[ad_1]

zhengzaishuru

Kimbell Royalty Companions’ (NYSE:KRP) latest $143.1 million Northern Midland Basin acquisition ought to increase its distributable money circulate by almost 20%, including round $0.05 to $0.06 per unit to its quarterly distribution with a 75% payout ratio.

This leads to Kimbell’s anticipated quarterly distribution throughout 2H 2023 ending up at round $0.36 per unit on the present strip of low-$70s WTI oil and roughly $2.75 NYMEX gasoline. That is up from my previous expectations, because of the influence of the acquisition.

The acquisition has a major optimistic impact on Kimbell’s near-term distribution, since there may be heavy improvement exercise on that acreage proper now. Nonetheless, many of the stock on the acquired acreage is projected for use up inside a few years, leading to declining contributions from the acquired property after that point.

I now estimate Kimbell’s worth at roughly $19 per unit, whereas its distributions for the remainder of 2023 and 2024 ought to profit from a excessive variety of wells being turned-in-line on the acquired acreage.

Northern Midland Basin Acquisition

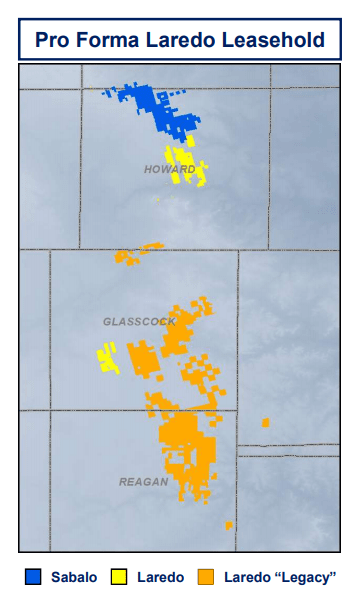

Kimbell paid $143.1 million (together with $48.8 million in money and 5.93 million Kimbell frequent items) for mineral and royalty pursuits from MB Minerals. That firm is a subsidiary of Sabalo Holdings, which is an EnCap portfolio firm).

Kimbell estimates that the acquired property will produce round 1,901 BOEPD (77% oil, 12% pure gasoline, 11% NGLs) within the 12-month interval ending March 2024. The acquired property additionally consist of roughly 806 Web Royalty Acres on round 60,000 gross unit acres within the Northern Midland Basin (northern Howard County and southern Borden County).

Kimbell talked about that it anticipated $43.3 million in subsequent 12 month money circulate from the acquired property based mostly on mid-April strip costs. Primarily based on present strip costs, that is in all probability nearer to $40 million now. The three.6x transaction a number of (based mostly on present strip) nonetheless seems to be fairly a low a number of for a transaction involving mineral and royalty pursuits.

The low transaction a number of seems to be because of the acquired property having a number of near-term improvement exercise (pushing up manufacturing over the following 12 months or two), however probably operating low on stock in a few years.

Close to-Time period Improvement Exercise

It seems that a big a part of the acquired pursuits need to do with the Northern Howard / Southern Borden acreage that Important Vitality (previously Laredo Petroleum) acquired from Sabalo Energy in 2021.

Sabalo Acquisition (vitalenergy.com)

Important is concentrated on growing its Northern Howard acreage, as that’s its finest acreage. Nonetheless, initially of 2023, Important was all the way down to solely two years of stock on that acreage because of the great amount of improvement exercise it deliberate there in 2023.

Thus, the acquired property may be capable of generate $40 million (or extra) per 12 months in money circulate over the following couple of years, however then money circulate would begin declining resulting from a big discount in new improvement exercise.

Outlook For The The rest Of 2023

Kimbell is now anticipating to common round 18,800 BOEPD (33% oil) over the last three quarters of 2023. This contains 18,400 BOEPD (32% oil) in common manufacturing in Q2 2023 and 19,000 BOEPD (34% oil) in common manufacturing throughout 2H 2023. Kimbell’s newest acquisition closed midway by means of Q2 2023, contributing round 45 days of manufacturing to that quarter.

At present strip for the final three quarters of 2023 (together with roughly $73 to $74 WTI oil), Kimbell is now anticipated to generate $174 million in revenues after hedges throughout that three quarter interval.

|

Kind |

Barrels/Mcf |

Realized $ Per Barrel/Mcf |

Income ($ Million) |

|

Oil (Barrels) |

1,724,448 |

$71.50 |

$123 |

|

NGLs (Barrels) |

723,856 |

$24.00 |

$17 |

|

Pure Fuel [MCF] |

16,332,580 |

$2.00 |

$33 |

|

Lease Bonus and Different Earnings |

$2 |

||

|

Hedge Worth |

-$1 |

||

|

Complete |

$174 |

Kimbell is thus projected to generate $119 million in distributable money circulate (or $0.46 per unit per quarter) over the last three quarters of 2023, which might translate right into a distribution of round $0.34 per unit per quarter with a 75% payout ratio. That is based mostly on Kimbell’s new unit depend of round 86.4 million.

|

$ Million |

|

|

Advertising And Different Deductions |

$10 |

|

Manufacturing Prices And Advert Valorem Taxes |

$14 |

|

Money G&A |

$15 |

|

Money Curiosity |

$16 |

|

Complete Bills |

$55 |

Kimbell’s quarterly distribution could also be round $0.32 per unit for Q2 2023 and round $0.36 per unit throughout 2H 2023 based mostly on present strip costs.

I now estimate Kimbell’s worth at roughly $19.00 per unit utilizing my up to date long-term costs of $75 WTI oil and $3.75 Henry Hub pure gasoline. Kimbell’s distributable money circulate will see a near-term increase from its acquired property, though this increase will begin diminishing after the following 12 months or two.

Conclusion

Kimbell’s latest acquisition ought to add round $37 million per 12 months (after factoring in curiosity prices) to its near-term distributable money circulate, whereas it added 5.93 million items. That is over $6 in distributable money circulate per unit added, in comparison with beneath $2 per unit for Kimbell earlier than the acquisition. The acquisition thus boosts Kimbell’s total distributable money circulate per unit by shut to twenty% for now.

This increase will diminish over time, although, for the reason that acquired property could not have a lot stock left by the tip of 2024. Thus, whereas the near-term increase to distributable money circulate is welcome, one should take into account sustainable distributable money circulate ranges too when estimating Kimbell’s worth. I thus consider $19 per unit is an affordable estimate for Kimbell’s worth in a long-term $75 WTI oil and $3.75 NYMEX gasoline surroundings.

[ad_2]