[ad_1]

Darren415

This text was first launched to Systematic Earnings subscribers and free trials on Mar. 19.

Welcome to a different installment of our CEF Market Weekly Evaluation the place we talk about closed-end fund (“CEF”) market exercise from each the bottom-up – highlighting particular person fund information and occasions – in addition to the top-down – offering an outline of the broader market. We additionally attempt to present some historic context in addition to the related themes that look to be driving markets or that traders should be aware of.

This replace covers the interval by means of the third week of March. You’ll want to try our different weekly updates overlaying the enterprise growth firm (“BDC”) in addition to the preferreds/child bond markets for views throughout the broader earnings area.

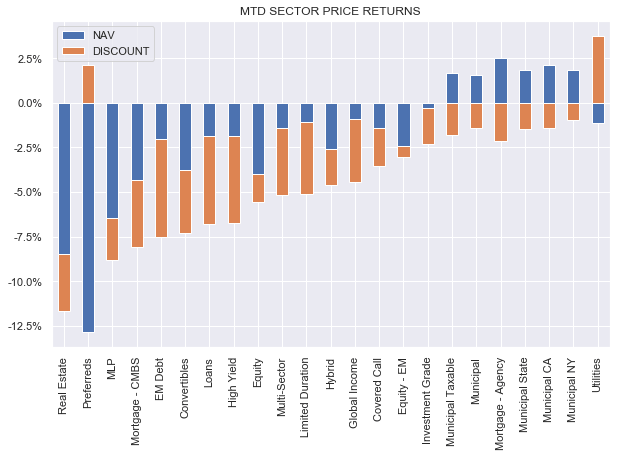

Market Motion

The CEF market was pretty flat this week outdoors of MLPs and Preferreds as decrease Treasury yields and better shares supplied a much-needed tailwind. Particular person preferreds stay underneath stress from continued uncertainty within the broader banking sector. For the reason that begin of the month, most popular CEFs are about 10% decrease, with a 2.5% low cost tightening partly offsetting a 12.5% NAV drop. Though a tighter low cost might sound puzzling in a interval of poor sentiment for preferreds it is a pretty frequent sample in intervals of sharp losses.

Municipal sectors continued to outperform, supported by the drop in charges. The 10Y Treasury yield has fallen 0.7% for the reason that begin of the month. HY company bond credit score spreads have offset the drop in charges considerably and have moved north of 5%.

Systematic Earnings

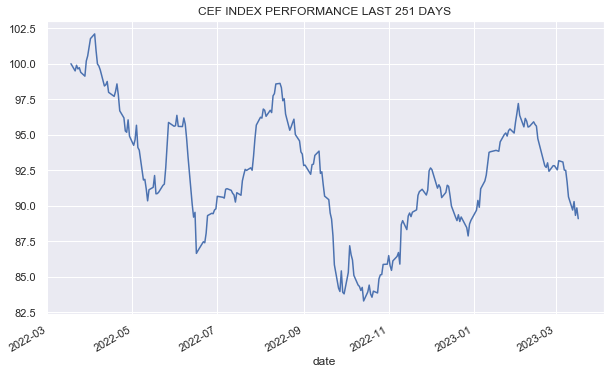

The CEF market has given again the entire year-to-date rally.

Systematic Earnings

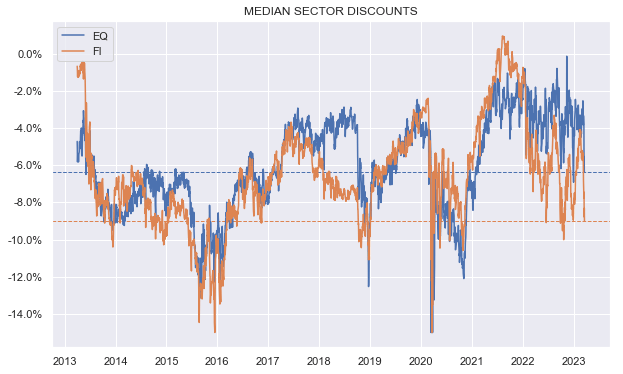

Mounted-income CEF sector reductions have moved to enticing ranges.

Systematic Earnings

Market Themes

There was a touch upon the service concerning the charges charged by numerous funds and whether or not it is smart to tilt to ETFs which have considerably decrease charges than CEFs. One problem in evaluating charges is that they’re normally not introduced apples to apples between CEFs and ETFs.

For instance a typical Muni CEF has a complete expense of round 2.5% on internet belongings versus one thing like 0.05% for a Vanguard fund – a giant distinction. Nevertheless, we have to break up CEF fund bills into administration charges and leverage prices and in addition take the extra CEF leverage into consideration.

