[ad_1]

ismagilov/iStock through Getty Photos

Great secular alternative

Ladies are having infants a lot later in life now than previously. Many ladies and {couples} concentrate on careers, schooling, touring, and turning into financially steady of their 20s (and even 30s) earlier than taking the plunge.

The median age of moms at delivery within the early Nineteen Seventies was 21. This reached 25 by 2008 and rocketed previous 30 at this time. Many have kids into their 40s, and fertility or adoption companies are sometimes vital.

There may be additionally a rising variety of nontraditional {couples} utilizing assisted reproductive expertise or adoption companies.

These developments open up an incredible market alternative for traders.

In the meantime, employers confront a labor market the place superior staff command terrific advantages. A primary-rate advantages package deal can usually sway staff much more than a base wage as a consequence of rising healthcare prices. The truth is, a 2022 research notes that practically half say they like higher advantages over extra pay. That is in all probability doubly true for higher-wage earners the place taxes restrict compensation upside.

What does Progyny do?

This market presents a unbelievable alternative for family-building protection supplier Progyny (NASDAQ:PGNY).

Progyny is the chief in complete protection, together with a big and rising community of suppliers, coordinated member companies, data-driven options, and pharmacy advantages.

This well being protection choice continues to be in its infancy (I could not resist), however employers are taking discover. Business-leading corporations from expertise to power to healthcare are providing protection. As Progyny administration factors out, corporations usually compete for a similar expertise pool. So as soon as one indicators up, it creates a snowball impact in that trade.

For instance, Progyny reported its first healthcare system shopper 4 years in the past. They’ve greater than 30 healthcare system shoppers at this time.

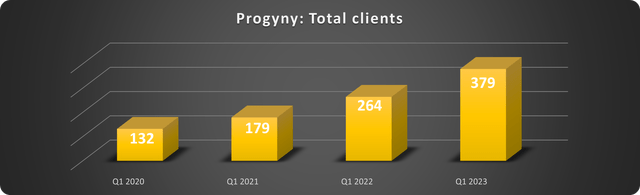

The crucial measure of Progyny’s progress at this stage is its capability to draw shoppers.

Progyny elevated its shopper base by 44% within the final 12 months, as proven beneath.

Information supply: Progyny. Chart by creator.

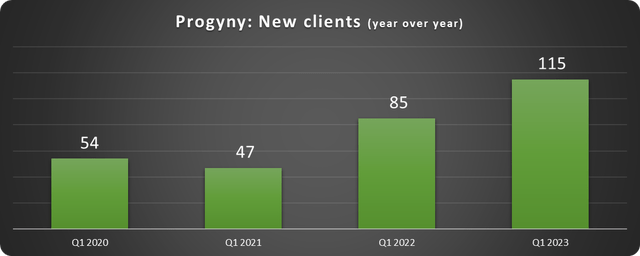

The rising win price is proof of the snowball impact, as proven beneath.

Information supply: Progyny. Chart by creator.

The corporate counts some recognizable manufacturers amongst its shoppers, as proven beneath.

Signing shoppers up is terrific, however do these shoppers stick round? In line with Progyny, its retention price since 2016 is sort of 100%.

How does Progyny become profitable?

The corporate’s major income driver is its fertility advantages resolution, Sensible Cycles. This can be a therapy bundle accessible to contributors by way of the supplier community. Shoppers can even embrace pharmacy advantages as an add-on. In 2022, 65% of income got here from fertility companies and 35% from pharmacy advantages.

Income comes from the utilization of companies and a month-to-month payment per worker or plan participant. A typical mannequin for related companies.

Progyny’s potential buyer base is huge, with massive company shoppers and self-insured well being and welfare plans that serve union members. Progyny estimates there are 8,000 US employers with greater than 1,000 staff and tens of millions extra within the labor inhabitants, representing an addressable market of 100 million contributors. Progyny covers 5.4 million members as of Q1 2023.

Is Progyny inventory a purchase?

Let’s begin with the dangers.

The inventory is a speculative play in a rising trade, so it is most acceptable for long-haul traders who’re okay with some ups and downs and perceive the dangers.

