[ad_1]

fstop123

Should you admire this text please like, remark, and share. Thanks.

Final yr we wrote an article on housing titled U.S. Housing Is A Dead Man Walking. In it, our evaluation recognized dangers to the U.S. housing market with this concluding thought:

The U.S. Housing Market is absolutely screwed up. Everyone seems to be making an attempt to purchase and first time homebuyers have been left within the mud. In any market, when everyone seems to be bullish that may be a good signal the highest is close to.

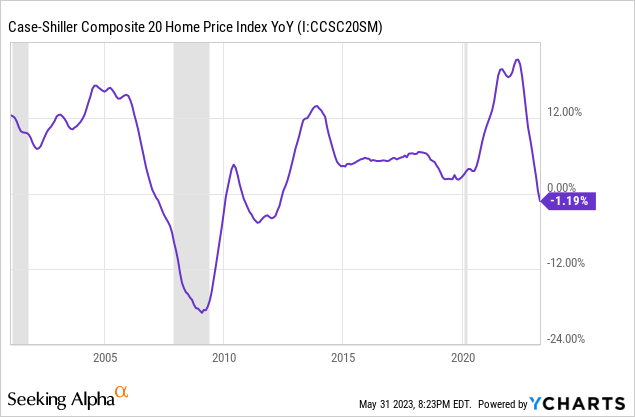

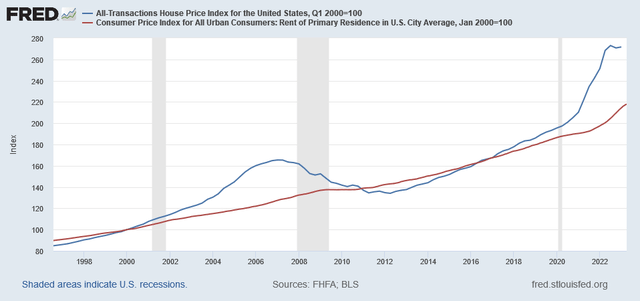

Since then, the housing market has peaked because the Case-Shiller Composite Dwelling Value Index has now fallen to -1.19% yr over yr. The worth of U.S. houses has declined by an estimated $2.3 trillion in 2022.

With the highest clearly behind us, it is time for an up to date tackle the U.S. housing market. Is it nonetheless a “lifeless man strolling” or is the underside in?

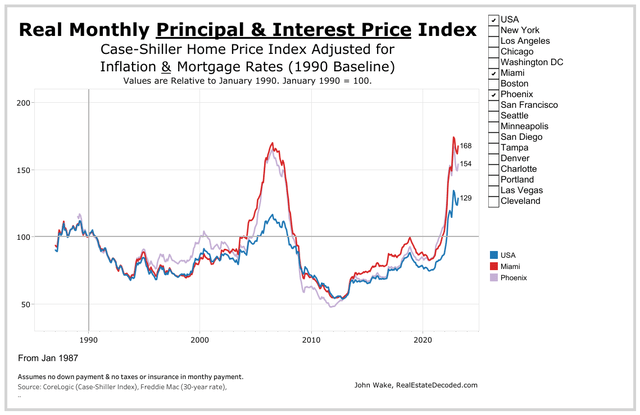

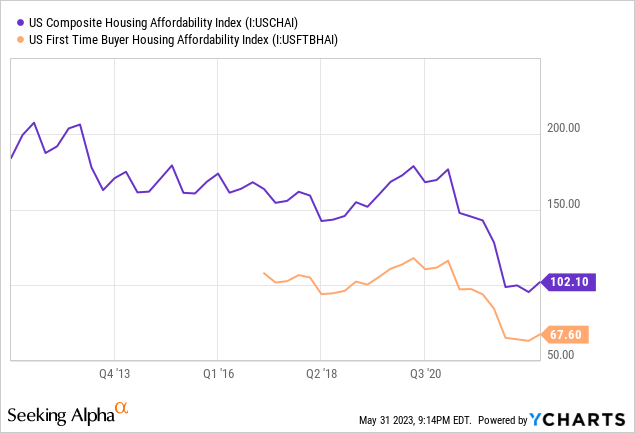

Our total evaluation is that the U.S. housing market is deeply distorted. Affordability is abysmal. The actual mortgage worth index by John Wake reveals simply how dangerous it’s. The common month-to-month mortgage cost, adjusted for inflation and rates of interest, continues to be close to all time highs throughout the U.S. A few of the priciest cities, together with Phoenix and Miami, are just under their all time highs set in 2006.

