miner, because the transaction is not going to be broadcast by Bitcoin Core as its non-standard.

If out of band charges grow to be very fashionable, that is doubtlessly unhealthy from the angle of Bitcoin’s decentralisation and subsequently censorship resistance. Firstly, miners will presumably want to join a centralised service or have a relationship with particular person customers. This can be a barrier to entry with a view to get into the mining business and will contribute to centralising mining. Additionally it is a destructive from a consumer perspective too, customers would wish to take care of some explicit entities to get their transactions within the blockchain, entities which might, in principle, censor transactions. Alternatively, there could also be different decentralised mechanisms to get a non-standard transaction to a miner with out utilizing the usual mempool system.

One other drawback with sending transactions on to a miner is that it slows down block propagation between mining swimming pools. It is because compact blocks don’t work effectively when intermediate nodes don’t learn about a transaction. Gradual propagation creates a centralisation stress. That is much less of an issue if the transaction is commonplace and pays sufficient price to finish up in all mempools, and the out of band cost is barely used to high up the price for sooner inclusion.

One might argue that out of band charges mustn’t exist. The reminiscence pool is already presupposed to be an open aggressive price market and subsequently out of band charges shouldn’t be required. Nonetheless, sadly it doesn’t at all times work like that. Out of band charges could possibly be widespread for the next causes:

- Some customers could not have ample experience to know the reminiscence pool and market price charges. On the similar time they might not know the best way to set charges appropriately.

- Pockets price administration programs will not be sufficiently consumer pleasant.

- Some wallets programs could not help all of the price administration options similar to customized price charges, RBF and CPFP.

- Companies like exchanges, could wish to speed up consumer deposits. They might not wish to use CPFP, because the funds could possibly be despatched to a chilly pockets and subsequently out of band charges could possibly be crucial for safety causes.

- An change could also be unwilling to make use of RBF for withdrawals, particularly batched withdrawals, as shoppers might rely upon the TXID not altering and will have already spent the unconfirmed outputs.

- A consumer could also be sending a transaction with out change and will don’t have any spare inputs and subsequently can not conduct an RBF price enhance.

- Some sort of good contract could possibly be concerned, similar to lightning non-cooperative closure transactions, which might restrict the power of customers to extend charges in sure situations.

- One of many quirks or buggy Bitcoin Core price logic might come into play, similar to an RBF price enhance that truly lowers the general cluster price charge on account of new transaction ancestors. One other instance is that customers could also be unable so as to add a CPFP transaction, on account of some cluster limits being breached.

- The transactions could possibly be non-standard and subsequently not broadcastable to the reminiscence pool.

As a result of quite a few causes above, it appears extremely unlikely that out of band charges will ever be completely eradicated. They subsequently could also be inevitable and unstoppable. Nonetheless, there may be actually lots of work to do with respect to schooling, pockets improvement and Bitcoin Core transaction choice coverage, with a view to minimise the potential alternative for out of band charges.

Block Template Knowledge

Partly impressed by our January 2021 post, the web site miningpool.observer was launched. Amongst different issues, similar to makes an attempt to detect transaction censorship, for each block produced by the miners the web site shows a candidate block from its native occasion of Bitcoin Core, utilizing getblocktemplate. One key metric to analyse is the price distinction. Which block has extra charges, the native Bitcoin Core node candidate block or the precise mined block?

At some latest Bitcoin meetups, some within the technical neighborhood had been indicating that they had observed a big uptick in these variations in the previous couple of weeks. Particularly, optimistic variations, when precise blocks have extra charges than the miningpool.observer template blocks. This might point out that the precise miners had been receiving transactions with increased charges “out of band”. These charges could possibly be within the transactions, however the transactions could by no means have been broadcast to the reminiscence pool. This was observed anecdotally, simply by looking the web site and so far as we’re conscious, no concrete knowledge has been proven.

