[ad_1]

Overview

Mineral exploration is an costly prospect, and as new deposits turn out to be deeper, fewer and farther between, it should solely develop costlier. But mining corporations can’t afford to decelerate — demand for important minerals resembling copper and antimony are shortly ballooning past our international manufacturing capability.

Management, due to this fact, has two choices. They will play it protected and solely pursue recognized portions and pre-existing mines within the hopes that it is going to be sufficient. Alternatively, they will direct their investments in the direction of unexplored and underexplored areas in favorable orogenic settings.

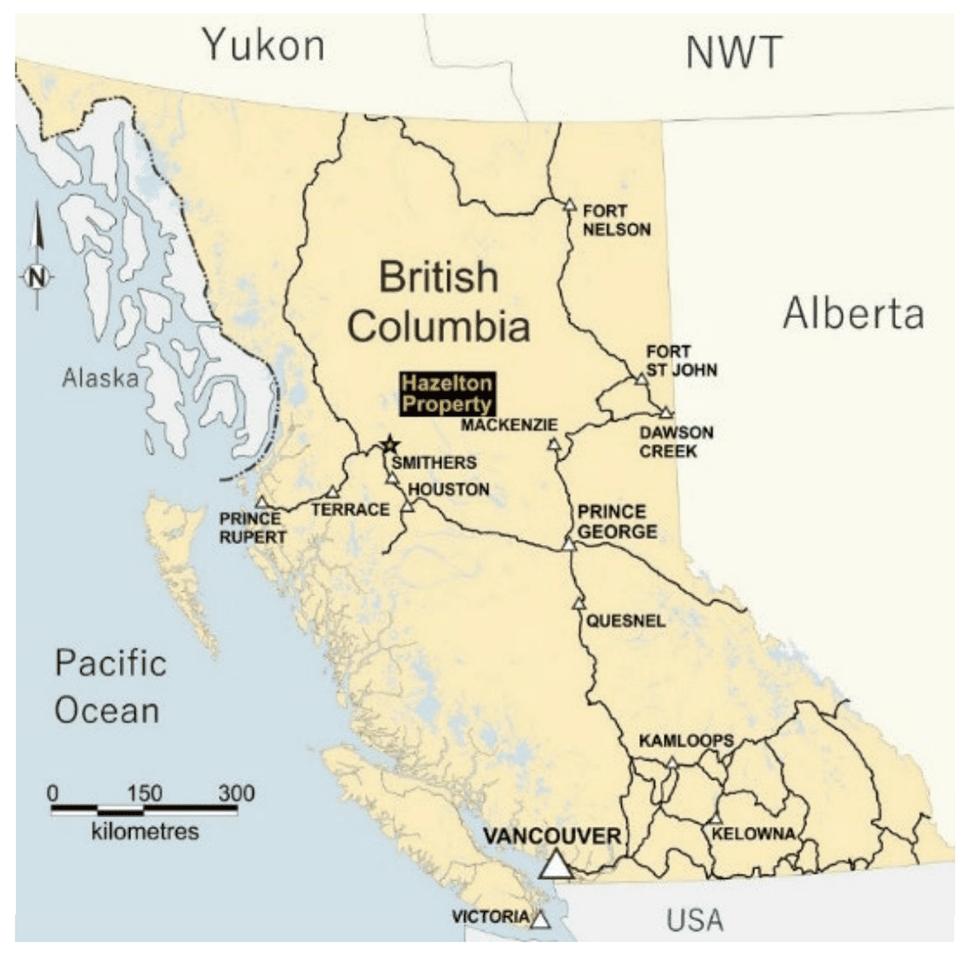

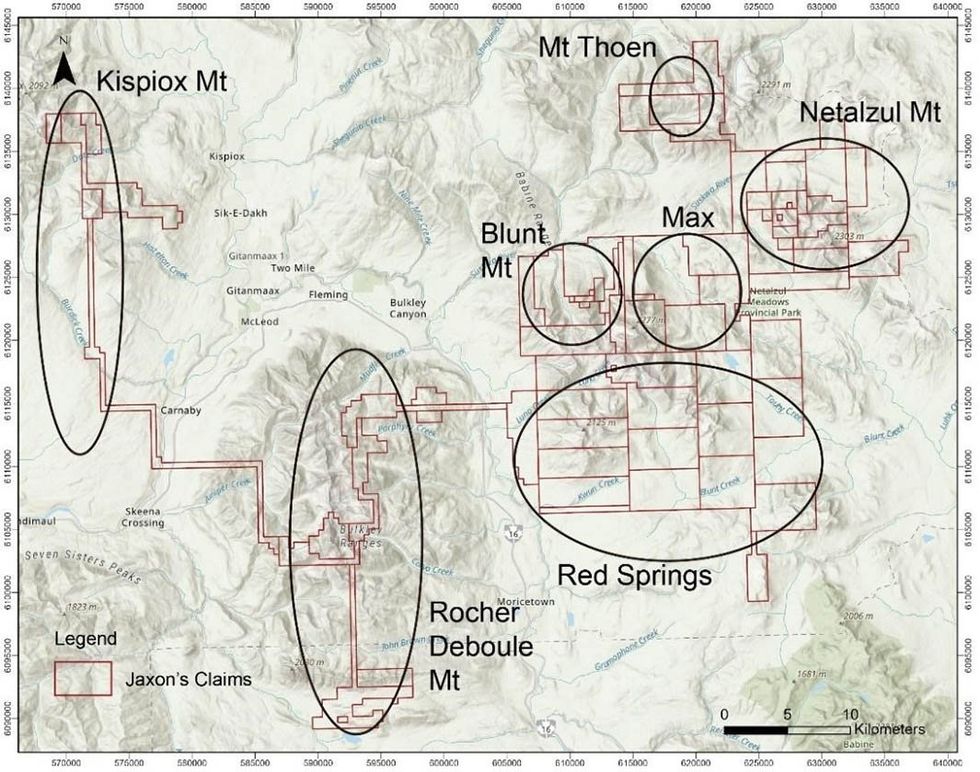

Jaxon Mining (TSXV:JAX, FSE:0U31, OTC:JXMNF) went with the second possibility when it bought the Hazelton Property. Comprising 74 contiguous mineral claims throughout an space totaling 730 sq. kilometers, the property is located 57 kilometers north of Smithers, in British Columbia’s potential but underexplored Omenica Mining Division. Hazelton comprises a complete of seven porphyries, three of which represent the corporate’s major focus in 2023: Netalzul Mountain, Kispiox Mountain and Pink Springs.

Netalzul is a polymetallic epithermal-porphyry system topped by one of many largest and strongest copper, molybdenum and zinc anomalies ever noticed in British Columbia. Kispiox Mountain, in the meantime, is house to arguably North America’s and one the world’s highest-grade antimony deposits. Equally, Pink Springs comprises one of many largest occurrences of mineralized quartz-tourmaline breccia zones and pipes ever found in North America.

The corporate’s management group consists of a number of the world’s main consultants in mineral exploration and improvement. John King Burns, CEO, and Dr. Tony Guo, the corporate’s president and chief geologist, respectively, are notably noteworthy.

