[ad_1]

On 11 April at 04:00 UTC, we are going to allow our new revenue and loss (PnL) realisation function – permitting our cross-margining customers to mechanically realise their PnL for open positions, with the identical margin forex, each 10 minutes.

On 11 April at 04:00 UTC, we are going to allow our new revenue and loss (PnL) realisation function – permitting our cross-margining customers to mechanically realise their PnL for open positions, with the identical margin forex, each 10 minutes.

Put merely, this implies cross-margining customers will have the ability to liberate capital from their successful positions, which they will then deploy when buying and selling a number of contracts.

The outcome? Extra capital-efficient buying and selling and an total discount in liquidation threat.

For the lowdown on our new function – and examples of the way it works – learn on.

If you haven’t yet signed up for a BitMEX account, you can do so here.

How the New PnL Realisation Function Works

Cross-margining customers who’ve positions with the identical margin forex (e.g. XBT, USDT, ETH) and opposing PnL will likely be in a position extra simply to stop liquidations – by offsetting their PnL throughout a number of contracts. It’s a course of that can occur mechanically each 10 minutes*.

Within the occasion {that a} explicit place has incurred unrealised losses – which is checked each time the Mark Value adjustments – its place margin will likely be topped up from the out there margin when required. In different phrases, earnings are transferred from Unrealised PnL to Realised PnL utilizing the Mark Value.

In distinction, if a successful place contributes realised revenue to the consumer’s pockets and the dropping place then takes it away, then this new function will see liquidation and chapter costs transfer in direction of the successful positions and in some circumstances by the preliminary entry worth of the commerce (i.e. the dealer might get liquidated on a successful place).

Notice: This new function will likely be relevant to all customers – throughout all cross margin derivatives positions – perpetual swaps, futures contracts, and settlement currencies.

*Within the close to future, we will likely be making incremental will increase to the frequency of our PnL realisation function.

Any change we make to the frequency of PnL realisation on BitMEX will likely be communicated to customers forward of time, through socials and web site bulletins.

Okay, Present Me the Examples

As an instance the advantages of our new PnL realisation function, we’ve included instance eventualities under (for sure, they’re fictional buying and selling eventualities):

