[ad_1]

Time period spreads rising barely, yields (nominal, actual) down, and threat measures up.

One nominal charges have dived; actual charges as nicely, suggesting the majority of the motion is motion in perceived future financial exercise.

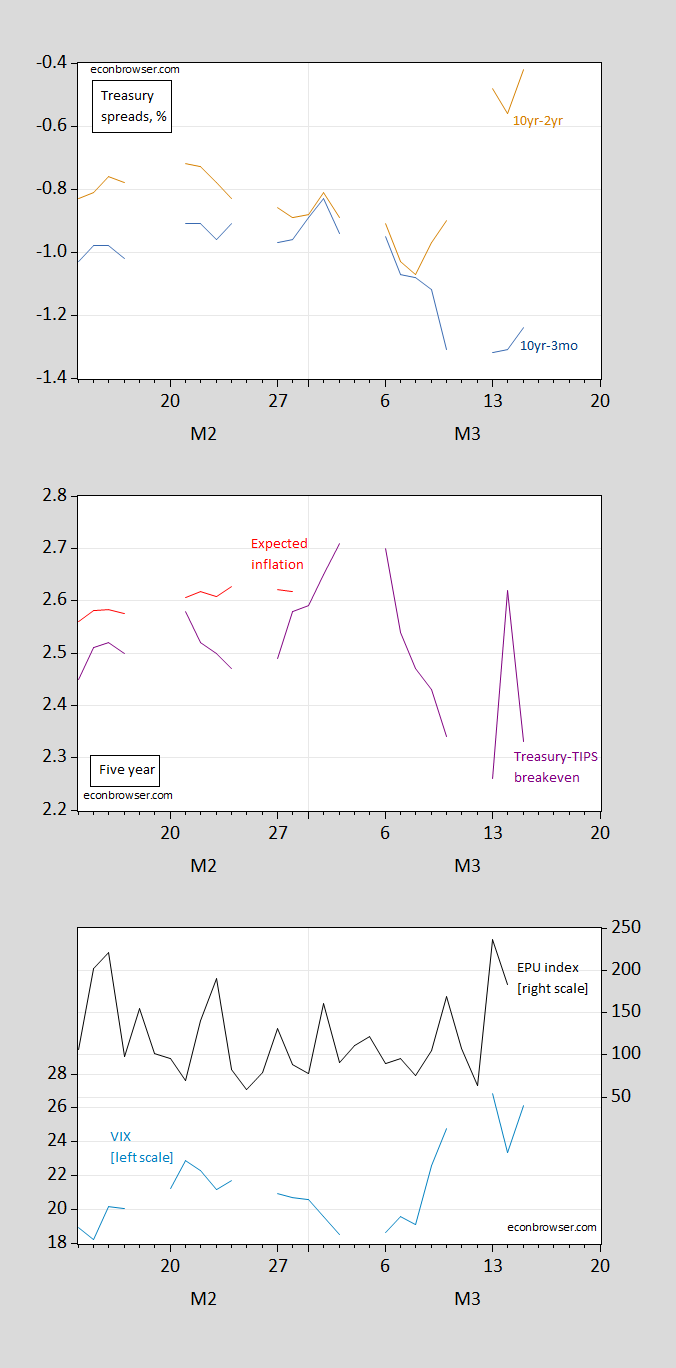

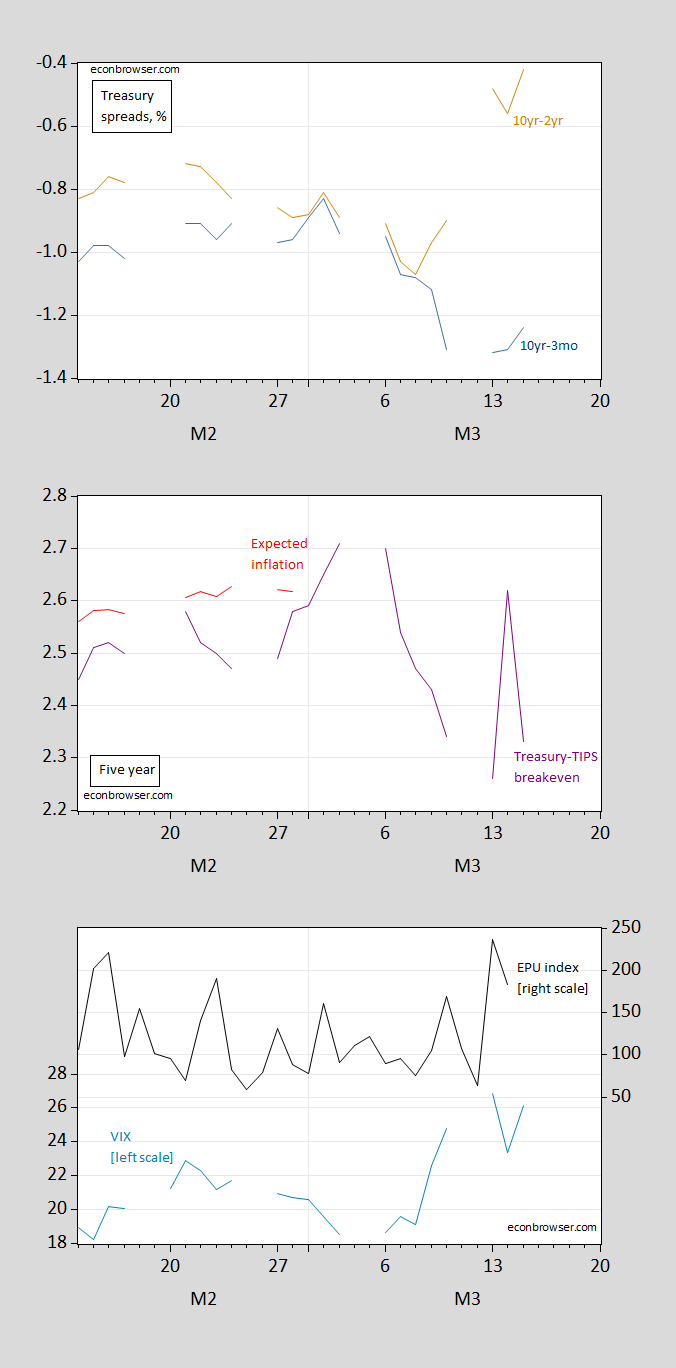

Determine 1: Prime panel: 10yr-3mo Treasury unfold (blue), 10yr-2yr unfold (tan), each in %; Center panel: 5 yr Treasury-TIPS unfold (purple), 5 yr unfold adjusted for liquidity and threat premia (crimson); Backside panel: VIX (sky blue, left scale), EPU (black, proper scale). Supply: Treasury by way of FRED, KWW following D’amico, Kim and Wei (DKW), CBOE by way of FRED, policyuncertainty.com.