Realestatedecoded.com, John Wake

The actual mortgage cost worth index is the very best measure of housing affordability, in our opinion. Costs are considerably influenced by leverage as most homebuyers mortgage their buy. As such, the month-to-month cost in relationship to prevailing rents and wages is the practical measure of affordability that impacts housing choices. In line with this index, and plenty of different measures, housing within the U.S. has by no means been dearer.

Which means one among three issues should happen:

- Mortgage charges lower

- Family incomes improve

- Dwelling costs lower

In actuality, a mixture of those elements can deliver stability to the housing market. As they are saying, “the treatment for prime costs is excessive costs.” We see the proof of treatment creeping by. The U.S. housing market is not lifeless. But it surely does should be introduced again to life.

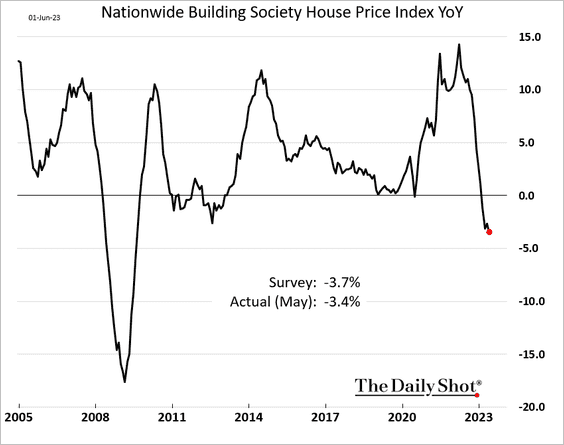

The place The Housing Market Is At the moment

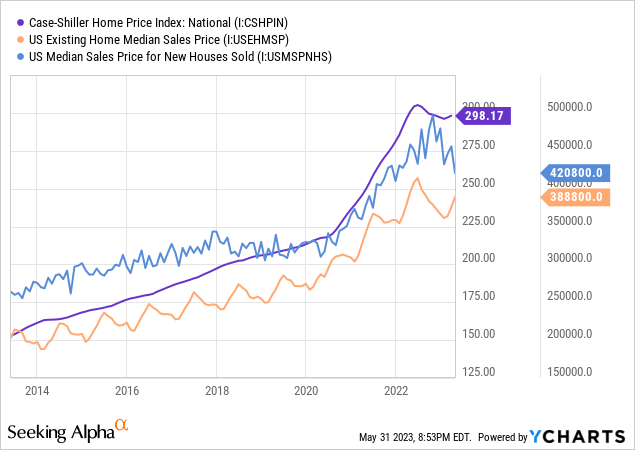

In line with the S&P/Case-Shiller U.S. Nationwide Dwelling Value Index, dwelling costs within the U.S. peaked in June 2022. However worth momentum will not be even throughout the nation. The value declines are concentrated in Western States together with California, Arizona, and Oregon. A lot of the Midwest and Southern US are nonetheless at their all time highs. The Nationwide Constructing Society Home Value Survey Index discovered that in Could dwelling costs had been down 3.4% YoY. Downward worth momentum has been sturdy with essentially the most fast decline in dwelling costs since 2008.

The Every day Shot (used with permission)

The Case-Shiller Dwelling Value Index discovered help in early 2023, prompting optimism that the housing market had bottomed. That is partly a operate of seasonal curiosity in dwelling shopping for and momentary aid to mortgage charges. However whereas present houses have held onto costs comparatively nicely, new dwelling costs have weakened. This alteration will not be absolutely represented within the worth information as a result of homebuilders have been providing numerous incentives to homebuyers to encourage gross sales with out dropping the sticker worth. A study confirmed that 57% of dwelling builders supplied an incentive in February 2023. These incentives embrace mortgage fee purchase downs (typically 1-2%), overlaying closing prices, and together with upgrades at no additional price.