Burns is a veteran within the mining finance sector, having managed threat and financed initiatives at each stage of improvement all around the globe. Guo, in the meantime, combines intensive enterprise experience with a doctorate diploma in geology and is a grasp explorationist. Between them, they’ve greater than 5 many years of expertise working with each main producers and junior exploration corporations.

Jaxon has leveraged the technical self-discipline and expertise of those people and the remainder of the corporate’s administration group very successfully, whereas additionally holding operations comparatively lean. Along with complete structural and floor mapping and modeling, the corporate has utilized geophysics, geochemistry and intensive sampling to its exploration and discovery efforts. This model- and data-driven strategy has greater than borne fruit, permitting the corporate to uncover a number of promising deposits with minimal drilling required.

Along with extremely promising geology, Jaxon’s challenge places permit the corporate to take full benefit of the Canadian authorities’s important minerals exploration incentives, together with the British Columbia Mineral Exploration Tax Credit score (BCMETC) and the Federal Vital Mineral Exploration Tax Credit score (CMETC).

The BCMETC provides credit equal to 20 percent of qualified mining exploration expenses, with an enhanced charge of 30 % for operations undertaken in mountain-pine-beetle-affected areas. The CMETC, in the meantime, is a lately launched 30 % funding tax credit score relevant to eligible flow-through share agreements. It applies to fifteen important minerals, together with copper and zinc — making Jaxon eligible to boost funds underneath the brand new necessities.

Firm Highlights

- Jaxon Mining is a junior mining firm working primarily in northwest British Columbia and helmed by business veterans with many years of experience.

- Jaxon is at the moment pursuing discoveries in its 100-percent-owned Hazelton land bundle, which has the potential to offer the corporate with a serious district-scale play.

