[ad_1]

In the present day, we’re lucky to current a visitor contribution written by Paweł Skrzypczyński, economist on the Nationwide Financial institution of Poland. The views expressed herein are these of the writer and shouldn’t be attributed to the Nationwide Financial institution of Poland.

We current an replace of the jobs-workers hole mentioned in these earlier posts: [1], [2], [3], [4].

Current BLS releases “The Employment Scenario – March 2023” and “Job Openings and Labor Turnover – February 2023” enable us to replace the jobs-workers hole and the enterprise cycle indicator primarily based on it. For March 2023 we assume that job openings degree declined to 9.8 mn from February 2023 degree of 9.9 mn, which might be in line what high-frequency knowledge by Certainly suggests (https://www.hiringlab.org/data/).

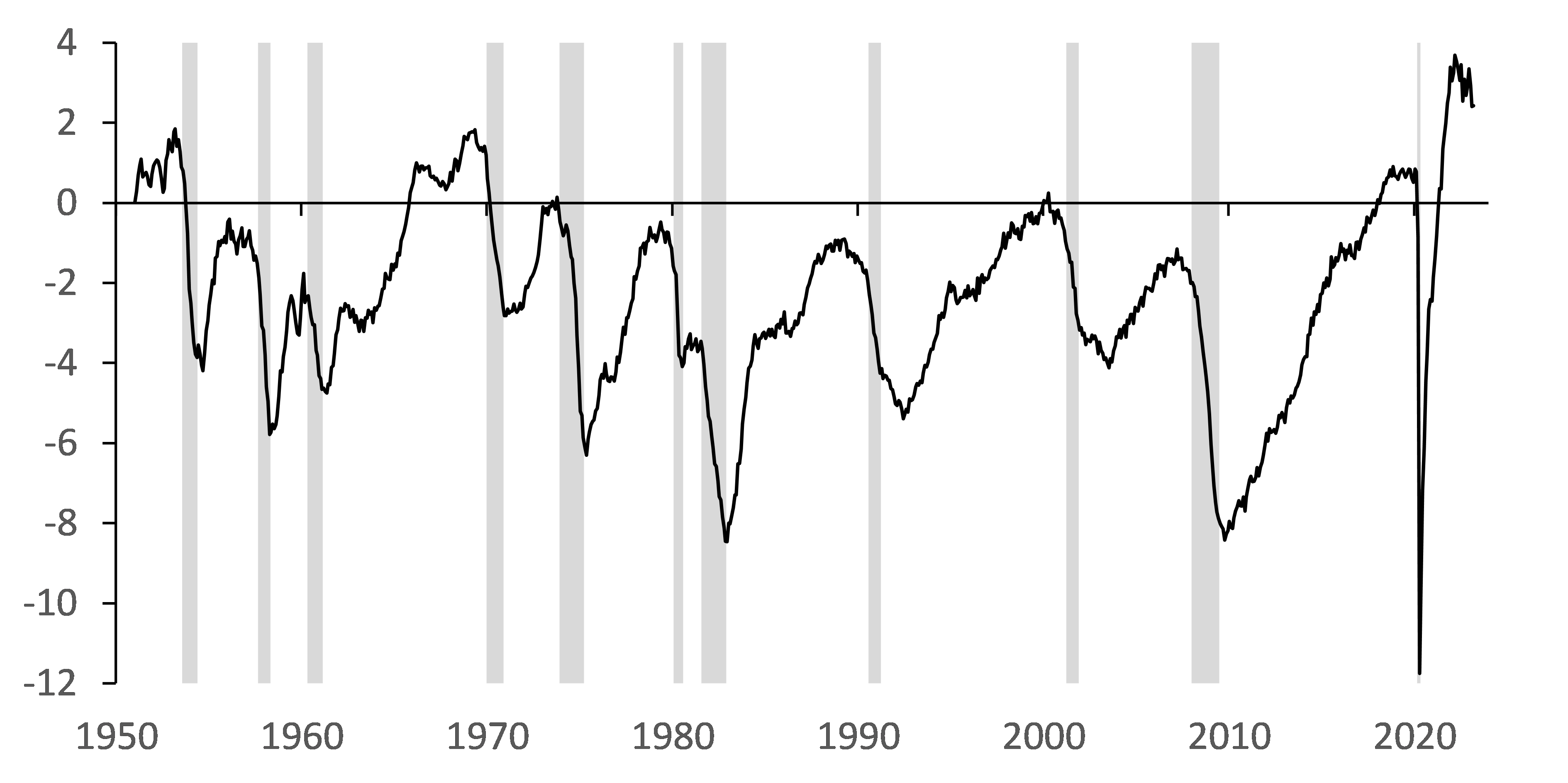

In March 2023 the jobs-workers hole was at 2.4% or 4.0 mn, unchanged from February 2023, nevertheless down by 0.5 pp or 0.9 mn from January 2023.