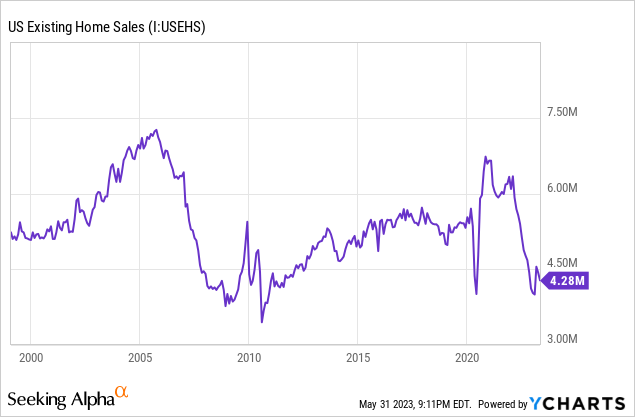

The most effective phrase to explain the U.S. housing market is stalemate. Present dwelling gross sales have plummeted to ranges final skilled through the wake of the nice recession.

Sellers Are Caught

The motivation construction of the market has been fully warped to encourage everybody to sit down and do nothing. Sellers have grow to be frozen as a result of 99% of mortgages are under present mortgage charges with the common mortgage fee within the U.S. under 4%. Sellers are affected by recency bias and anticipate to obtain the identical quantity for his or her dwelling as they’d have a yr in the past.

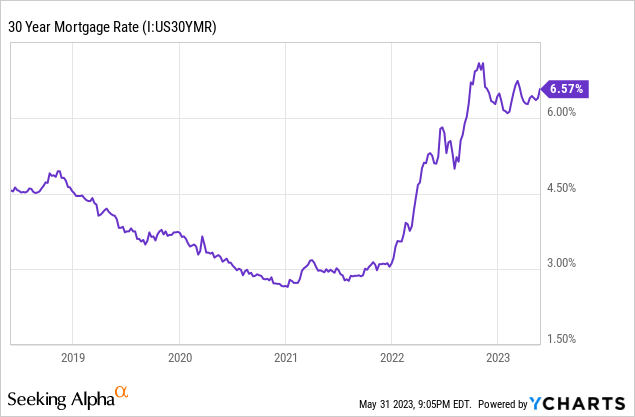

This bias is blind to the truth that as mortgage charges rise the intrinsic worth of property declines. Mathematically, when mortgage charges rise from 4% to five% the intrinsic worth of property is predicted to say no by 11%. When charges rise additional to 7.5% the decline rises to 32%. It is because for many homebuyers the worth they’ll afford is dependent upon the month-to-month cost as a operate of their month-to-month earnings. With all different issues being equal, they’ll afford much less dwelling at greater charges. Because of this, sellers are strongly disincentivized to give up their sub-4% mortgage fee to acquire a mortgage at at present’s charges of 6.5%+. Sellers are sabotaging themselves by anticipating the identical worth for his or her present dwelling at greater charges after they themselves can not afford their very own dwelling at present charges and costs.

Consumers Are Locked Out

With costs remaining cussed within the face of rising charges, consumers are getting locked out. The common actual month-to-month mortgage cost within the U.S. is round $2,900 per 30 days. The historic restrict for the actual month-to-month cost has been round $2,400. The family earnings required to afford a median mortgage is now above $100,000, far above the median earnings of $70,000.

