[ad_1]

Ron Crabtree/DigitalVision through Getty Photos

The Fed is Spooked

After weeks of hawkish speak after the February FOMC assembly, the Fed (and the world) out of the blue was confronted with a brand new disaster. Seemingly out of nowhere, a run started on Silicon Valley Financial institution (SIVB), one of the most important within the US. Inside days, financial institution runs had unfold to different California banks like First Republic (FRC) and PacWest (PACW). New York-based Signature Financial institution (SBNY) collapsed subsequent, adopted by the fireplace sale of Credit score Suisse (CS) a couple of week later. And these weren’t just a few neighborhood banks. This month, three out of the 30 largest commercial banks in America have discovered themselves at or close to whole collapse. These banks largely catered to the highest 1% and 0.1% of revenue earners in America. And in opposition to all odds, they had been the primary to crumble from the Fed’s charge hikes!

In a standard financial system, the Fed would reply to this by reducing rates of interest to ease the burden on the banking system. Nonetheless, that is no regular financial system. Out-of-control inflation and former coverage errors put the Fed between a rock and a tough place. This time round, the Fed has far much less means to assist the monetary markets than up to now. As a consequence of inflation, excessive valuations, and issues with the labor market, they’re kind of caught into elevating extra. So when the FOMC meeting got here round this week after another hot inflation print, they’d no selection however to hike rates of interest by 0.25% to a variety of 4.75% to five.00%, lest they threat a large surge in inflation. If inflation stays cussed (i.e. no recession), then Powell indicated that they’re going to hike charges extra. And quantitative tightening isn’t slowing down.

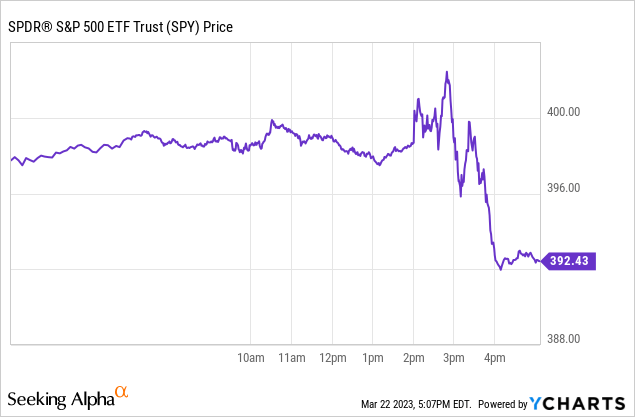

As such, the “pivot” that might assist shares get much more costly did not come, and will not come. Shares bought off sharply throughout and after the FOMC press convention. Caught between inflation on one hand and monetary instability on the opposite, the Fed is in a terrible position.

QE 2023: False Rumors

Twitter has been abuzz over the previous couple of weeks that there is some conspiracy for the Fed to slyly print a bunch of cash and quit on combating inflation. This isn’t true. Whereas the Fed’s steadiness sheet has elevated, it is come from advancing cash to the FDIC to make depositors complete, and from short-term lending to banks through the low cost window and thru the new bank term funding program. Brief-term loans at excessive charges of curiosity should not the identical as shopping for bonds from banks to place cash within the system! The FDIC cash is a non-starter on inflation – the Fed superior them cash they usually’ll receives a commission again because the FDIC relentlessly liquidates Silicon Valley Financial institution. It is basically a government-to-government mortgage.

This is also true for the opposite loans. True to the 1873 banking traditional Lombard Street, the Fed is lending freely, at a penalty charge, and in opposition to collateral. Banks should not going to take this costly capital from the Fed after which mortgage it out and trigger inflation. What is going on to occur is that they are going to deleverage, pull again on lending, and tighten their requirements. Because of this the provision and velocity of cash will dramatically lower within the areas of the financial system that these banks serve. Varied banks that are actually in hassle had a variety of jumbo mortgage loans (i.e. $1-4 million West Coast mortgages, often with less than 20% down, often ARMs, and infrequently underwritten utilizing bonuses and inventory compensation). Loans that had no less than two of those 4 had been asking for hassle from the beginning, and these are going to be very laborious to get going ahead, they usually’ll be much more costly. Something to do with enterprise capital, crypto, actual property improvement, and so forth., is now dealing with a near-immediate credit score crunch. The reality is definitely the precise reverse of the rumors being unfold by Bitcoiners on Twitter that the Fed is flooding the system with cash to redistribute wealth and/or enrich the American higher class.

In the actual financial system, that is thought to rely for an impact of someplace from a 25 bps to a 50 bps hike, although Powell famous that it is “guesswork” how a lot the precise impact can be. The online impact of that is fairly clear. Areas of the financial system which might be broadly thought-about to be speculative are going to have critical hassle getting financing going ahead. The Fed’s hope all alongside was that they may decelerate hypothesis and inflation with out hurting credit score availability to small companies and the financial system at giant, and the chances simply dramatically narrowed of them with the ability to do this.