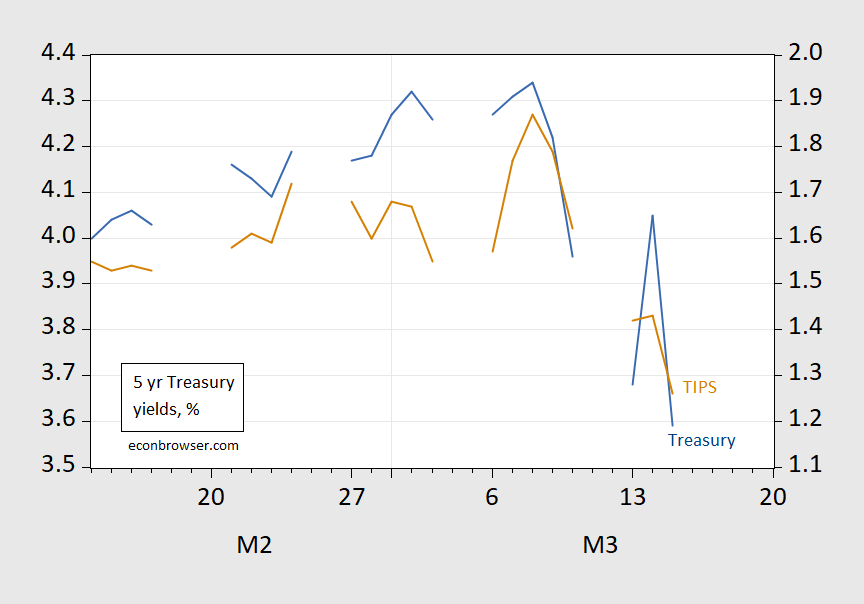

The 5 yr yield dropped 46 bps in the present day, whereas the 2 yr dropped 27 bps. Actual or nominal results? Right here’re the corresponding 5 yr nominal and actual charges.

Determine 2: 5 yr Treasury yield (blue), TIPS (tan), each in %. Supply: Treasury by way of FRED.

During the last week, nominal 5 yr fee has fallen 75 bps, whereas the TIPS yield has fallen 61 bps. That is suggestive of an actual decline — which in fact could possibly be pushed by the outlook for the true economic system, or by expectations of Fed coverage tightness (see the previous post on the implied path of the Fed funds rate).

[ad_2]