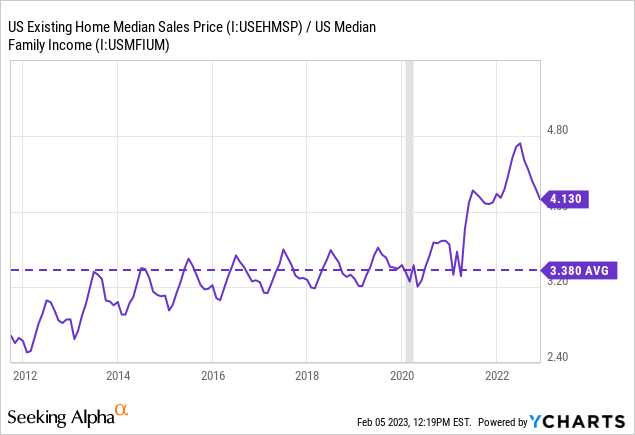

The U.S. Housing Affordability Index is now decrease than the underside in 2007. The common home cost to earnings ratio is round 42%. This final peaked at 41.7% in 2007 and troughed at 23% in 2013. The common since 1997 is 30.2%, which is the ratio that’s generally advisable by monetary advisors. Dwelling costs would want to decline by greater than 30% to succeed in that historic imply.

Consequently, mortgage originations have fallen sharply. In January 2023, 82% of Fannie Mae survey respondents stated that now’s a “dangerous time” to purchase a house. Consumers undergo from their very own measure of recency bias as many look to the costs of 2020 and prior and stay skeptical of the 30-40% improve in dwelling costs since that point. Knowledge from Redfin demonstrates that 21% of houses on the market in 2022 had been thought-about reasonably priced, a big drop from 40% in 2021 and 45% in 2020. CBS News lately revealed an article that stated for many Individuals proudly owning a house has grow to be a “distant dream.” To say that first time dwelling consumers are despondent can be an understatement.

The U.S. median housing cost as a share of median earnings was 42.9% in December, down from a peak of 46.4% however nonetheless greater than the height in 2006. To return to development, median dwelling costs must fall 18.5% or median household incomes must rise 22%.

How Did We Get Right here

The meteoric rise in dwelling costs was not an entire shock. Some contributing elements, resembling mortgage charges, had been clearly bullish for the market. Nonetheless, it was the mix of near-perfect elements that resulted in the most costly housing market in U.S. historical past. It began with the Federal Reserve and the COVID pandemic.

Financial Stimulus

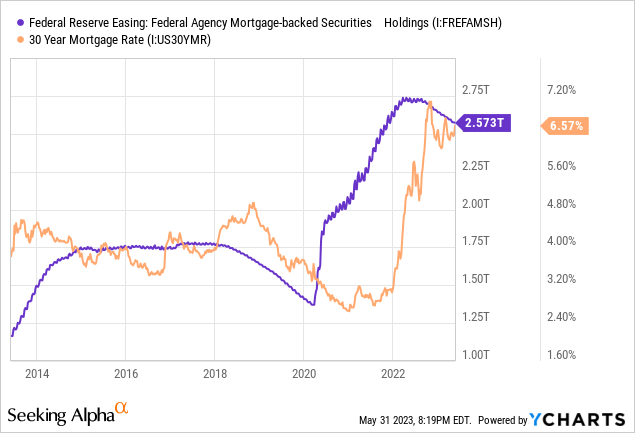

In response to the COVID pandemic in early 2020, the Federal Reserve expanded its stability sheet and dropped rates of interest in an try and help the economic system by financial easing. This included the acquisition of $1 trillion in mortgage backed securities. By buying MBS, the Fed offered liquidity to the residential lending market which helped to subdue mortgage charges under 3%, the bottom in trendy historical past. The decrease charges made mortgage funds extra reasonably priced and allowed homebuyers to bid up costs. As costs bid greater, it inspired hypothesis and cemented aggressive bidding as householders feared lacking out on the appreciation positive factors available in the market.

Fiscal Stimulus

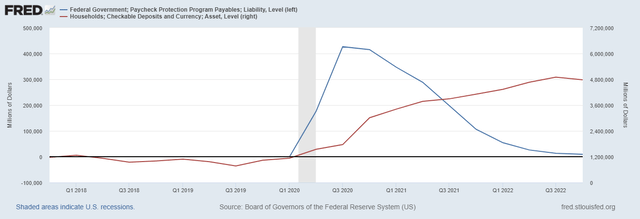

The Federal Authorities contributed to the help effort by implementing moratoriums on evictions, foreclosures, and pupil mortgage funds. Subsequent, over $814 billion in stimulus checks had been distributed to American households whereas $800 billion in Paycheck Safety Program loans had been distributed, about 92% of which have been a minimum of partially forgiven. Documented evidence means that fraudulent use of PPP funds are significantly widespread and resulting in elevated convictions prompting Federal officers to increase the statute of limitations for PPP fraud from 5 to 10 years. Many of those convictions contain the fraudulent use of PPP funds to purchase real estate.