As an illustration a typical Muni CEF administration payment is round 0.6% which is the suitable quantity to match in opposition to the ETF’s 0.05%. As soon as we apply it to the entire fund’s belongings (usually 50% increased than the fund’s fairness) that turns into round 0.9% on internet belongings. The remainder of the differential between ETF and CEF charges is because of leverage prices which clearly don’t go to administration although they’re paid for by shareholders.

Nevertheless you slice it, CEF prices are going to be increased than these of passive ETFs so why maintain CEFs over ETFs proper now? Subscribers which have been round for some time know that considered one of our favourite allocation methods is to change between CEFs and open-end funds. 2021 was an excellent time to rotate away from CEFs as mentioned on the time as CEFs have been significantly unappealing as a result of costly reductions and low underlying yields. Proper now, the scenario is kind of a bit totally different and there are 4 explanation why CEFs are extra compelling now in combination regardless of their increased charges.

First, CEF reductions are fairly broad. What this implies is that some CEFs are in impact cheaper than ETFs as soon as you’re taking their reductions into consideration. If a fund costs 0.7% however then provides 0.8% in yield phrases as a result of its low cost, its administration payment is principally destructive.

The second cause why CEFs may be extra compelling is due to lively administration. The hope is that lively administration creates a optimistic return – it’s not assured to do that however it’s simpler in fixed-income than in shares and, in idea a minimum of, it’s simpler when volatility is excessive resembling now.

Three, as soon as yields transfer up, the chance to yields is extra symmetric i.e. there’s a respectable probability that yields fall which might enable leveraged autos like CEFs to generate a better whole return over unleveraged counterparts like ETFs.

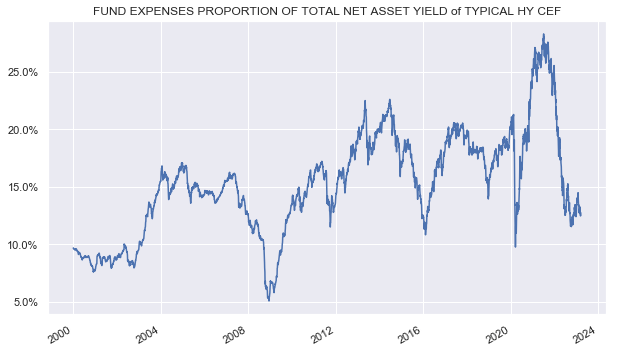

4, when yields are excessive, the upper CEF payment issues a lot much less. For instance, the chart we revisit often is fund bills of a typical HY CEF relative to portfolio yield. In 2021 that reached almost 30% which made CEFs much less interesting and at the moment that quantity is round 13%. Briefly, the upper the underlying yields, the much less of the fund’s whole yield goes to pay for its charges. This makes CEFs “cheaper” proper now than when asset yields have been decrease.

Systematic Earnings

Market Commentary

Blackstone mortgage CEFs BGX, BGB and BSL raised their distribution as soon as once more by 3-5%. That is the fourth time in a yr because the funds continued to lift distributions each quarter. Consensus has shifted quickly in the direction of anticipating decrease charges. This doesn’t imply it’s going to occur very quickly however what’s clear is that the current slowdown within the Fed coverage charge means the uptrend in mortgage CEF distribution hikes is unlikely to final previous the center of the yr. Mortgage CEF reductions have widened just lately, maybe, in expectation of decrease short-term charges. That is too early in our view as the following Fed transfer is more likely to be increased than decrease. Even when the Fed stops climbing, it is prone to preserve charges secure for a while as inflation stays a lot too excessive for its liking. This could enable mortgage CEFs to proceed to drive a excessive stage of earnings.

Stance And Takeaways

Previous to the current sell-off throughout earnings markets we highlighted that high-yield company bond credit score spreads have been overly tight, buying and selling not removed from 4%, significantly in gentle of worsening main indicators. Now that spreads have jumped 1% to north of 5%, they’re now not clearly costly. That stated, we might look forward to spreads to revisit their 2022 peak of 6% earlier than growing our public company credit score allocation.

Amongst funds on our radar – on the upper danger spectrum is the XAI Octagon Floating Charge & Various Earnings Time period Belief Fund (XFLT), buying and selling at a 14.2% yield and a 2% low cost. The fund holds primarily CLO Fairness and financial institution loans and is buying and selling not removed from its 2022 low. The fund has sturdy historic whole NAV returns and has held up properly over the previous yr.

On the decrease danger spectrum we just like the Nuveen Company Earnings 2023 Goal Time period Fund (JHAA) which is a evenly leveraged / higher-quality high-yield company bond fund that is because of both terminate or have a young supply on the finish of this yr – the sample of Nuveen time period CEFs. The fund trades at a 3.9% low cost which affords a pretty return for little danger.

Editor’s Word: This text covers a number of microcap shares. Please concentrate on the dangers related to these shares.

[ad_2]