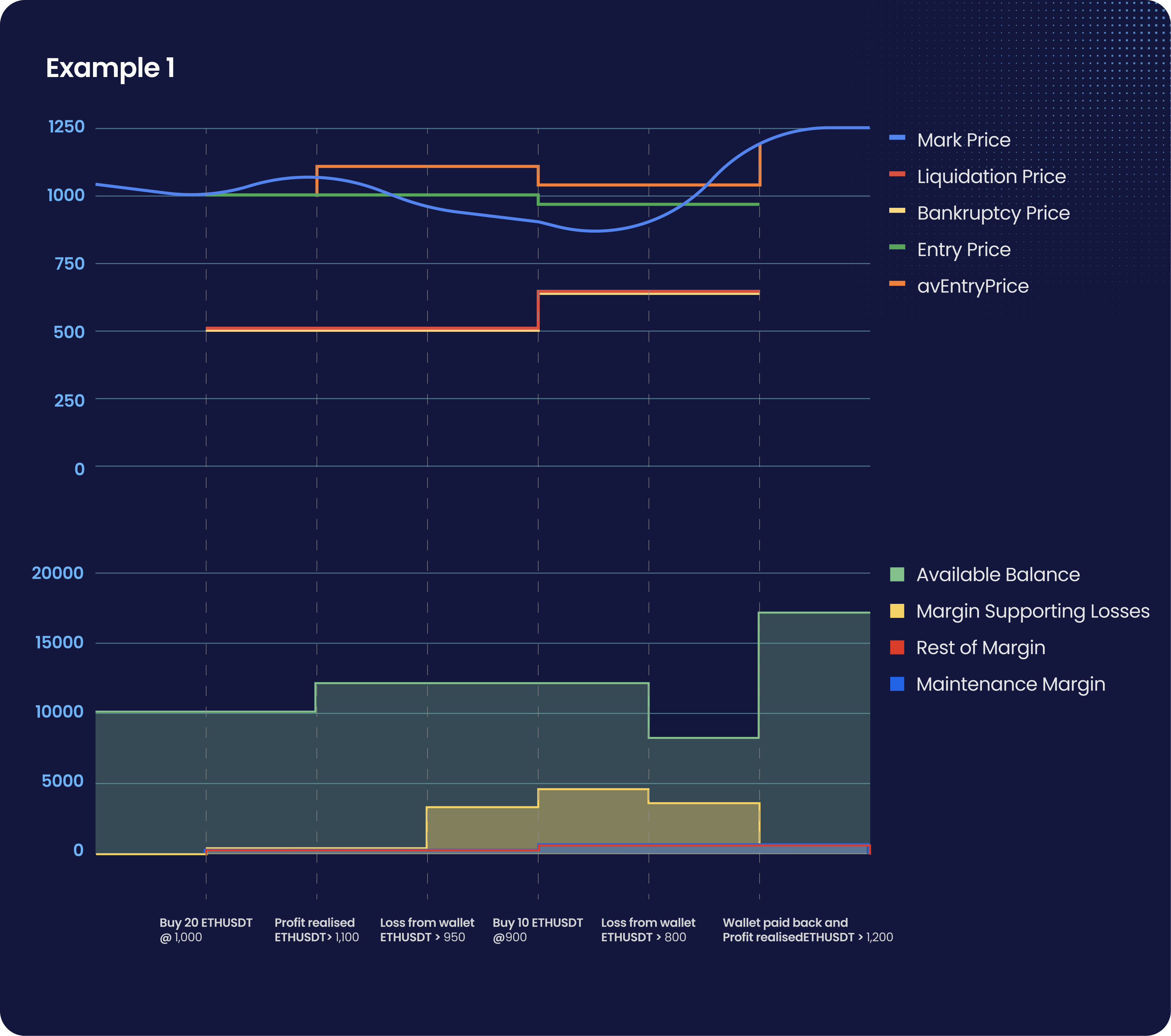

State of affairs one: Karen rides out the uneven market by buying and selling the ETHUSDT perpetual swap.

- Her BitMEX account pockets has 10,000 USDT.

- She buys 20 contracts of ETHUSDT on the worth of $1,000 at 50x Cross Margin.

- The required preliminary margin is 2% = 400 USDT, and the upkeep margin is 1% = 200 USDT.

- Her Entry worth (avgCostPrice) is 1,000.

- Her avgEntry worth can be 1,000.

- Her liquidation and chapter costs are 510 and 500, respectively.

- Her out there steadiness is now USDT 9,600.

- The Mark Value strikes as much as $1,100, therefore a revenue of two,000 USDT is realised (bear in mind: this course of can occur each 10 minutes).

- The required margin remains to be USDT 400 (upkeep margin is 200 USDT).

- Her Entry worth (avgCostPrice) remains to be 1,000 (that is the quantity you will note on BitMEX web site).

- Her avgEntry worth is now 1,100 (the worth at which revenue was realised).

- Her liquidation and chapter costs are 510 and 500, respectively.

- Her out there steadiness is now 11,600 USDT.

- The Mark Value strikes all the way down to 950. A 3,000 USDT loss must be pulled from her Pockets (bear in mind: this course of can occur at any time when the Mark Value updates, i.e. each 5 seconds).

- The required margin remains to be 400 USDT, and the upkeep margin is 200 USDT.

- Her Entry worth (avgCostPrice) remains to be 1,000 (that is the quantity you will note on the BitMEX web site).

- Her avgEntry worth remains to be 1,100.

- Her liquidation and chapter costs are 510 and 500, respectively.

- Her out there steadiness is now 8,600 USDT.

- The Mark Value strikes all the way down to 900 and Karen buys 10 extra contracts of ETHUSDT at 900.

- The required margin is now 2% of 9,000 (add. place) + 2% of 20,000 (first place) = 580 USDT, and the respective upkeep margin is 290 USDT.

