[ad_1]

Small particular person buyers, such as you and me, don’t have many benefits over giant establishments.

However as counterintuitive as it would sound, our small measurement is a large one.

Institutional buyers have deep pockets. They will fund analysis groups with dozens of Ph.D.s. They will fund lobbyist teams that work to bend rules towards their favor. They will co-locate their know-how with the exchanges’ … guaranteeing their orders get crammed sooner and at higher costs than ours do.

The checklist goes on … and makes for a compelling counter-argument.

However my good friend and colleague Mike Carr made an awesome level lately, arguing that you and I aren’t Warren Buffett … so we shouldn’t try to be.

Mike says that, as a result of Buffett is likely one of the largest cash managers within the sport, he has entry to alternatives the “little guys,” like us, may solely dream of.

Consider it this manner… Greater than a dozen personal jets reportedly landed in Omaha because the banking disaster erupted in mid-March. What number of landed outdoors your house?

However even when we will’t make investments the best way Warren Buffett does, our small measurement permits us alternatives he may by no means contact.

The Oracle of Omaha has even admitted this himself as soon as, saying:

Anybody who says that measurement doesn’t damage funding efficiency is incorrect. The best charges of return I’ve ever achieved have been within the Nineteen Fifties – however I used to be investing peanuts then.

It’s an enormous structural benefit not to have some huge cash.

See, Buffett manages tons of of billions of {dollars}. Which means he can’t contact “small” shares with a 10-foot pole … even when he needs to.

It is a blessing for small buyers. It means there’s an entire sector of funding alternative that may make a big effect in your wealth early on … and a good greater influence as soon as these shares develop sufficient to draw institutional consideration.

And who do we’ve got to thank however the SEC for affording us one of the best of one of the best of those alternatives…

Small Caps and the $5 Rule

Almost a century in the past, the SEC established a frankly ridiculous rule which makes it an actual ache for any huge investor to purchase a sure class of small-cap shares.

(In the event you’re already aware of small caps, be happy to skip right down to the subsequent part the place I speak about this rule in-depth. In any other case, learn on for a fast primer.)

Shares are usually categorized by their market capitalizations, or “market cap.” A inventory’s market cap is just it’s per-share worth multiplied by the variety of shares it has excellent.

Shares with a market cap above $10 billion are thought-about large-cap shares. $2 billion to $10 billion makes up the mid-cap class. That is the sandbox the place the large cash performs.

$250 million to $2 billion is the “small-cap” house. And corporations with market caps beneath $250 million are known as micro-caps.

Successfully, the complete micro- and small-cap classes of inventory are off-limits to Buffett and his friends. Even when he sees a pretty alternative there, he is aware of the dimensions of his funding could be too small to matter … or that he would transfer the market if he invested a significant quantity of capital.

On the finish of the day, Buffett is aware of he can’t contact small shares. I doubt he bothers to even take a look at them nowadays, as a result of even when he does … he has to “move.”

After all, Buffett is simply the prototypical giant institutional investor — he’s removed from the solely one.

A whole bunch of mutual funds, hedge funds, pensions, endowments and insurance coverage firms face the very same “measurement penalty.” They’re too huge to put money into one of the best small-cap firms.

A lot of these giant buyers even have inflexible guidelines written into their charters and mandates, completely prohibiting them from investing in firms which are too small, both on the premise of market cap or a inventory’s per-share worth.

In reality, one of many “silliest,” but extremely exploitable anomalies associated to the dimensions of a inventory is what I name “The $5 Rule.”

Exploiting the $5 Rule

The $5 Rule dates again to SEC regulation that was written within the Thirties, creating further hurdles institutional buyers should soar by way of when shopping for a inventory that’s priced beneath $5 a share.

The $5 threshold is, so far as I can inform, fully arbitrary. There isn’t any significant distinction between a inventory that’s priced at $4.99 and one priced at $5.01.

But, within the eyes of the SEC, and the institutional buyers topic to the $5 Rule, there is a distinction.

$5.01 and above, shares are “truthful sport.” $4.99 and beneath, shares are successfully “off limits.”