Determine 1. Jobs-Staff Hole (P.c)

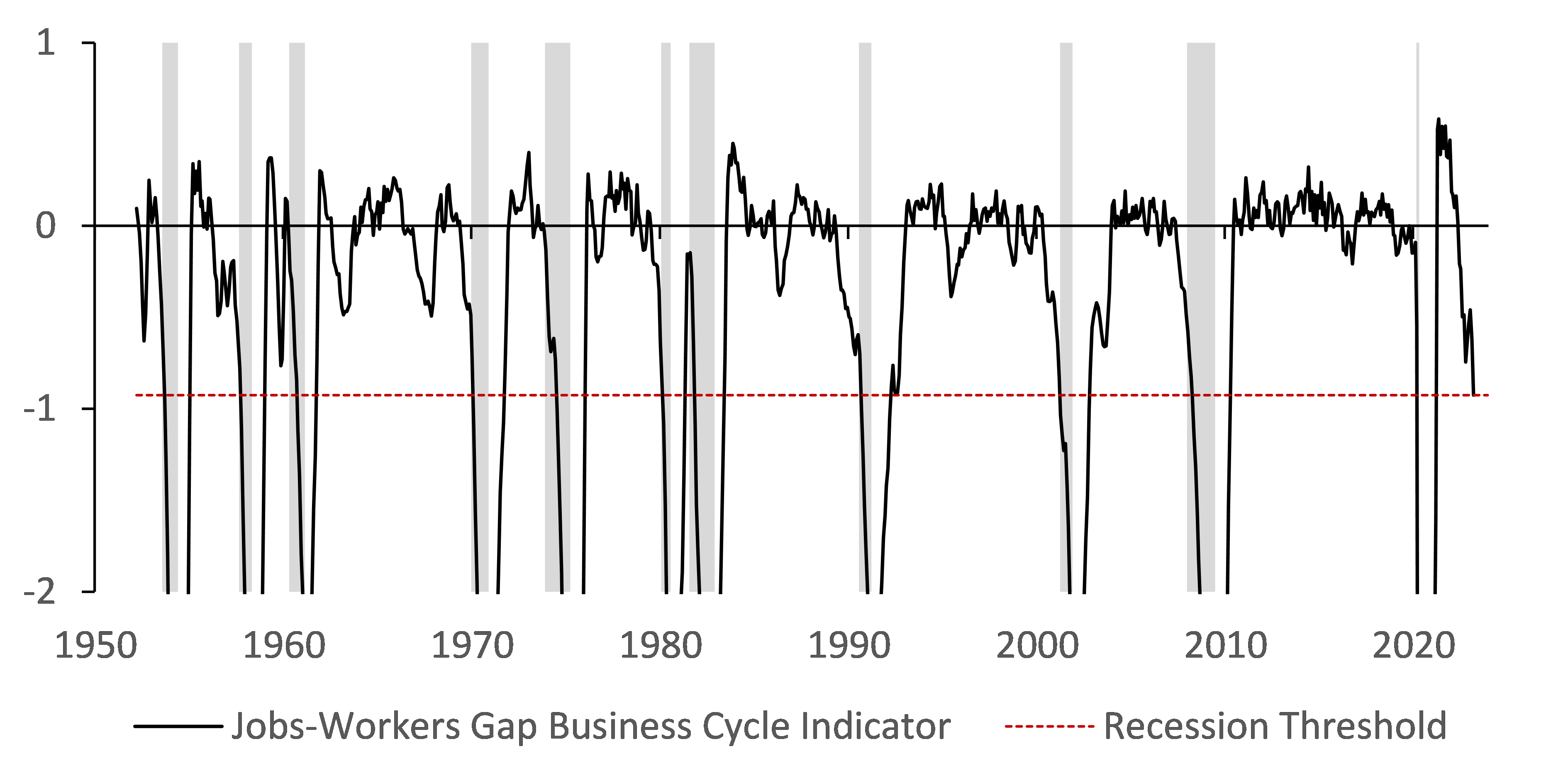

With this new knowledge the jobs-workers hole enterprise cycle indicator (JWGBCI) decreased to -0.93 pp in March 2023 from -0.62 pp in February 2023 and -0.46 pp in January 2023, hitting the recession threshold of -0.93 pp. Recall the indicator makes use of a smoothed hole, particularly we calculate the change of the three-month transferring common of the jobs-workers hole relative to its most throughout earlier twelve months.

Determine 2. Jobs-Staff Hole Enterprise Cycle Indicator (Proportion Factors)

Conclusion of this replace is as follows. Current readings of the jobs-workers hole and the enterprise cycle indicator primarily based on it counsel that labor market situations softened over the course of earlier yr to the diploma that traditionally can be ample to make a recession name. Whether or not this case is a real or false constructive stays to be answered with future knowledge releases, not solely referring to the labor market itself. General, recession watch is on, now additionally via the lens of labor market incoming knowledge.

This put up written by Paweł Skrzypczyński.

[ad_2]