- Divided into seven owned and linked goal areas, Hazelton exists in a complete mining service middle with shut proximity to a serious freeway and railroad, power infrastructure and an airport.

- Copper, antimony, molybdenum, silver and zinc symbolize the Hazelton Property’s major mineral assets. There may be additionally the potential for important reserves of gold, lead and tungsten.

- Jaxon expects a copper equal grade of 0.7 % from its initiatives, considerably larger than the province’s common.

- Porphyries in Hazelton are primarily located above sea degree and ought to be amenable to superior underground mining methods.

- In February 2023, the corporate received $741,890.96 in mineral exploration tax credit score from the BC Provincial Authorities.

Key Initiatives

Netalzul Mountain

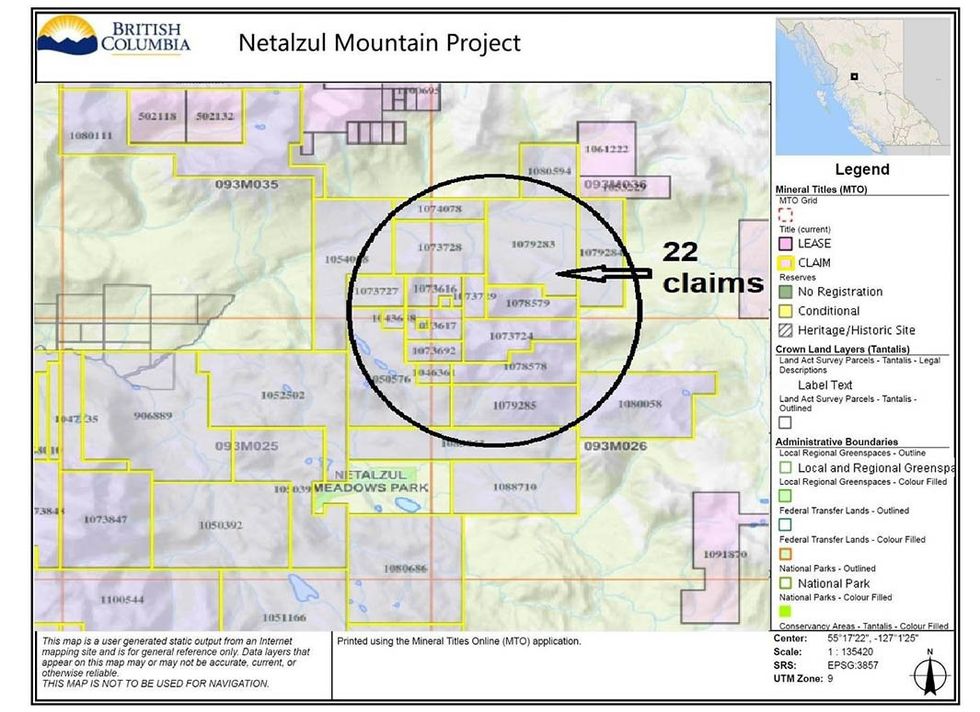

As the primary of Jaxon’s drill-ready and drill-permitted initiatives, Netalzul Mountain consists of twenty-two contiguous claims totaling 136.42 sq. kilometers. The first deposit is a copper-molybdenum-silver-gold-zinc-lead-antimony sulfide QV epithermal-porphyry mineralization system with exceptionally high-grade silver within the excessive sulfidation epithermal quartz veins. Though this residue has been the topic of appreciable artisanal mining exercise, it is also traditionally underexplored — Jaxon is the primary to drill take a look at the world.

Consolidated in 2020, Netalzul’s most notable attribute is the bizarre power of its magnetic anomalies. Located alongside the Skeena Arch within the Canadian Cordillera’s central Intermontane Belt, Netalzul comprises the strongest geochemical and geophysical anomalies in copper porphyries found in BC to this point. In accordance with Jaxon, the deposit’s mineralization is analogous to SolGold’s extremely profitable Ecuadorian Alpala Porphyry.

Undertaking Highlights:

- Distinctive Anomalies: In accordance with a evaluation of Jaxon’s 3DIP chargeability and 3DMT knowledge, excessive MT conductivity may be discovered at depths of as much as 1,000 meters together with annular excessive chargeability anomalies and a number of discrete and variably linear magnetic low anomalies. These anomalies are all centered round a 10-square-kilometer Late Cretaceous granodiorite intrusion within the challenge’s middle space.