And that’s why I’m saying the little guys like us have a significant benefit over the large boys. After we discover a high-quality firm whose inventory trades for lower than $5 … we will purchase it simply as simply as a inventory that trades for $50.

Whereas the inventory trades beneath that threshold, we’ve got little competitors from the Wall Road machine and its largest gamers.

Most establishments gained’t contact a inventory whereas it’s beneath $5. So, many analysts don’t hassle protecting it.

And that leaves a trove of high-quality firms that go neglected, undiscovered or untouched … just because they’re “too small,” in response to that arbitrary $5 rule.

And right here’s essentially the most stunning a part of all of it…

As soon as a inventory that was beforehand beneath $5 crosses above that threshold … Wall Road’s handcuffs are off. Analysts, portfolio managers and allocators can all soar again in.

And after they do, typically , it may possibly ship costs dramatically increased.

At this level, the investor who’s learn one too many Berkshire Hathaway annual letters could also be studying this and thumbing their nostril on the dangers related to small-cap shares.

Effectively, you’re proper. These dangers exist.

However if you make investments the best way I do, you understand how to mitigate these dangers … and discover solely the small-cap shares with the best odds of success.

The Proper Strategy to Discover Nice Small-Caps

Most tutorial analysis has rightfully targeted on market cap as a measure of measurement than the per-share worth, although there’s fairly a little bit of overlap.

Shares that commerce for lower than $5 a share are usually on the smaller facet of the market cap spectrum.

Certainly, there are dangers that include investing in small-cap shares. Relative to giant firms, small firms usually are characterised by the next:

- A smaller capital base, decreasing their capacity to take care of financial uncertainty.

- Higher volatility of earnings.

- Higher uncertainty of money flows.

- Much less depth of administration.

- Much less confirmed enterprise fashions (in some circumstances).

- Much less data availability, as a result of fewer analysts protecting them.

- Higher volatility of share worth.

After all, except you for some purpose consider in “free lunches,” the distinctive dangers that include investing in smaller firms is exactly why investing in smaller firms gives a increased return.

Over the lengthy arc of market historical past, small-cap shares have outperformed large-cap shares.

A lot of analysis research on U.S. shares, in addition to international developed and emerging-market shares, have proven that is true.

It’s additionally true over numerous time frames, some stretching all the best way again to the Twenties.

After all, U.S. large- and mega-cap shares had a improbable run in the course of the middle- and late-stages of the final bull market. And that’s why everybody I discuss with appears unaware of the long-run benefit to purchasing smaller firms.

It’s additionally why I’m on a mission to coach readers on this benefit … and why I’m biasing the portfolios I construct in my inventory analysis providers — Inexperienced Zone Fortunes and 10X Shares — to the “small” facet.

Notably since now is the good time to be constructing an chubby “small-cap” portfolio…

Whereas small-cap shares normally, and low-quality small caps specifically, are likely to expertise outsized volatility throughout bear markets and recessions…

That volatility represents shopping for alternatives, notably in the kind of high-quality small-cap firms that are likely to outperform like gangbusters within the wake of a recessionary pullback.