- Her Entry worth (avgCostPrice) is 966.67.

- Her avgEntry worth is 1,033.33.

- Her liquidation and chapter costs are 643 and 633.33, respectively.

- Her out there steadiness is now 7,420 USDT.

- The Mark Value falls even additional to 800 and one other 3,000 USDT loss must be pulled from the Pockets (bear in mind: this course of can occur each 5 seconds).

- The required margin stays at 580 USDT, and the upkeep margin stays at 290 USDT.

- Her Entry worth (avgCostPrice) remains to be 966.67.

- Her avgEntry worth remains to be 1,033.33.

- Her liquidation and chapter costs are nonetheless 643 and 633.33, respectively.

- Her out there steadiness is now 4,420 USDT.

Lastly, Karen’s place begins to repay when the Mark Value rises to 1,200 when revenue realisation occurs (each 10 minutes). The revenue swing is 12,000 USDT, of which 7,000 pays again funds drawn from the Pockets:

30 ETHUSDT x (avgEntryPrice – 800) = 30 x (1033.33-800) = 7,000 USDT

And the rest is realised revenue (in comparison with the final avgEntryPrice):

30 ETHUSDT x (1200 – avgEntryPrice) = 30 x (1200 – 1033.33) = USDT 5,000

Which means that:

- The required margin remains to be 580 USDT, and the upkeep margin is 290 USDT.

- Her Entry worth (avgCostPrice) remains to be 966.67.

- Her avgEntry worth is up to date to 1,200.

- Her liquidation and chapter costs are nonetheless 643 and 633.33, respectively.

- Her out there steadiness is now 16,420 USDT.