The trade is aggressive, and different massive insurance coverage carriers are formidable foes. For instance, UnitedHealth (UNH) offers protection choices and a community of suppliers in all 50 states. For perspective, UNH produced $324 billion in gross sales in 2022. Infertility protection is remitted in 15 states, so the massive insurers provide some advantages however do not specialize as Progyny does. The UNH plan is taken into account reasonably priced however would not provide all the benefits of Progyny. Progyny is thought to be premium protection within the trade.

Progyny acquired 26% of its gross sales from two shoppers in 2022. That is down from 34% in 2021 and may proceed to say no because it provides shoppers at a formidable clip. Nonetheless, dropping one in every of these can be a major dent in income.

Talking of income…

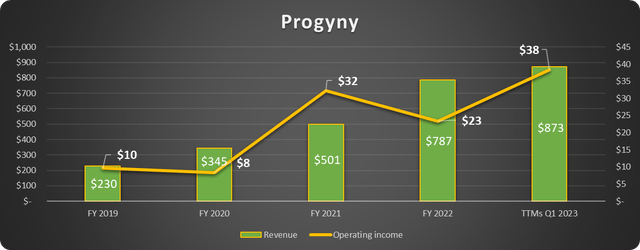

Progyny has elevated income at an unbelievable clip lately, going from $230 million in 2019 to $873 million over the trailing twelve months. This 51% compound annual progress price (CAGR) is spectacular, as is the 44% year-over-year progress reported in Q1 2023.

The corporate is GAAP worthwhile, and its working revenue seems headed in the precise course after elevated bills compressed margins in 2022, as proven beneath.

Information supply: Progyny. Chart by creator.

Progyny tasks that gross sales will exceed $1 billion in 2023, and diluted earnings per share (EPS) will are available between $0.42 and $0.48.

The beauty of the enterprise mannequin is that this can be very capital-light. Which means money flows aren’t swallowed up by vital investments in property and gear like different industries. The truth is, solely $3.2 million was spent on CapEx in all of 2022.

Progyny expects $180 million in adjusted EBITDA in 2023, a stable 17% of gross sales. Most of this could translate to free money circulate and proceed to fill the coffers. The steadiness sheet is rock stable, with $320 million in working capital and 0 long-term debt.

These are spectacular numbers for a corporation in a progress section.

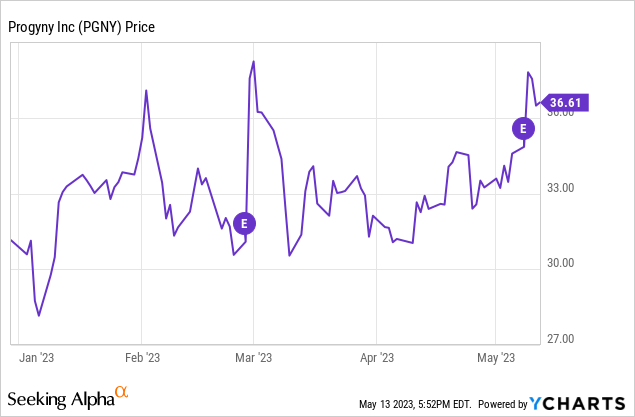

The market was impressed with Q1 earnings; the inventory has risen 17% this 12 months, as proven beneath.

It is a problematic inventory to worth as a consequence of its progress and specialization. With a market cap of simply $3.5 billion, it has huge potential for positive factors if it continues to land clients. Nevertheless, the ahead price-to-earnings (P/E) ratio (~80) and ahead price-to-sales (P/S) ratio (~3.3) do not inform us a lot at this level.

Earnings have the potential to multiply over the following a number of years. I’ll search for money circulate, margin enlargement, and rising shoppers as key efficiency indicators.

Progyny is an fascinating inventory in an trade that might see exponential progress as a consequence of demographic and social developments. The monetary outcomes are compelling, and the corporate seems well-managed. The inventory value will probably be unstable, so traders ought to accumulate shares over time to minimize danger and make the most of dips. I am not prepared to leap in with each toes fairly but, however the distinctive alternative satisfied me to dip a number of toes within the water.

[ad_2]