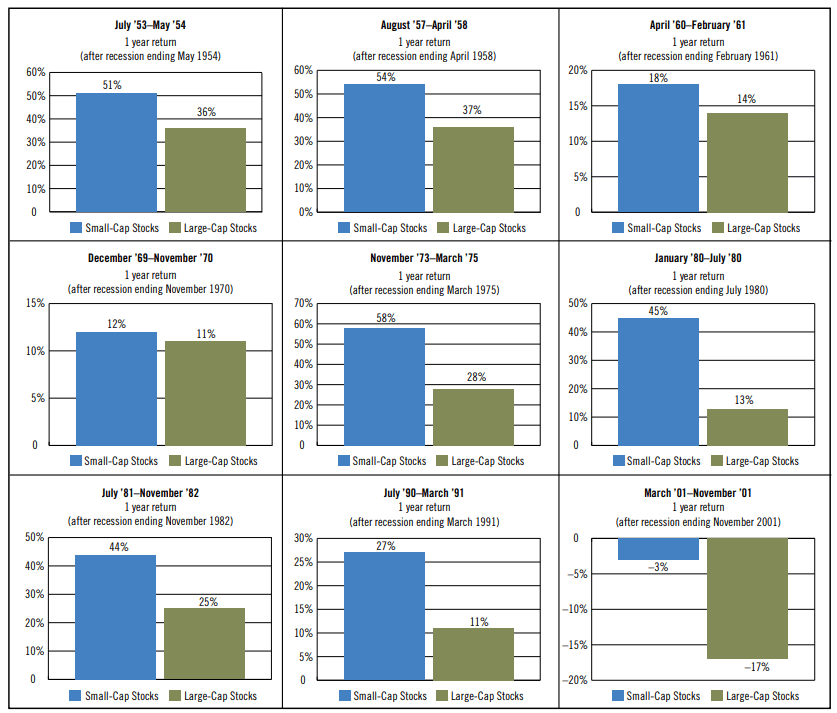

Contemplate this chart from a Prudential study, which exhibits small-caps have outperformed large-cap shares following the final 9 recessions…

That’s why I’m gearing up for what I count on to be a large run of outperformance in small, high-quality firms over the subsequent two to a few years.

The bear market is creating this once-in-a-decade alternative to purchase small firms at deeply discounted costs — lots of them for lower than $5 a share, Wall Road’s “off limits” threshold.

And utilizing my Inventory Energy Rankings system, I’m capable of display screen out solely essentially the most high-quality small-cap shares from the names that current extra danger than reward.

I‘ll share extra specifics on that quickly. However right here’s the large takeaway.

These alternatives are merely not accessible to Warren Buffett or his mates …

It’s just for to the “little guys,” such as you and me.

And I don’t learn about you, however I’m able to pounce and make the most of it!

Regards,

Adam O’DellChief Funding Strategist, Cash & Markets

Adam O’DellChief Funding Strategist, Cash & Markets

P.S. Within the coming weeks, I’ll share extra about my analysis to date on sub-$5 small-cap shares … together with a report of potential candidates that I’ll share fully at no cost.

We’re engaged on the ultimate checklist now, however it’s trying like upwards of 300 names so that you can try. Maintain an eye fixed out for that subsequent week.

Within the meantime — inform me, did I sway your opinion on small-cap shares, in the event you held a adverse opinion to start with?

Write me at BanyanEdge@BanyanHill.com along with your ideas.

In yesterday’s Edge, Mike Carr characterised final month’s banking scare as a “black-necked swan,” slightly than a black swan.

Which means, it appeared like a scary, widespread occasion within the banking sector. However on nearer inspection, it’s not more likely to blow up the world.

I really agree with Mike.

Nevertheless, that doesn’t imply there gained’t be penalties.

A banking system that’s fixated on strengthening its steadiness sheets — and stopping a flood of shoppers from working out the door — is not a banking system making loans.

And each mortgage not being made represents a enterprise that may not get the capital it must launch, develop or add employees.

It’s far too early to say for certain, however it does seem that preliminary jobless claims popped in March.

We’ll know extra because the April knowledge rolls in.

It may very well be that the economic system nonetheless has sufficient momentum behind it to shrug off the results of financial institution tightening. However as I’ve been writing all 12 months, the yield curve is deeply inverted, which has traditionally been a predictor of a pending recession.

It wouldn’t be onerous to see March’s financial institution scare as a catalyst — one which lastly ideas us into recession.

We’ll see. Within the meantime, we nonetheless need to capitalize on the alternatives on this market.

Adam makes an awesome level about how small-cap shares fare in recessions, traditionally. Ian King’s discovered much like assist that concept. Like again in January, when he gave you five reasons to buy small caps in a bear market.

Like Adam’s coming report on sub-$5 small-cap shares (which you don’t need to miss out on), Ian additionally is aware of the worth of small caps. In his Extreme Fortunes service, for instance, he explores tech firms on this market cap which are in disruptive markets. And so they’re on the brink of soar by 500% — as much as 1,000% inside a couple of years.

If you wish to be taught extra about Excessive Fortunes, go here to watch Ian King’s free presentation concerning the subsequent “Convergence” in small caps.

And subsequent week, you’ll hear extra about Adam O’Dell’s $5 small-cap performs.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]