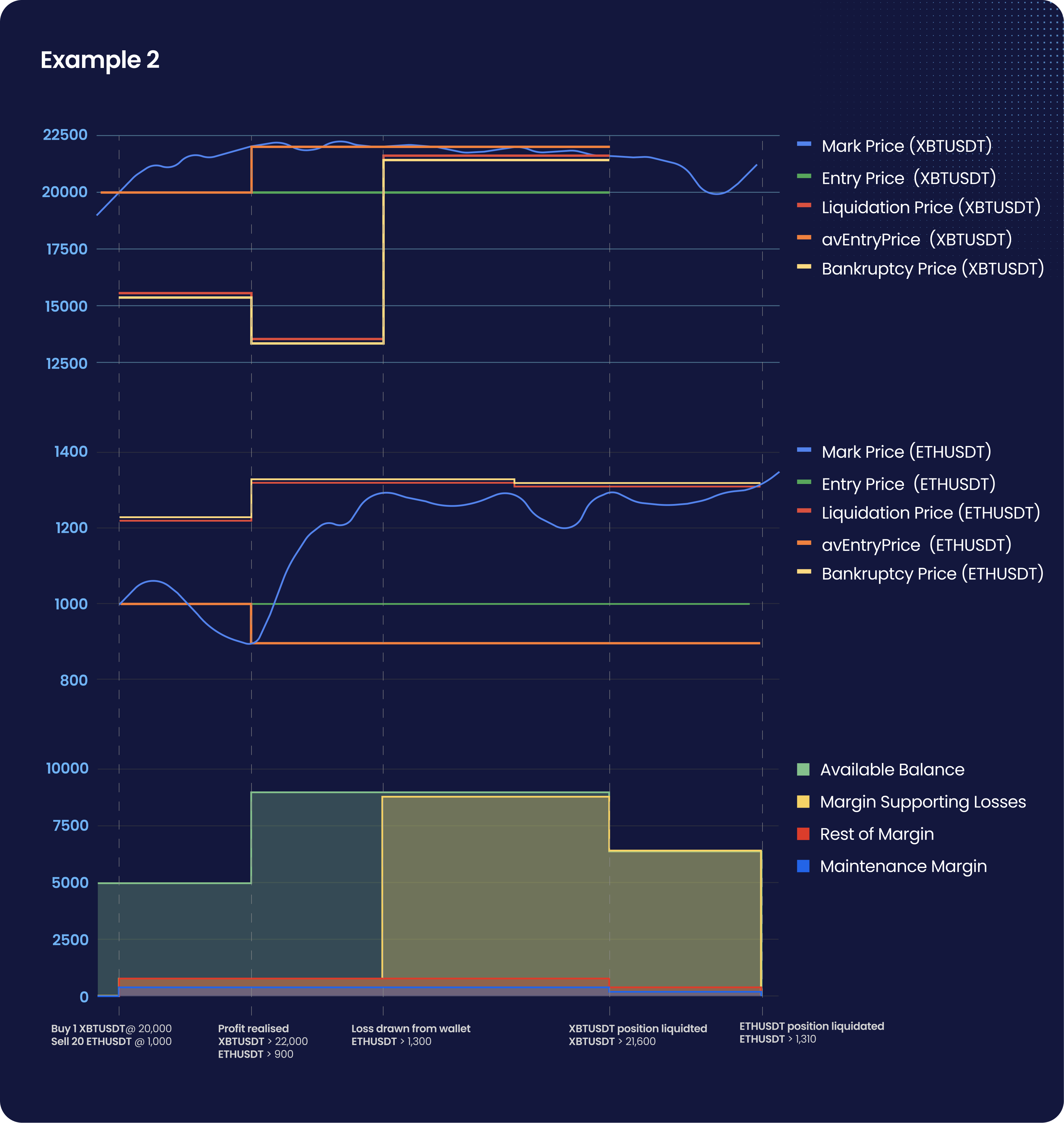

State of affairs two: Bryan calls his unfold commerce proper in the beginning however then will get REKT.

State of affairs two: Bryan calls his unfold commerce proper in the beginning however then will get REKT.

- His BitMEX account pockets has 5,000 USDT.

- He thinks ETHUSDT (Mark Value 1,000) and XBTUSDT (Mark Value 20,000) will diverge with XBTUSDT transferring up greater than ETHUSDT.

- He buys 1 XBT of XBTUSDT at 20,000 – and sells 20 ETH of ETHUSDT at 1,000, each at 50x Cross Margin.

- The whole required margin is 800 USDT, and the upkeep margin is 400 USDT.

- His Entry costs (avgCostPrice) are 20,000 and 1,000.

- His avgEntry costs are additionally 20,000 and 1,000.

- His liquidation/chapter costs are 15,600/15,400 and 1,220/1,230, respectively.

- His out there steadiness is now USDT 4,200.

- His technique initially proves proper; ETHUSDT goes all the way down to 900 and XBTUSDT goes as much as 22,000. Revenue is realised on each trades (a complete of 4,000 USDT).

- The whole required margin remains to be 800 USDT, and the upkeep margin is 400 USDT.

- His Entry costs (avgCostPrice) are nonetheless 20,000 and 1,000.

- His avgEntry costs at the moment are 22,000 and 900.

- His liquidation/chapter costs are 13,600/13,400 and 1,320/1,330, respectively.

- His out there steadiness is now 8,200 USDT.

- However then ETHUSDT rallies to 1,300 and XBTUSDT doesn’t transfer, which suggests he has misplaced 8,000 USDT on this transfer. This loss is drawn from the pockets to his ETHUSDT place.

- The whole required margin remains to be 800 USDT, and the upkeep margin is 400 USDT.

- His Entry costs (avgCostPrice) are nonetheless 20,000 and 1,000.

- His avgEntry costs are nonetheless 22,000 and 900.

- His liquidation/chapter costs at the moment are 21,600/21,400 and 1,320/1,330, respectively.

- His out there steadiness is now simply 200 USDT.

- XBTUSDT then drops to 21,600, and 200 USDT is taken from the pockets to XBTUSDT, however the place remains to be on the liquidation worth, so it’s liquidated.

- The whole required margin is now USDT 400, and the upkeep margin is 200 USDT.

- His Entry worth (avgCostPrice) is 1,000.

- His avgEntry worth is 900.

- His liquidation/chapter costs at the moment are 1,310/1,320 respectively.

- His out there steadiness is now zero.

