[ad_1]

The Wisconsin Department of Revenue’s Economic Outlook May forecast got here out yesterday. Because the US outlook (from S&P World Market Insights, previously Macroeconomic Advisers and IHS Markit) has improved, so too has that of Wisconsin.

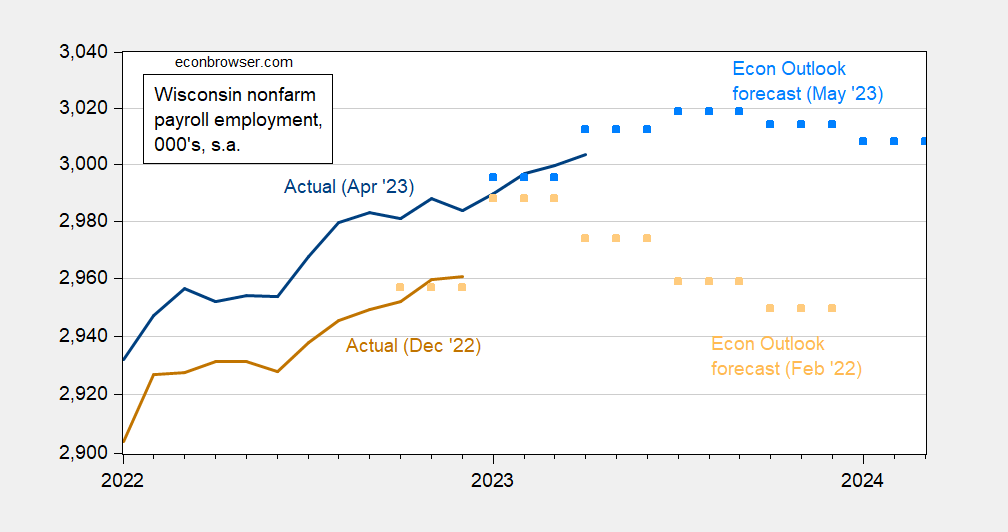

Determine 1: Wisconsin nonfarm payroll employment from April launch (blue), from December 2022 launch (tan), forecast from Might Financial Outlook forecast (sky blue squares), and February Financial Outlook forecast (tan squares). Supply: BLS, and Wisconsin Financial Outlook (May, February).

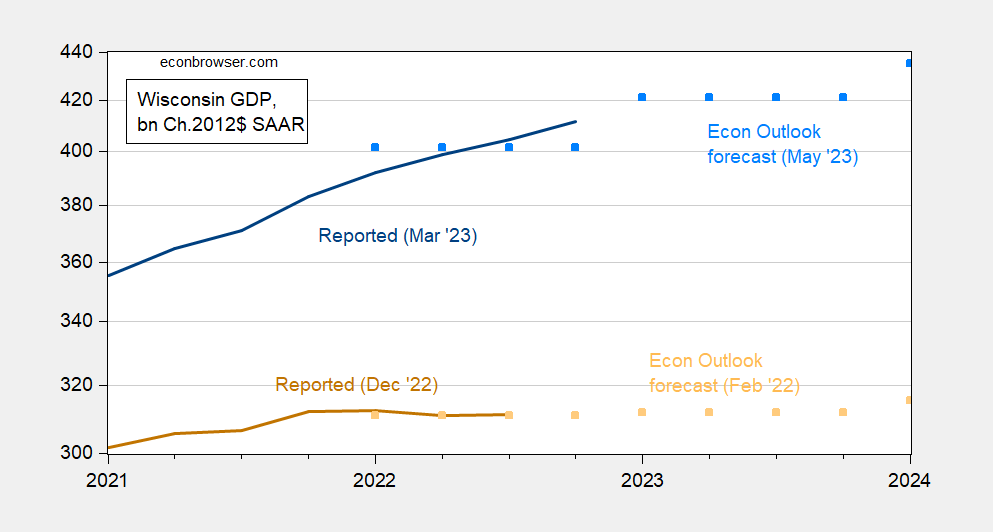

Determine 2: Wisconsin GDP from March launch (blue), from December 2022 launch (tan), forecast from Might Financial Outlook forecast (sky blue squares), and February Financial Outlook forecast (tan squares). Supply: BLS, and Wisconsin Financial Outlook (May, February).

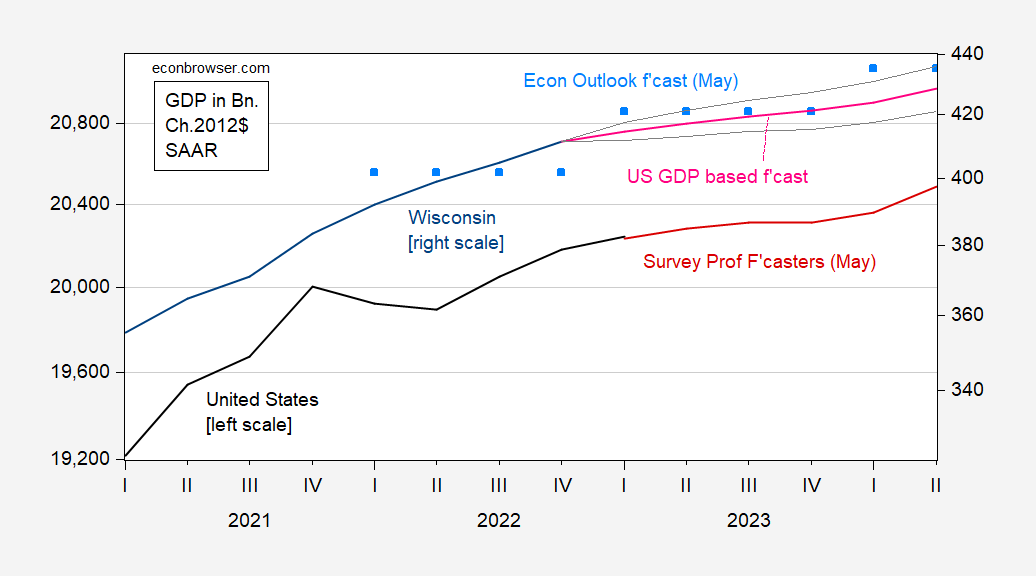

How does the DoR forecast evaluate towards a mannequin based mostly on the correlation with US GDP? I estimate a primary variations regression for 2005Q1 to 2022Q4; the adjusted R2 is 0.83, and coefficient indistinguishable from one. I present US GDP, forecast, Wisconsin GDP, DoR forecast, and the forecast generated utilizing this equation in Determine 3.

Determine 3: US GDP (black, left scale), Might Survey of Skilled Forecasters median (crimson, left scale), Wisconsin GDP (blue, proper scale), Might DoR Financial Outlook forecast (sky blue squares, proper scale), and regression based mostly forecast (pink, proper scale), 60% prediction interval (grey traces, proper scale), all in bn.Ch.2012$ SAAR. Supply: BEA, Philadelphia Fed (Might), WI of DoR (Might), and creator’s calculations.

[ad_2]