- Compelling Historic Information: Excessive-grade polymetallic rock samples reported in 2010 embody silver grades of over 100 grams per ton (g/t) and copper, zinc and lead contents all above one %.

- Promising Geology: Jaxon has collaborated extensively with organizations resembling Fathom Geophysics to assemble a mannequin of the zone that features geochemical knowledge, magnetic knowledge, geophysical knowledge and pattern knowledge. Highlights embody:

- Massive granodiorite and monzonite dyke swarms each topped and surrounded by hornfels.

- Underlying hornfel sedimentary rock from the Bowser Lake Group and granodiorites from the Bulkley Intrusive.

- Non-magnetic monzonite dykes generated by the deeper porphyry system outcrop within the magnetic low space.

- Shut fractured zones and shear zones with high-grade quartz and sulfide veins distributed all through the intrusive, with shears and dykes trending northeast and dipping southeast.

- Excessive-grade, Close to-surface Propylitic Zones: At current, Netalzul consists of 4 epithermal zones with excessive silver, gold, copper, molybdenum, lead, antimony and zinc content material. Seize and channel samples from these zones are encouraging, and a number of the highest outcomes embody:

- Silver at as much as 5,301 g/t.

- Gold at as much as 5.9 g/t

- As much as 37.85 % zinc.

- As much as 29.18 % lead.

- As much as 3.45 % copper with soil anomaly contents of over 10,000 elements per million (ppm).

- Non-negligible quantities of antimony and molybdenum.

Kispiox Mountain

Kispiox, Jaxon’s portable-drill-ready goal, homes what’s probably one of many largest and highest-grade antimony deposits in North America. As with Netalzul, Kispiox has traditionally seen restricted exploration, probably due at the very least partially to its considerably difficult geography. The challenge is characterised by broad wooded valleys which separate remoted mountain peaks with rugged cliffs and steep slopes.

Even so, Jaxon’s area geologists in 2021 performed geophysical and geochemical surveys on accessible elements of the property. They collected a complete of 54 rock samples — 33 mineralized samples and 21 geochemistry samples, which had been despatched to MSALABS in Langley, BC for evaluation.

This sampling program allowed Jaxon to establish three high-grade antimony large to disseminated sulfide quartz mineralization outcrops. Jaxon adopted up its rock sampling program with a soil sampling program, accumulating, and inspecting a complete of 11 samples with a handheld XRF analyzer. This confirmed excessive antimony content material within the soil — as much as 736 ppm.

Undertaking Highlights:

- Underlying Geology: Sedimentary strata from the Bowser Lake Group and Kitsuns Creek Formation of the Skeena Group may be discovered beneath Kispiox with a number of porphyritic intrusions from the Bulkley Plutonic Suite.

- Robust Proof of Promising Mineralization: Learning the quartz sulfide veins, geologists noticed important stibnite together with hint quantities of fine-grained chalcopyrite and molybdenum. Pyrite is widespread each on the quartz veins and as fracture coating within the hornfels. This means the presence of a porphyry-epithermal antimony-copper-molybdenum system.

- Excessive-grade Antimony: One high-grade rock outcrop pattern collected from inside an 8 to 10-meter-wide sulfide quartz veining mineralization zone confirmed as much as 29.69 % antimony. There may be additionally proof to counsel that oxidation and weathering of stibnite minerals on the floor might have lowered the grade of this pattern’s antimony.

- Promising Pattern Outcomes: Highlights from Jaxon’s collected rock and soil samples embody:

- Over 1,000 ppm antimony in 11 samples, of which one outcrop rock pattern comprises over 29 % antimony, and one two-meter chipping pattern comprises over 6 % antimony.

- Higher than one % antimony in 4 samples.

- Seven samples with over 500 ppm copper, together with three with higher than 1,000 ppm.

- Three samples with over 100 ppm molybdenum.

- Hint quantities of galena and sphalerite in collected granodiorite intrusive rocks, with one pattern returning 1,047 ppm lead and a couple of,003 ppm zinc.

- Soil samples contained important antimony, copper and molybdenum.

Pink Springs

Drill-ready and absolutely drill-permitted, Pink Springs is an energetic, copper-rich porphyry system with a number of, large-scale porphyries and intensive mineralized, gold-bearing quartz-tourmaline breccia zones and pipes. The system can broadly be divided into two distinct mineralized zones.