- Sadly for Bryan, ETHUSDT trades up just a little bit and hits his liquidation worth of 1,310 – and he will get REKT.

Key factors to notice about Bryan’s expertise:

- Bryan bought liquidated in a successful lengthy place at 21,600, which is above his authentic entry worth of 20,000 – and effectively above his authentic liquidation worth of 15,600.

- Bryan bought liquidated in his dropping brief place at 1,310, which is effectively above his authentic liquidation worth of 1,220.

- The brand new cross margin function saved him in his ETHUSDT place longer than the earlier model of margining.

- By sharing revenue with the dropping place from his successful XBTUSDT place, it was liquidated, whereas it will have been intact within the earlier model of cross-margining.

- His positions have been liquidated at almost the identical time.

The Finer Particulars

The Finer Particulars

Please notice that the next fields – proven within the place sections of our derivatives buying and selling pages – will exhibit a change in behaviour as soon as PnL realisation is enabled (for a proof of the fields under, click here):

Costs

- avgEntryPrice will symbolize the worth at which the final PnL realisation passed off (utilizing avgCostPrice for commerce entry worth).

- The marginCallPrice, liquidationPrice, and bankruptPrice will transfer differently when holding a number of positions below Cross Margin.

PnL and Price

The next will change as a result of modified timing and circumstances of PnL realisation:

- realisedGrossPnl, realisedPnl, unrealisedGrossPnl, unrealisedPnl, unrealisedPnlPcnt, unrealisedRoePcnt, rebalancedPnl, prevRealisedPnl, prevUnrealisedPnl, realisedCost, and unrealisedCost.

Place Margin and Price

The next will change as a result of modified timing of PnL realisation:

- posCost2, posLoss, and posMargin.

Deleveraging Precedence

- deleveragePercentile will change attributable to smaller unrealised PnL and a decrease likelihood of deleveraging.

The 101 on Margining and Our Mark Value Technique

Unrealised vs Realised PnL: What’s the Distinction?

Unrealised PnL is calculated based mostly on the present revenue and loss from all open positions. Merchants’ PnL figures are continually altering – that is why the Mark Value is used to make sure that the unrealised PnL is calculated appropriately.

However, realised PnL refers back to the revenue and loss on a commerce after the place has been closed. Our new performance permits for the realisation of earnings earlier than closing the place, with subsequent unrealised losses pulled again from the dealer’s out there steadiness.

For a extra in-depth rationalization of those ideas, try this PnL Guide.

What’s Cross Margin?

At BitMEX, we make use of two margining strategies: cross margin and remoted margin. Cross margin is our default margin setting, that is the place margin is shared between open positions with the identical settlement forex (e.g. XBT). The brand new PnL realisation function applies solely to cross margin.

To be taught extra about our margining strategies, read this guide.

What’s Place Margin?

It’s the portion of your margin that’s assigned to the preliminary margin necessities (i.e. the minimal preliminary quantity wanted to enter a place) in your open positions. That is the entry worth of all contracts merchants maintain – divided by the chosen leverage, plus unrealised PnL.

What’s Obtainable Margin?

This refers back to the funds merchants have out there to high up current positions or create new positions, and is calculated as follows: (preliminary pockets steadiness + realised PnL) – margin allotted to positions.

Preliminary vs. Upkeep Margin: What’s the Distinction?

The preliminary margin is the minimal preliminary quantity wanted to enter a place, whereas upkeep margin refers back to the minimal quantity wanted to maintain that place.

What Does Mark Value Imply?

The Mark Value is the worth at which a derivatives contract is marked for Unrealised PNL and Liquidation functions. We make use of a system referred to as Truthful Value Marking to keep away from pointless liquidations – particularly when customers commerce highly-leveraged merchandise.

For the lowdown on our Truthful Value Marking Technique, click here.

To be the primary to find out about our new listings, platform updates, and giveaways, you may join with us on Discord, Telegram, and Twitter. We encourage you to additionally examine our blog usually.

Within the meantime, when you have any questions please contact Support.

Associated

[ad_2]