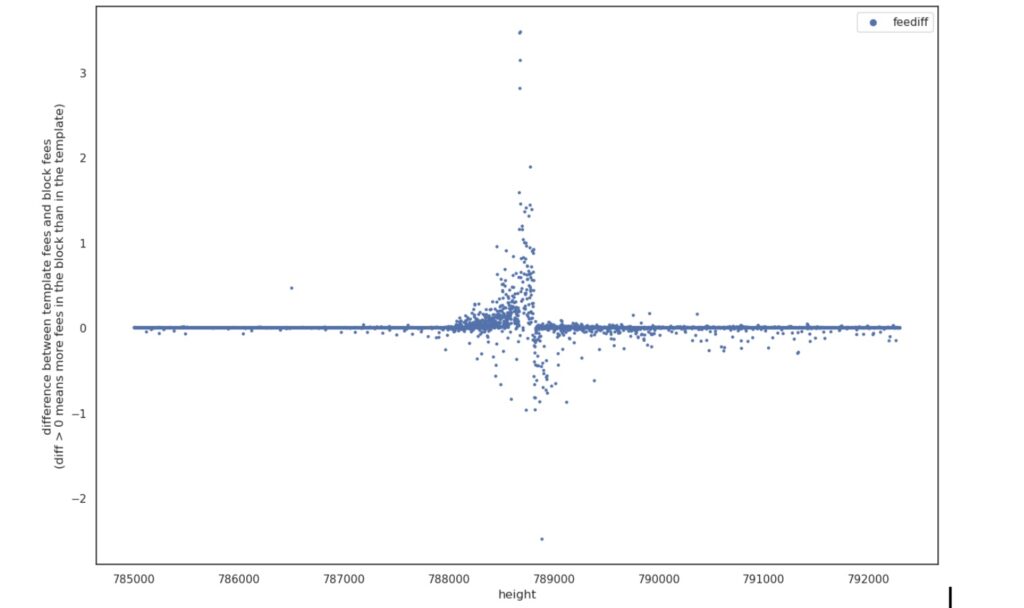

Nonetheless, sadly, it’s doable that the miningpool.observer node was impacted by this bug, which can have diminished the power to provide efficient candidate blocks. This problem could partly clarify the latest uptick in optimistic variations. The chart under, Determine 1, was offered by the administrator of miningpool.observer and exhibits the latest variations. The chart exhibits the variations are largely optimistic and rising, earlier than reaching an inflection level and turning largely destructive. That is when the node was restarted and subsequently a bug could have precipitated this sample, moderately than any fundamentals to do with mining economics.

Determine 1 – Miner charges – Precise blocks vs block templates (Variations) – BTC

Notice: Knowledge from miningpool.observer

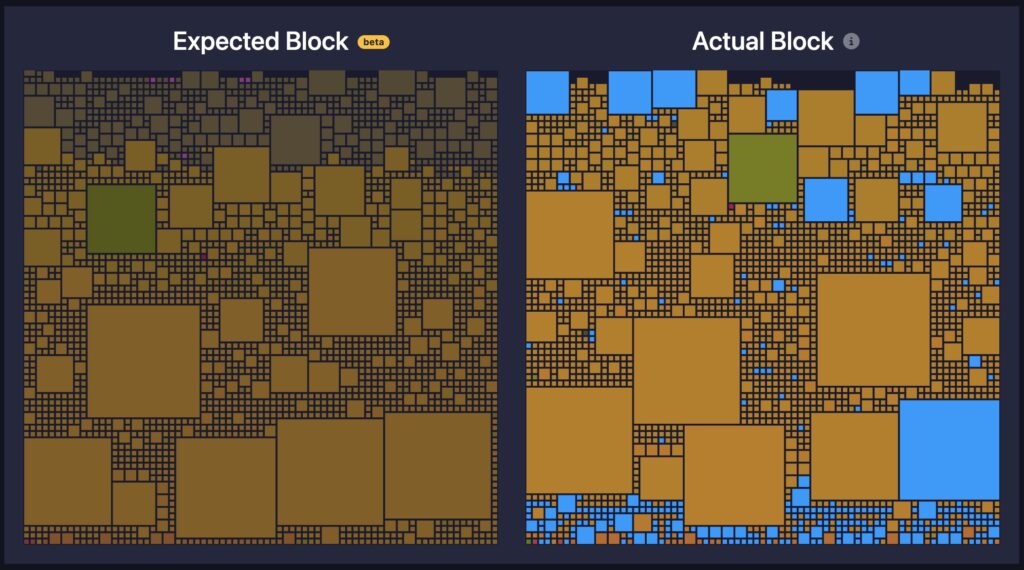

Mempool.space has additionally just lately added this similar function to their web site, in a characteristically fantastically applied function referred to as “Audit”.