The result’s a sharply acute discount in family bills and elevated earnings. Checkable deposits for households within the U.S. has risen over $3 trillion within the final three years.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

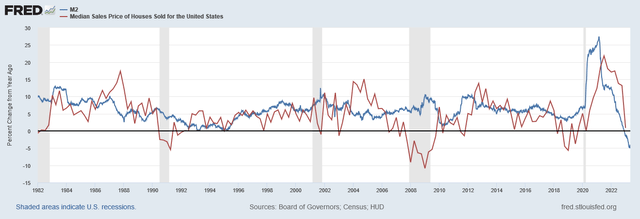

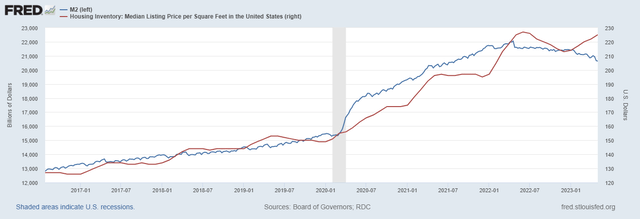

As a consequence, the U.S. M2 cash inventory rose over 40% after the pandemic. The chart under reveals how the yr over yr worth of homes within the U.S. compares to the yr over yr change in M2. The information demonstrates that dwelling costs largely reply to adjustments in cash provide with a brief lag. It must be anticipated, then, that dwelling costs responded to the rise in M2 cash inventory with impeccable similarity. Likewise, the M2 cash inventory has been declining in 2023 together with dwelling costs.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

Change in Housing Choice

The pandemic modified a lot concerning the way of life decisions of Individuals. Due to lockdowns and the chance of virus unfold, individuals started to worth suburban houses extra with additional house and backyards. After many corporations transitioned their workforce to distant work, individuals had the flexibleness to work from anyplace and selected to maneuver to fascinating locations. This brought on The Great Pandemic Migration from city facilities to suburban and rural settings. This additionally included many individuals migrating to extra fascinating areas resembling Florida, Colorado, and different locations.

The rise in distant work brought on tens of millions of households to reexamine their want for house of their dwelling as individuals added an workplace in a single day however with no room to place it in. Others nonetheless, with their newly infused financial savings accounts, may now transfer out of their present dwelling scenario and afford to reside solely, thus leading to family formation. These and several other different elements impressed tens of millions to change their dwelling for one more.

Hypothesis

Many individuals determined to make use of their new disposable earnings to put money into actual property. The market was sizzling which attracted plenty of consideration and costs rose rapidly which prompted livid shopping for. The net is replete with tales of extraordinarily lengthy queues at open homes, a number of presents inside hours of itemizing, presents extraordinarily over asking, waived inspections, waived contingencies, and letters written to tug at coronary heart strings. Subscribers to the reddit discussion board “realestateinvesting” surged from 88,000 in January 2020 to 1.68 million in April 2023. The habits had all of the markings of euphoric hypothesis.

To compound this problem, institutional consumers had been concerned available in the market in power. Between 2020 and 2023, the share of dwelling gross sales to institutional consumers rose from 0.5% to 2.5%. The classification of iBuyers, like Opendoor and Redfin, accounted for one more rise from 0.2% to 2.0% throughout that point. Whereas the share of dwelling gross sales seems minor, this dramatic change in giant consumers with entry to low price capital has a significant influence on the marginal purchaser. These institutional consumers typically provide dwelling sellers all money generously over asking with few contingencies. One of the vital lively classes of housing funding was within the quick time period rental house. Between 2021 and 2022, Airbnb bookings elevated 31%.

