[ad_1]

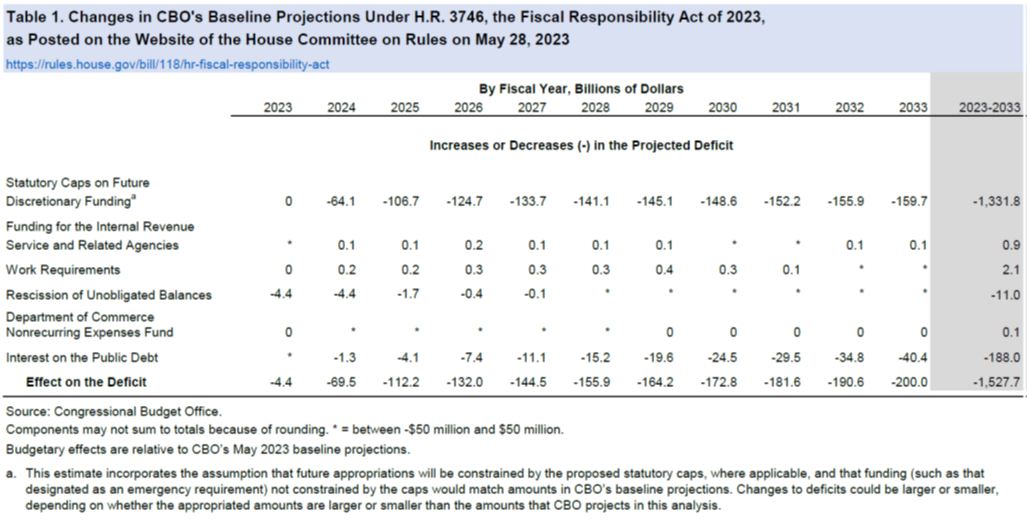

Observe within the desk reductions in deficit solely begin from FY 2024. The discount is about 0.25 ppts of GDP in FY2024, about 0.37 ppts in FY2025.

Macro Influence? Relative to no debt-crisis standoff, from Bloomberg:

The height affect will come later subsequent 12 months by decreasing actual GDP by 0.15%, reducing 150,000 jobs and rising unemployment by about 0.1 proportion factors, in keeping with Mark Zandi, chief economist at Moody’s Analytics. “Not fascinating given the uncomfortably excessive recession dangers, however manageable,” he says.

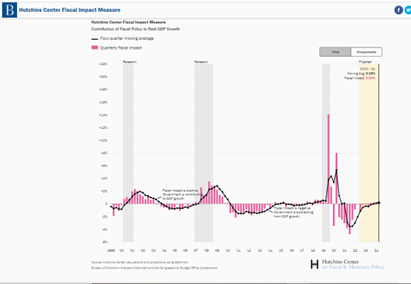

How does the plan have an effect on the fiscal impulse? Pre-agreement, fiscal coverage was going to exert a drag (even when impartial in 2023Q1). With little change occurring to spending till FY2024, this trajectory stays largely in place.

Supply: Brookings Hutchins Center, accessed 5/31/2023.

Micro. Why no larger affect from work necessities (and certainly why does spending rise)? CBO explains.

Work Necessities

Division C of the invoice would modify work necessities for SNAP and TANF. CBO estimates that these provisions would enhance federal spending by about $2.1 billion over the 2023–2033 interval, consisting of a rise of $2.1 billion for SNAP and a discount of $5 million for TANF. These estimates are knowledgeable by a 2022 CBO report that examined the consequences of labor necessities on enrollment and earnings for members in means-tested applications.7Supplemental Vitamin Help Program. To obtain SNAP advantages for greater than 3 months inside a 36-month interval below present legislation, able-bodied adults below the age of fifty who don’t stay with any dependent youngsters should work or attend a coaching program for at the very least 80 hours a month. States can waive the SNAP work requirement for individuals who stay in an space with out ample jobs and, on the state’s discretion, can use a restricted variety of month-to-month exemptions for individuals who in any other case can be topic to the requirement. Underneath present legislation, states can carry over any unused discretionary exemptions indefinitely.

H.R. 3746 would make a number of adjustments to work necessities. The requirement can be expanded first (in fiscal 12 months 2024) to able-bodied adults ages 50 to 52 who don’t stay with dependent youngsters after which (in fiscal years 2025 and later) to able-bodied adults as much as age 54 who don’t stay with dependent youngsters. A number of teams would newly be exempt from work necessities: folks experiencing homelessness, veterans, and other people ages 18 to 24 who have been in foster care once they turned 18. These adjustments would terminate on October 1, 2030.

The invoice additionally would completely cut back the variety of month-to-month discretionary exemptions that states can use for individuals who in any other case can be topic to work necessities, and it will stop states from carrying over unused exemptions for multiple 12 months.