Bulls shopping for bubbly tech shares which might be up 20% to 50% year-to-date as a result of they assume a “pivot” can be good for them could possibly be in for lots of ache right here shortly.

No Gentle Touchdown: Inflation Could Speed up If There’s No Credit score Crunch, Forcing Extra Hikes

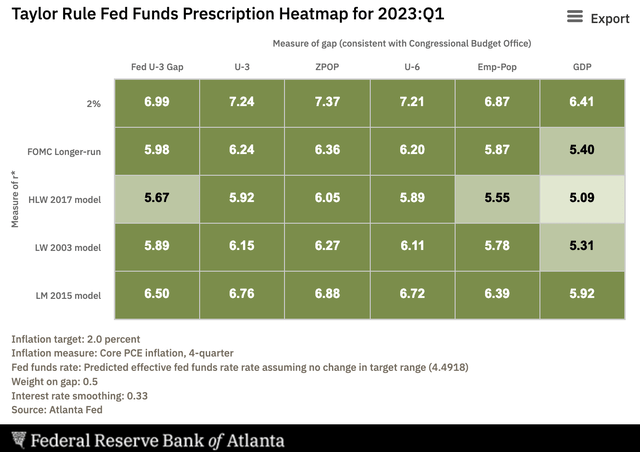

The Fed is doing one of the best it could possibly right here to steadiness bringing inflation down with avoiding blowing up the monetary system. The issue is that below mainstream econometric assumptions, rates of interest might want to go above the speed of inflation to gradual issues down. The Fed’s dot plot got here in at a 5.12% Fed funds charge this 12 months, lower than 29 of 30 models I’ve run utilizing the Taylor Rule and numerous macroeconomic assumptions.

If we escape recession, charges must go over 6% and may must go near 7%.

Taylor Rule (Atlanta Fed)

There’s an enormous hole right here between what fashions let you know the Fed funds charge must be to carry inflation down and what the Fed is saying. And the one manner that core inflation of 5.5% and a terminal money charge of 5.00 to five.25% actually reconcile is for there to be a recession. Recessions are brutally effective at reducing costs. And in a typical recession, the Fed is ready to shortly reduce charges and assist, however this time they can not, no less than not as shortly. If the Fed thinks {that a} terminal charge of 5-5.25% will suffice, there is a robust likelihood that they know one thing that inventory bulls do not about an upcoming recession. We simply obtained hot inflation data from the UK and an advance warning that used automotive inflation within the US (a giant driver) will quickly speed up as effectively. So if we do not get a recession/credit score crunch in brief order, the Fed may get fully run over by inflation numbers in months forward, as we see taking place in Europe and the UK now. Both manner, it isn’t good for shares.

What Does This Imply For Your Portfolio?

Shares are very costly, with the S&P 500 (SPY) buying and selling for about 18x 2023 earnings estimates. That is on the excessive facet of regular and is made worse by the truth that earnings estimates are nonetheless inflated by shoppers spending what’s left of their COVID financial savings, and worse nonetheless by the truth that the yield on money is now roughly the identical because the earnings yield on shares. Earnings estimates are steadily falling, the Fed has indicated it is going to hike no less than as soon as extra, and shares rallied on nonsense to begin the 12 months.

Take a look at the largest holdings of the index funds. It is loopy how costly shares are. The one actual parallels within the US are the dot-com bubble and 2021.

- Apple (AAPL) is up 26% YTD, has unfavourable EPS progress, and trades for 27x shaky 2023 earnings estimates. Promote it.

- Microsoft (MSFT) is just about 29x 2023 earnings and has vastly superior progress prospects to Apple. MSFT remains to be not an awesome deal, having run up a lot. Maintain MSFT.

- Amazon (AMZN) would not even have any earnings to worth it in opposition to. Promote.

- Nvidia (NVDA) and Tesla (TSLA) commerce for insane valuations. These are straightforward sells.

- Bitcoin (BTC-USD) is up like 40% for the reason that banking disaster began. BTC is a maintain except you purchased the panic through which case it is a fast promote. I truly like Bitcoin for the long term however the characters orchestrating panic shopping for in it on the web are both mendacity or do not perceive economics.

Backside Line

It takes actually zero talent to earn 5% in Vanguard Cash Market (VMFXX). However doing so will earn you extra return every year than the underlying earnings from investing within the premier companies in America. And if the Fed is correct in regards to the recession (in between the traces after all), shares are dramatically mispriced. If the Fed is fallacious, they will be compelled to hike and you will earn 6% or 7% on money as an alternative of 5%. And 10-year inflation breakevens between Treasuries and TIPS are about 2.3% as of my scripting this. In case you assume the Fed is filled with it and can let inflation soar to keep away from a recession, you should purchase TIPS (TIP) and make enormous earnings over the subsequent 10 years. I feel a tough touchdown/recession is extra possible at this level. My private ideas? Buckle up, fill up on money, and be extraordinarily selective with what shares and funds you purchase over the subsequent 3-6 months.

Editor’s Notice: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

[ad_2]