[ad_1]

At the moment, we’re happy to current a visitor contribution by Laurent Ferrara (Professor of Economics at Skema Enterprise College, Paris and Director of the International Institute of Forecasters).

Towards the present background of high inflation rates, questions come up on the best way central banks can management inflation and their technique to succeed in their goal. Since 1990, foremost central banks world wide have progressively adopted a framework of inflation concentrating on. Because of this their goal of value stability is ready via the evolution of the annual progress price normally value stage, i.e. inflation price, round a focused worth (e.g. 2% for Fed and ECB).

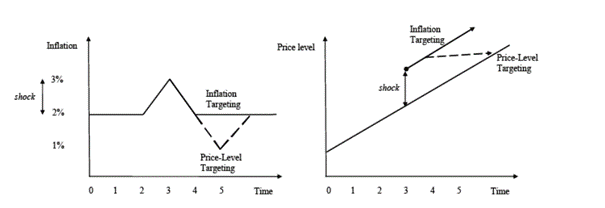

One of many well-known problems with this inflation concentrating on method is that, by specializing in the expansion price of costs, it doesn’t account for the worth of previous inflation charges. We are saying that “bygones are bygones”. Concentrating on a mean of two% over time, because the Fed does, is a technique to alleviate this concern. An alternate can be to instantly goal the value stage. This method permits for extra flexibility by accounting for deviations to the goal after an sudden shock. For instance, assuming an inflation goal at 2%, if inflation will increase to three% after a given shock, rational financial brokers will count on a 2% inflation within the wake of this shock, whereas it will be just one% below a price-level goal regime. That is effectively defined in Determine 1 taken from this VoxEU post.

Determine 1: Inflation and price-level concentrating on in contrast

Supply: Minford and Hatcher, 2014, VoxEU

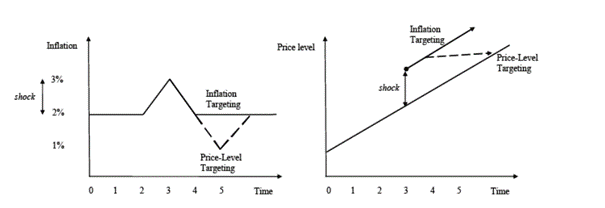

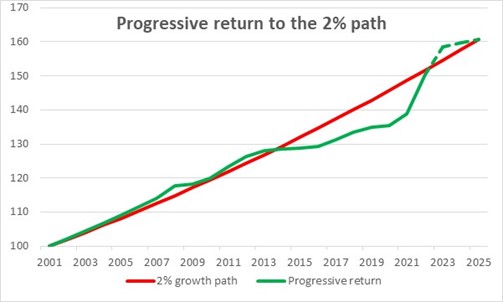

It’s informative to take a look on the euro space via the lens of a value stage evaluation. After years of getting a stage of inflation under the value stage implied by a 2% inflation since 2001, the noticed value stage has now virtually reached this “theoretical” value stage in 2022 (see Determine 2). The sharp will increase within the stage of costs in 2021-22 have thus erased 9 years of evolutions under the two% development.

Determine 2: Value stage within the euro space and value stage implied by the two% path

Supply: Eurostat and ECB March 2023 macro projections

What’s fascinating is to contemplate the inflation forecasts for 2023-25 launched by the ECB in its March 2023 Staff Macro Projection Exercise (+5,3% in 2023, + 2.9% in 2024 and +2.1% in 2025): The worth stage is more likely to persistently exceed the “theoretical” value stage implied by a 2% progress path. For the primary time within the historical past of the euro space, we are going to observe a major and protracted hole between the 2 strains of Determine 2 (about 3.5% in 2025), suggesting that euro space residents will completely face excessive costs for items and companies. Furthermore, if we assume that inflation will return to the two% goal after 2025, then the 2 strains will evolve in parallel after this date (as in Determine 1, proper panel).

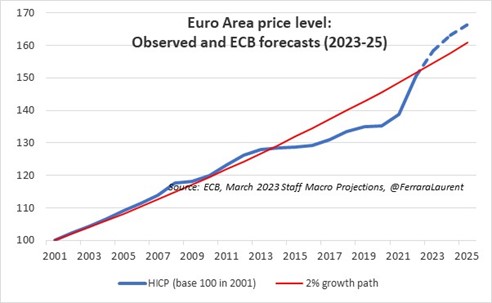

So how may policy-makers shut this hole? The primary possibility is to tighten the financial coverage stance with the intention to convey the value stage again to the two% path line. That is what the ECB is at the moment doing by growing its foremost refinancing rate of interest. However this financial coverage tightening could be finished in two methods: laborious or mushy. A tough tightening would suggest a speedy return to the two% line, by producing a deflation of about -0.5% in 2024 (Determine 3). Very seemingly that this state of affairs would additionally suggest an financial recession inside the euro space in 2024.

Determine 3: Value stage state of affairs with a deflation in 2024

Supply: Eurostat and creator’s computation

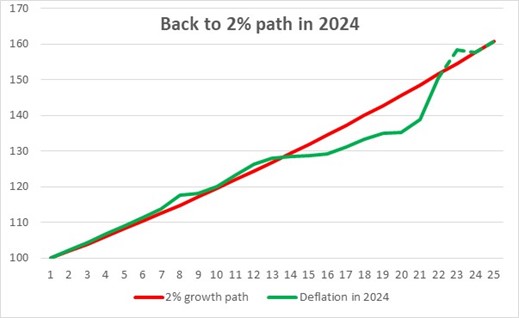

A mushy financial tightening would suggest an inflation price effectively under the goal for each 2024 and 2025. For instance, an inflation price of 0.8% in 2024 and 0.7% in 2025 would ship the value stage again to the two% path in 2025 (see Determine 4). This second state of affairs is actually the popular one, because the euro space would definitely escape an financial recession and all its related prices when it comes to employment and revenue.

Determine 4: Value stage state of affairs with a progressive return to 2% path

Supply: Eurostat and creator’s computation

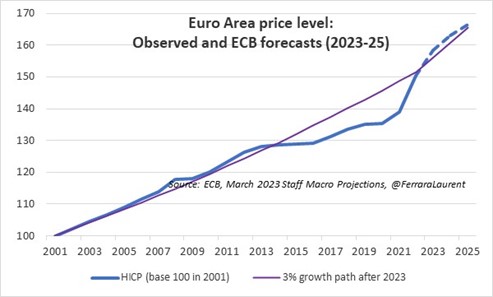

There’s a second possibility, extra advanced to implement however typically advocated by main economists like Olivier Blanchard, that’s to extend the inflation goal. In spite of everything, there is no such thing as a sturdy theoretical argument in favour of the two% worth. This worth is principally primarily based on previous intervals thought-about by policymakers as intervals of value stability. So why not utilizing a goal of three% or 4%? Determine 5 reveals a theoretical impact of a shift to an inflation goal of three% ranging from 2023. We see that the anticipated value stage will likely be aligned with the one implied by a 3% inflation goal.

Determine 5: Value stage state of affairs with a 3% goal from 2023

Supply: Eurostat and creator’s computation

A value stage evaluation means that to keep away from a persistent hole between noticed normal stage of costs and the extent of costs implied by a 2% inflation goal within the euro space, the ECB is more likely to proceed to tighten its financial coverage stance in upcoming months. An alternate can be to extend inflation goal however that’s one other story that can gas debates amongst tutorial and coverage circles for the months to return …

This publish written by Laurent Ferrara.

[ad_2]