CBO estimates that the entire adjustments to SNAP work necessities would enhance direct spending by $2.1 billion over the 2023–2033 interval. Through the 2025–2030 interval, when the group of individuals as much as the age of 54 can be topic to the work requirement and the brand new exclusions have been in impact, roughly 78,000 folks would acquire advantages in a mean month, on internet (a rise of about 0.2 p.c within the whole variety of folks receiving SNAP advantages).These adjustments are the results of a number of offsetting results, CBO estimates. First, by itself, increasing the work requirement to adults as much as the age of 52 in 2024 and as much as age 54 over the 2025–2030 interval would scale back spending for SNAP by $6.5 billion over the 2023–2033 interval. Second, by itself, the exclusion of a number of teams would result in a spending enhance of $6.8 billion over the identical interval.

CBO expects that further will increase in direct spending would happen as a result of the provisions can be enacted concurrently. The brand new exclusions wouldn’t solely apply to some beneficiaries below age 50 who in any other case can be topic to the work requirement below present legislation, but additionally would apply to some beneficiaries ages 50 to 54 who in any other case can be topic to work necessities below the invoice. Consequently, CBO estimates, direct spending would enhance by an extra $1.8 billion. CBO estimates that the adjustments to discretionary exemptions would scale back spending for SNAP by a negligible quantity.

Non permanent Help for Needy Households. Underneath present legislation, to obtain the total federal block grant for TANF, a state should be certain that grownup recipients in at the very least 50 p.c of single-parent households and 90 p.c of two-parent households are engaged in a work-related exercise. The chances are decrease for states which have lowered their TANF caseloads since 2005 and for states that spend greater than a required quantity of state funds to help TANF recipients’ actions. The Division of Well being and Human Companies (HHS) can cut back a state’s grant for failure to fulfill the proportion necessities until the company determines that the state has an authorized purpose for not assembly the usual or the state is complying with a corrective plan.Title I of division C would set the benchmark 12 months for the caseload discount to 2015 (relatively than 2005) and would stop individuals who obtain lower than $35 in state funding inside a interval decided by the Secretary of HHS from being included in a state’s accounting for the work requirement. CBO estimates that HHS would scale back state grants barely as a result of some states wouldn’t meet the work requirement and wouldn’t adjust to a corrective plan, and HHS wouldn’t approve their purpose for not assembly the usual. CBO estimates that the ensuing discount in block grants would scale back direct spending by $5 million over the 2023–2033 interval.

Footnote 7 refers to this CBO Working Paper by Justin Falk.

Relative to debt default, we keep away from a world recession of unimaginable nature.

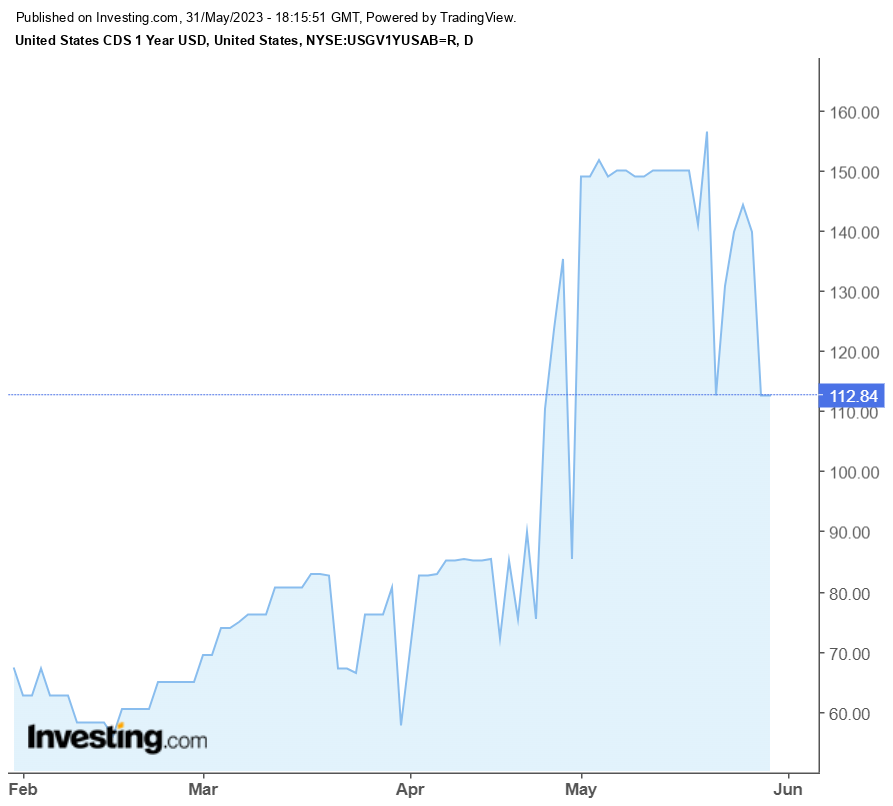

Odds of passage. Market betting as of yesterday.

Supply: Investing.com, accessed 5/31/2023, 1:20pm Central.

[ad_2]