[ad_1]

Jeremy Poland

Funding thesis

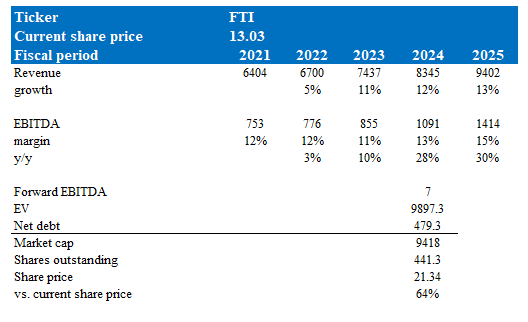

I like to recommend a purchase score for TechnipFMC (NYSE:FTI). There is no denying that the trade has been by means of a secular deflationary cycle for the higher a part of a decade, making for a tough provide chain. However I feel FTI has leveraged this time to return out on high as a extra formidable firm. Rising curiosity in Subsea 2.0 merchandise provides me hope that the adoption cycle could quicken even in a moderated FID setting, because it displays a extra common cultural shift towards larger vendor-based integration and early engagement. The funding narrative for FTI is fairly easy. FTI has a powerful stability sheet (<1x internet debt to EBITDA ratio), a beautiful earnings outlook (consensus expects $0.98 EPS in FY24 vs $0.04 in FY22), and a excessive risk of valuation re-rating upwards as earnings inflection triggers optimistic momentum.

4Q22 outcomes

The outcomes had been $1.70 billion in income, $121.1 million in EBITDA, and $503 million in free money movement. FTI’s 4Q22 outcomes had been usually sturdy, and the corporate’s earnings cadence by means of 2023 was barely stronger than anticipated. Definitely, the revised outlook out to 2025 is spectacular, and it provides weight to the case that the offshore market will proceed to rise steadily over the subsequent a number of years.

FTI lastly launched the revised outlook for its long-term subsea steerage (final given since Nov 21 Investor Day), and it didn’t disappoint. As market situations have considerably improved, it’s my perception that quite a few traders have been anticipating a revision to the 2025 steerage. For context, administration guided for $7.0 billion in Subsea income, $1.05 billion in EBITDA (a margin of about 15%) again in November 2021. The earlier information was, after all, not with out doubts from the investing neighborhood. For myself, my most important concern was what’s the mature margin profile. Whereas administration, again then, talked about that the guided 15% was not the height, it was exhausting to underwrite and imagine that was the case. Nonetheless, quick ahead in the present day, the revised steerage got here out higher than the 15% guided beforehand, and it was a marked enchancment. Subsea income is now anticipated to achieve $8.0 billion with 18% EBITDA margin, leading to an EBITDA of $1.4 billion. This was a major improve from the earlier information, which had been set at $1.2 billion. As well as, administration expects whole Subsea inbound orders of $25.0 billion by 2025, which is a rise of 23% vs 2022 on an annual foundation. Crucially, the FCF conversion fee is now projected to extend from 30% in 2023 to 50% in 2025. Regardless that traders are usually cautious of multi-year forecasts, I’m assured in FTI’s forecast as a result of the corporate has a observe file of issuing correct forecasts (I’m way more assured in the present day than in 2021). On high of those, administration added their very own dose of optimism. They identified that even when the 18% Subsea margin purpose is reached, it should not be seen as a ceiling as a result of 11% of the anticipated Subsea income combine in 2025 will nonetheless replicate legacy backlog. All in all, I imagine the ahead wanting statements are very optimistic and the market clearly loves it primarily based on the share worth response.

Additional dialogue

Throughout the 2021 FTI Investor Day, the administration workforce introduced a set of key drivers that would doubtlessly increase the Subsea margins. These drivers included enhancing operational effectivity, using vegetation and vessels to their most potential, backlog initiatives coming on-line, and the incremental contribution from Subsea Service. These drivers are nonetheless related in the present day, and the projected improve in Subsea Service income attests to their ongoing relevance. FTI additionally highlighted its distinctive choices, corresponding to iEPCI and Subsea 2.0, that are supported by the corporate’s industrialization initiatives. I imagine these choices distinguish FTI from its rivals and contribute to its potential for continued development and success. Furthermore, FTI’s concentrate on power safety allows it to work with the proper accomplice that it will possibly extract most synergies from. I anticipate such focus to be mirrored within the alignment of contract phrases and contributes to FTI’s aggressive differentiation within the market.

In line with Floor Applied sciences’ administration, the corporate will earn $1.375 billion at 13% margins in 2023, which can result in 30% y/y EBITDA development. Particularly, I anticipate that the worldwide sector, notably Saudi Arabia and the United Arab Emirates, would be the major driver of development, with the latter contributing considerably to the previous by means of a lift in worldwide income. The elimination of underperforming NAM area shops and product strains may have a unfavourable impact on Floor income, however enlargement into new worldwide markets will assist mitigate this impact. Nonetheless, these modifications ought to have a optimistic impact on backside strains usually.

Capital allocation

The administration workforce has made vital progress in the direction of its share buyback program, buying round $50 million price of shares. This buy signifies that the corporate has accomplished 25% of the buyback authorization that was final yr. Furthermore, the up to date steerage means that the corporate’s FCF conversion is anticipated to extend from 30% in 2023 to 50% in 2025. Given this enchancment, I proceed to anticipate that shareholder returns will stay a precedence for the corporate. In actual fact, the administration workforce has reiterated its dedication to initiating a quarterly dividend within the second half of 2023.

Valuation

Personal valuation

My variant view for FTI is that I anticipate valuation to re-rate upwards to 7x ahead EBITDA from the present normalized a number of 5.3x (utilizing 24mths ahead EV/EBITDA a number of), which I do not suppose it is truthful given the sturdy earnings development outlook (FTI is anticipated to extend its EBITDA by practically 2x from FY22 ranges). As to why I put the valuation at 7x is as a result of traditionally it’s the place FTI would commerce at when earnings outlook was notably sturdy. That is the case in FY15, the place FTI traded at 7x ahead EBITDA when EBITDA, then, grew greater than 2x from ~USD950million to ~$2.1 billion.

Dangers

The expansion of the oil discipline providers trade is straight proportional to the amount of cash invested in it by upstream oil and fuel corporations. And expenditures are proportional to the money movement from E&P, which is extremely delicate to the value of oil and pure fuel. For FTI, a chronic interval of low oil costs might have a unfavourable impact on its backlog and future earnings potential due to the extended interval of low orders for subsea gear. As well as, the character of mega-projects within the deep sea implies that orders for subsea timber have traditionally been lumpy, including a further dimension of uncertainty. Dangers related to civil unrest, terrorist assaults, forex fluctuations, and governmental actions are all on the rise in a variety of worldwide markets.

Conclusion

FTI is a buy-rated inventory with a powerful stability sheet, engaging earnings outlook, and potential for valuation re-rating upwards as earnings inflection triggers optimistic momentum. The 4Q22 outcomes had been spectacular, and the revised outlook for the long-term subsea steerage exceeded expectations. The corporate’s capital allocation can be spectacular, with vital progress made in the direction of its buyback authorization and dividends. General, FTI is poised for regular development over the subsequent a number of years and is a strong funding choice.

[ad_2]