[ad_1]

z1b

Thesis Abstract

NIO Inc. (NYSE:NIO) is buying and selling at underneath $9/share, however the inventory seems prepared to start out heading larger. Each fundamentals and technicals help this.

Regardless of unimpressive Q4 results, I nonetheless imagine NIO is an effective long-term maintain and has grow to be a discount at these costs.

As liquidity flows again into shares, NIO may surpass its earlier all-time excessive of $60 and will probably 10x from right here.

Newest Outcomes

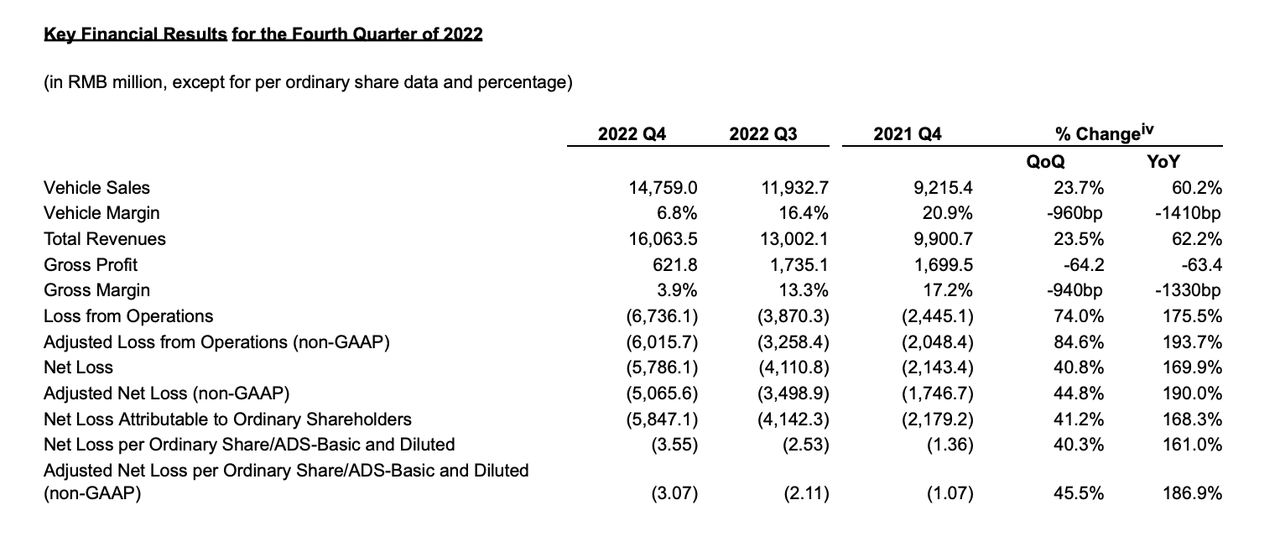

NIO missed on each earnings and revenues in This fall, however nonetheless offered stable YoY progress. Let’s take a look at some key monetary metrics from the earnings launch.

Monetary Metrics (NIO earnings)

Electrical automobile (“EV”) gross sales had been up 60% YoY, and an honest 23.7% QoQ. The massive outlier, although, was automobile margin. VM was 16.4% within the earlier quarter in comparison with 6.8% on this one.

The corporate defined this within the report:

The automobile margin within the fourth quarter of 2022 was negatively impacted by 6.7 proportion factors as a result of stock provisions, accelerated depreciation on manufacturing services, and losses on buy commitments for the prevailing technology of ES8, ES6 and EC6.

Supply: NIO results.

Trying forward, the corporate expects deliveries of between 31,000 and 33,000 autos in Q1, which might suggest a YoY progress price of 20.3% to twenty-eight.1%.

By way of profitability, William Li had this to say within the incomes name:

So, for the gross margin for the complete yr of 2023, we’re assured that within the This fall of 2023, the automobile gross margin will return to 18% to twenty% as a result of a number of components. The primary one is of our product portfolio. Ranging from the second quarter of this yr, we’re going to begin the supply of car fashions with larger automobile gross margins.

The second issue is rather like you talked about, just lately, we have now witnessed the associated fee reductions of the uncooked supplies, together with the lithium carbonate, chips and different commodities.

Supply: Earnings Call.

Administration appears to be assured that this latest fall in profitability was a one-off, and if NIO can proceed its present progress path, then the subsequent earnings report ought to be way more encouraging.

Development Outlook

We should always positively see a rise in profitability within the coming months, however what about progress? The Chinese language slowdown narrative has been in play for a while now, however we at the moment are getting some proof that 2023 could possibly be a greater yr than anticipated.