The primary is an in depth thrust fault that hosts high-grade gold-bearing tourmaline breccia with cobalt, copper, antimony and bismuth credit, a first-of-its-kind discovery in British Columbia. The second is a big copper-molybdenum porphyry mineralization.

Jaxon has carried out intensive work in Pink Springs, together with 1,050 meters of diamond drilling, a seven-line 31-kilometer-line survey, 16 precedence IP anomalies, a magnetic survey, a soil chemistry survey and a LIDAR topographical survey. It has additionally collected roughly 1,200 rock samples and mapped roughly 30 sq. kilometers of the challenge.

The corporate is at the moment planning a drill take a look at for the challenge’s major ridge porphyry goal, set to occur someday in 2023.

Undertaking Highlights:

- Promising Geology: Pink Springs is marked by three Late Cretaceous Ok-feldspar disseminated sulfide granodiorite porphyry outcrops.

- Excessive-grade Mineralization: Pink Springs’ mineralization areas each have high-grade copper and molybdenum of their soil anomalies and breccia zones/pipes containing high-grade gold-copper-cobalt. The zone additionally hosts high-grade large sulfide and sulfosalt silver-antimony-gold-copper.

- Drilling Outcomes: Assay outcomes from Jaxon’s diamond drilling program returned as much as 8.2 g/t gold equal with 6.6 g/t gold, 0.1 % cobalt and 0.04 % bismuth.

Blunt Mountain

Blunt Mountain is a high-grade sulfide quartz-vein epithermal porphyry system with a high-grade gold-silver-antimony-zinc-lead. The world’s major deposit takes the type of a four-kilometer-long mineralization hall with a number of high-grade veins in addition to indications of molybdenum and copper.

Max/Knoll

Max/Knoll is a promising silver challenge that shows lots of the identical traits because the close by Fairness Mine, as soon as Canada’s most worthwhile silver mine.

Rocher Deboule Mountain

Located throughout the Rocher Deboule inventory, the Rocher Deboule Mountain challenge covers roughly 13.3 sq. kilometers. It comprises recorded three mineral occurrences — copper-silver, molybdenum-copper and tungsten-gold. In March 2023, Jaxon acquired 4 new mineral tenures to develop the challenge.

Mount Thoen

One other comparatively current declare alongside Rocher Deboule, Mount Thoen is a porphyry-driven polymetallic copper-molybdenum goal.

Administration Workforce

John King Burns – Chairman and Chief Government Officer

John Burns has intensive expertise in managing threat and financing useful resource initiatives within the exploration, improvement and manufacturing phases each within the Americas and throughout the globe. Beforehand, Burns served as a non-executive unbiased director of China Gold Worldwide Assets (TSX, HKEX), the affiliate of China Nationwide Gold Group. He additionally beforehand served as chairman of Athabasca Potash (TSXV), as chairman of Dolly Varden Silver (TSXV), as a director of Corazon Gold (TSXV), as chairman of Titan Goldworx Assets (CNSX) and as chairman of Northern Orion Explorations (TSX).

Burns is former vice-president and chief monetary officer of the Drexel Burnham Lambert Commodity Group in New York, London and Chicago; former managing director and international head of the Spinoff Buying and selling and Finance Group of Barclays Metals Group, Barclays Financial institution PLC in London and former managing director of Frontier Threat Administration LLC, a grains-and-livestock-focused CTA in Chicago. He serves as lead director and an audit committee member for a lot of non-public venture-focused corporations.

Yingting (Tony) Guo – Director, President and Chief Geologist

Yingting (Tony) Guo has over 30 years’ expertise within the mining business engaged on mineral exploration and improvement initiatives/mines, primarily in Asia and North America. Guo’s enterprise experience consists of mineral useful resource exploration, estimation, improvement, evaluation, acquisition and challenge administration. He has participated and managed a number of mineral exploration initiatives internationally and has been instantly concerned within the discovery of two giant gold deposits (MOz Plus) for the final 20 years.

His credentials embody a Bachelor of Science diploma in Geology from Nanjing College in addition to a Doctoral Diploma in Geology and Exploration from China College of Mining and Expertise. He’s a registered Skilled Geoscientist from the Province of British Columbia, Canada and QP Committee member of Mining and Metallurgical Society of America. As a Senior Geologist or a Senior Administration Officer, Guo has labored in mining corporations to consulting corporations resembling SW Tech Company, Jinshan Gold Mines, China Gold Worldwide and Behre Dolbear Group, Guo is the founder and chairman of the Affiliation of Chinese language Canadian Mining Professionals in Canada. He additionally serves as chairman of C2 Mining Worldwide Company and Transcontinental Gold Company.

