[ad_1]

Going again to intro macro, bear in mind after we rapidly impose the equilibrium situation Y=AD? What does it imply that Y doesn’t equal AD? Right here’s a fast reminder.

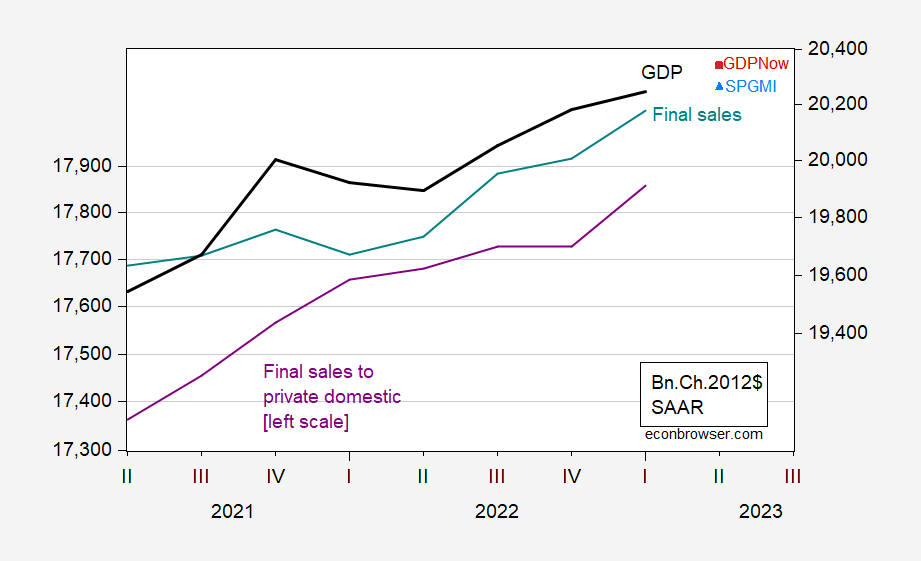

Mixture Demand (AD) is usually measured by Ultimate Gross sales. Earnings or output (Y) will be measured by the expenditure aspect or earnings aspect. The standard image is AD and GDE, proven in FIgure 1 beneath.

Determine 1: GDP (black, proper log scale), closing gross sales (teal, proper log scale), closing gross sales to non-public home purchasers (purple, left log scale), all in billions Ch.2012$ SAAR. Supply: BEA 2023Q1 2nd launch.

The distinction is stock accumulation/decumulation. If all of the stock change is desired, then closing gross sales is an effective measure of mixture demand. The newest studying signifies fast progress for closing gross sales, at 3.4% vs. 1.3% for GDP (SAAR). Ultimate gross sales contains gross sales to overseas purchasers, and subtracts imports. A conjectured superior measure of home non-public demand is closing gross sales to non-government home purchasers; this collection just isn’t essentially extra secure (the expansion fee has a better commonplace deviation than closing gross sales). This collection grew 2.9% in Q1.

Stressing Y (which will be measured in varied methods) vs. closing gross sales highlights that mixture demand can deviate from earnings. As greatest we are able to inform, demand remains to be rising.

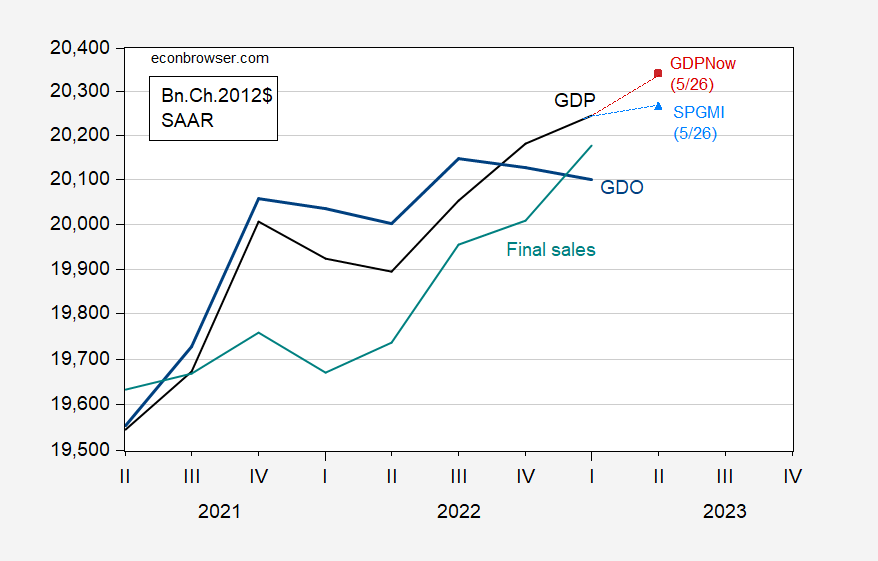

Determine 2: GDP (black), GDPNow (purple sq.), SPGMI GDP monitoring (sky blue triangle), GDO (daring blue), closing gross sales (teal), all in bn. Ch.2012$ SAAR. Supply: BEA 2023Q1 2nd launch, Atlanta Fed, SPGMI.

If one actually believed GDO as output (see dialogue here of GDO vs GDP+ vs GDP) and closing gross sales as mixture demand, then demand would appear to be robust. Nonetheless, GDO (as the common of GDP and GDI) just isn’t going to be constructed in a fashion according to the calculation of ultimate gross sales – in any case, closing gross sales is simply Gross Home Expenditure (which we name GDP) minus stock accumulation. If the most important measurement error have been in C, fastened I, and G, then one may assume closing gross sales appeared extra like GDO minus stock funding.

As it’s, stock funding is a extremely risky part of GDP. During the last enterprise cycle (2009Q2-19Q4), the usual deviation of stock accumulation was about the identical as the usual deviation of GDP (in billions of Ch.2012$) – 60bn vs 62bn Ch.12$ SAAR. Sadly, I don’t understand how massive revisions to inventories are in current instances; the final research I discovered is Howrey (REstat 1984).

In any case, I feel it helpful to contemplate our greatest estimates of each output/earnings and mixture demand, when eager about the place the financial system goes.

[ad_2]