Once more, some commented anecdotally that precise blocks just lately began to include extra charges than the mempool.space blocks, an uptick in optimistic variations. Nonetheless, this spike can also be on account of a bug, which is now mounted.

Variations Dataset

There’s a node which commonly produces candidate blocks, which we don’t suppose was considerably impacted by a bug of this type the place we now have the information. At the very least we hope the affect of those sorts of bugs is minimal. The node was not producing template blocks for some durations, which explains the gaps within the under charts. The information under, in Determine 2, exhibits that there was a big latest uptick in variations, this time within the destructive course (i.e. candidate blocks have extra charges than precise blocks). This happens simply earlier than block 790,000. This destructive course is extra per historic norms, as an illustration our January 2021 piece largely consisted of destructive variations on common. Nonetheless, massive destructive variations might additionally point out out of band charges, this time charges which might be “absolutely” out of band, i.e. not included within the transactions. These charges could possibly be paid to the miners by lightning funds, bank card funds or month-to-month US$ wire transfers for instance. Alternatively, maybe a extra seemingly reason for the variations is the reminiscence swimming pools of the miners struggling to maintain up with the community within the latest interval.

Determine 2 – Miner charges – Precise blocks vs block templates (Variations) – BTC

Notice: Optimistic quantity signifies precise block charges are increased than the block template charges. Block template knowledge from one Bitcoin node run by Sjors Provoost. Gaps are the durations the node was not producing templates.

Nonetheless, as Determine 3 under exhibits, Bitcoin charges have elevated quickly in the identical latest interval, maybe on account of Ordinals and “BRC-20” tokens boosting demand for block area. This similar exercise could have elevated the dimensions of some reminiscence swimming pools, which might have made it more durable for some mining swimming pools to maintain up.

Determine 3 – Bitcoin charges per block (40 block rolling common) – BTC

Supply: BitMEX Analysis

In Determine 4 under, the information has been adjusted to strip out the affect of those increased charges. We did this by dividing the variations by the entire charges within the precise block. With Determine 4, it’s a lot more durable to argue there was a latest uptick in variations (in both course). Due to this fact, there may be restricted proof of a rise in “out of band” charges. Nonetheless, one can decide for one’s self if there’s a noticeable pickup in variations round block 790,000. It does appear to be turbulence could have marginally elevated within the interval.

Determine 4 – Miner charges – Precise blocks vs block templates (Variations) – Proportion of whole charges

Notice: Optimistic quantity signifies precise block charges are increased than the block template charges. Block template knowledge from one Bitcoin node run by Sjors Provoost. Gaps are the durations the node was not producing templates.

Determine 5 is a repeat of Determine 4 above, besides every main mining pool now has its personal color. There doesn’t look like any noticeable variations within the distinction knowledge by mining pool, at this cut-off date.

Determine 5 – Miner charges by pool – Precise blocks vs block templates – Proportion of whole charges

Notice: Optimistic quantity signifies precise block charges are increased than the block template charges. Block template knowledge is from one Bitcoin node run by Sjors Provoost. Gaps are the durations the node was not producing templates. The chart is constructed by Google Sheets in layers, with Poolin on the high and Foundry USA on the backside.

Determine 6 signifies that each main mining pool is barely much less efficient at choosing transactions than our native node. Efficiency has been fairly related throughout all the main swimming pools. The exception to that is that Poolin seems to be the worst performer, by a substantial margin. Nonetheless, this solely pertains to 483 blocks and the dataset might be too small to deduce any sturdy conclusions. A few blocks, similar to 755749 contributed considerably to this very “low rating”, and these massive variations could possibly be defined by SPV mining, not hidden out of band charges.

Determine 6 – Miner charges by pool – Precise blocks vs block templates – Proportion of whole charges

Notice: Optimistic quantity signifies precise block charges are increased than the block template charges. Block template knowledge from one Bitcoin node run by Sjors Provoost. 38,000 block interval ending 792,298. Interval consists of gaps.

Conclusion

The proof we now have suggests there was no latest important enhance in these variations (Precise charges vs template charges), when in comparison with the upper market price charges. There’s additionally no proof we now have discovered which means that out of band price funds are at the moment a significant trigger for concern. Nonetheless, charges have elevated just lately, as have reminiscence pool sizes. The community is actually being examined, no less than to some extent.

Associated

[ad_2]