Brian Crawford – Chief Monetary Officer and Company Secretary

Brian Crawford holds a B. Com. from the College of Toronto and has intensive expertise as a senior monetary govt with private and non-private corporations. He has additionally served as a accomplice in a nationwide agency of chartered skilled accountants. Crawford based and co-founded a number of corporations at the moment listed on the TSXV and the CSE.

He at the moment serves as a director, company secretary, and CFO of a number of TSX Enterprise Change or Canadian Securities Change listed corporations together with Silver Bullet Mines Corp., Searchlight Assets Inc., CBLT Inc. and Tempus Capital Inc.

James Lavigne – Director and Technical Advisor

James Lavigne has been a director of Jaxon Mining since November 2008. Lavigne has over 25 years’ expertise in all phases of mineral exploration and improvement, predominantly in base and valuable metallic deposits. He has held senior technical positions with main Canadian and Australian mining corporations and has been concerned in technical and administration roles with a number of junior exploration corporations.

Lavigne is at the moment a consulting geologist specializing in superior exploration and useful resource delineation and estimation. He holds a B.Sc. (Geology) from Memorial College of Newfoundland and a M.Sc. (Geology) from the College of Ottawa. He’s licensed as knowledgeable geologist by the Northwest Territories and Nunavut Affiliation of Skilled Engineers and Geoscientists.

Laurence Stephenson – Director

Laurence Stephenson has been a director of Jaxon Mining since November 2008. He has over 40 years’ expertise within the area of mineral exploration and in guiding new corporations within the acquisition and utilization of capital. He was instrumental in beginning Glencairn Exploration Ltd., a listed firm and its subsidiary Wheaton River Minerals Ltd. (previously listed on the Toronto Inventory Change earlier than its plan of association with Goldcorp Inc.).

Stephenson acquired his B.Sc. from Carleton College and his MBA from York College. He’s a member of the Skilled Engineers of Ontario and the Skilled Engineers and Geoscientists of British Columbia.

Melinda Hsu – Director

Melinda Hsu has over 30 years of diversified expertise in areas of accounting, finance, company improvement and administration. She has held senior administration positions with numerous mining and oil & fuel corporations with each Canadian and worldwide operations and has served as CFO and company secretary for numerous TSX and TSX Enterprise-listed corporations.

Hsu is a member of the Chartered Skilled Accountants of British Columbia and Ontario and has a Grasp of Arts in Commerce from Renmin College of China.

Gregory Corridor – Technical Advisor

Greg Corridor is a geological advisor of Golden Phoenix Worldwide Pty Ltd and was chief geologist for Placer Dome Group from 2000 to 2006. He managed exploration in Western Australia for Placer Dome from 1988 to 2000 and CSR Restricted from 1984 to 1988. The invention of Rio Tinto’s Yandi iron ore mine and Gold Fields’s Granny Smith gold mine in WA are highlights in his profession.

Corridor graduated from the College of New South Wales in 1973 with a Bachelor of Utilized Science.

Russell Mason – Technical Advisor

Russell Mason is a structural geology advisor employed by Tectonite Geology. He has labored primarily as a advisor each independently (2003-present) and for a consulting agency (Fractal Graphics 1996 – 2003) with a interval working as a analysis scientist for CSIRO (1994 -1996) and minor exploration roles and contract mapping initiatives (1984 – 1990). Mason’s work is field-based structural geology and is mostly utilized to gold and copper exploration and mining. Russell graduated from Monash College with a Bachelor of Science (1st class honors) and accomplished a PhD from Imperial School, London College in 1994.

Wenhong (Wilson) Jin – Technical Advisor

Wilson Jin has three many years of area exploration, acquisitions, financing and funding expertise for valuable and non-ferrous metals in Asia, Africa and in North America. He has served as Chief Geologist, VP of Acquisitions and President and CEO of Huakan Worldwide Mining Inc.

Primarily based in Vancouver since 2010, Jin led a profitable exploration of the J&L Gold polymetallic deposit in BC. He additionally found a medium-sized gold deposit and made important achievements within the exploration of adjoining claims of Jinduicheng molybdenum porphyry deposit in Shaanxi province, China. Jin is CEO and President of Transcontinental Gold Corp., CEO and president of Wildsky Assets and serves as an unbiased director to 2 different publicly listed corporations.

[ad_2]