First off, China’s PMI for February hit an 11 yr excessive. Following the Chinese language new yr, and with the covid lockdowns now a factor of the previous, the Chinese language economic system is off to a surprisingly good begin.

That is additionally being aided by an accommodative financial coverage. The PBoC has been one of many first banks to show the liquidity faucet again on. Final Friday, the Central Financial institution decreased the Reserve Requirement Ratio by 0.25%. This might theoretically add 500 billion to 600 billion yuan to the monetary system. A liquidity increase ought to assist increase shares like NIO.

Although issues look good in China, I’ll say that the expansion trajectory in Europe remains to be removed from spectacular. This was additionally addressed within the earnings name.

For this yr, we imagine the gross sales will not be of prime precedence. To be trustworthy, our goal by way of the gross sales quantity for the European market this yr might be lower than 10,000. And we imagine a very powerful factor for us is definitely the person satisfaction price.

Supply: Earnings Name.

NIO is taking a giant threat transferring into the European market, and regardless of seeing a “excessive person satisfaction price,” the corporate is barely making any gross sales within the continent.

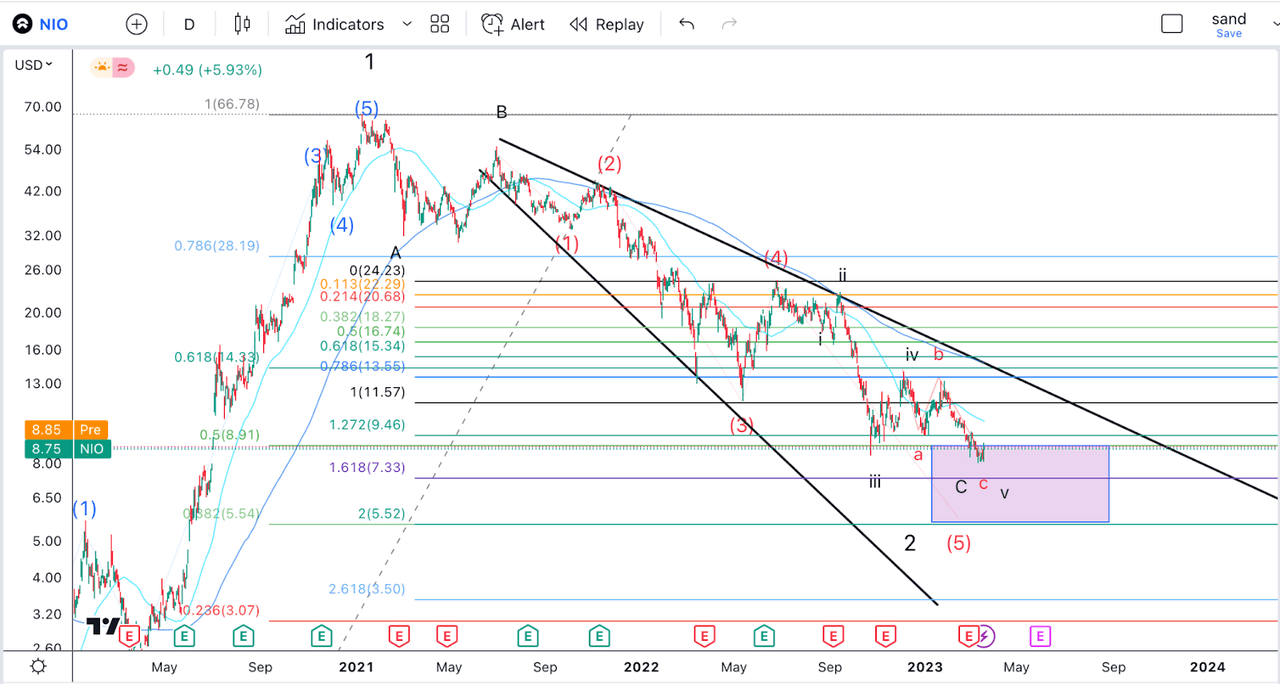

Technical Evaluation

With the newest selloff in NIO, which took the inventory value under 8$, we may start to contemplate {that a} backside could possibly be in place.

With that decrease low, we may think about that wave C of v of (5) has ended. We do have some extra room to run. The perfect goal for our wave (5), based mostly on the 1.618 ext of wave (4) can be $7.33. Under that, the 61.8% retracement of the big diploma wave 1 initiatives is in direction of $5.54. If NIO entered this vary, then I’d purchase aggressively.

Takeaway

The tides are turning. Liquidity is as soon as once more getting into the market, each domestically and overseas, and electrical automobile producers will profit from decrease enter costs and simpler monetary situations. NIO Inc. remains to be, in my view, a best-in-class EV producer, and I totally count on the value to carry out very effectively within the coming 12 months.

[ad_2]