Housing Stock

The prevailing narrative is that the dramatic rise in dwelling costs are a results of vital housing shortages within the U.S. Intuitively, there was neither a dramatic rise in inhabitants nor decline in housing items over the previous three years that might justify a pointy rise in worth. It ought to go with out saying that at present there may be at the moment not sufficient provide to fulfill demand at decrease costs. Nonetheless, it’s disingenuous to assert that there’s not sufficient housing within the U.S. One problem is that so most of the houses are getting used for functions apart from main residence. Whereas this contributes to housing demand, it’s typically missed as a possible headwind for the market as a result of whereas main residences are sluggish to vary in response to financial situations, different makes use of of residential houses are faster to vary.

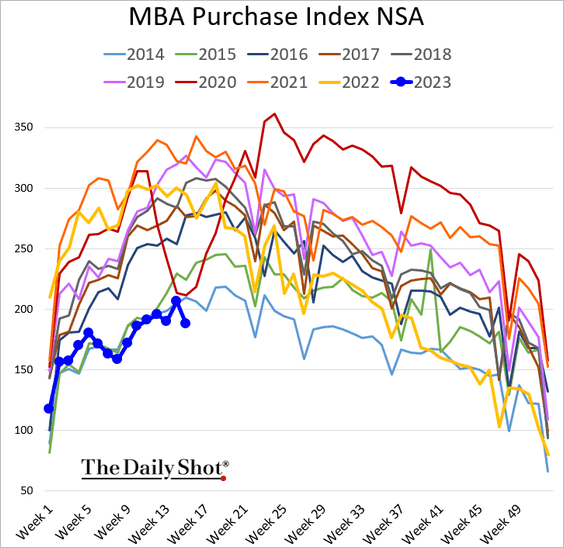

Seasonally adjusted mortgage buy functions fell to 147.1, the bottom since 2000. Buy functions are down 41.5% YoY. Present dwelling gross sales ended 2022 down roughly 35% and was falling at a quicker fee than throughout 2005-07. The MBA Buy Index to start with of 2023 is the bottom since earlier than 2014. This information demonstrates that the quantity of dwelling gross sales is grinding to a halt. Many analysts level to this decline in quantity as an indication that stock is tight.

The Every day Shot (used with permission)

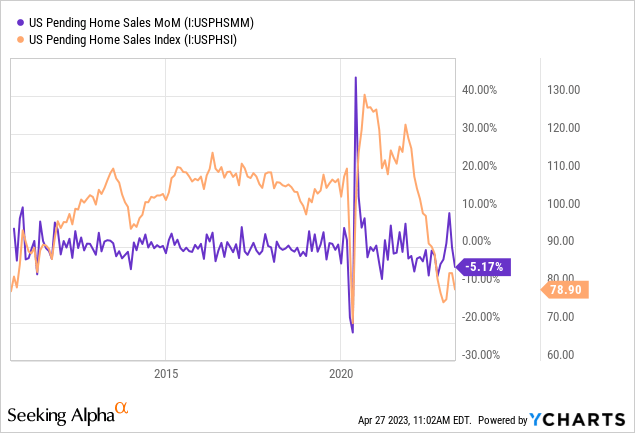

Dwelling gross sales information helps this view. US Pending dwelling gross sales are at depressed ranges skilled through the midst of pandemic lockdowns in 2020. This is similar stage of gross sales skilled after the nice recession.

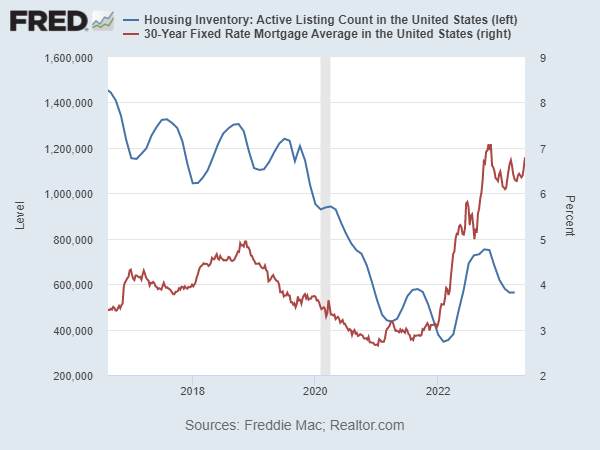

The variety of lively listings are nicely under their 10-year imply. Lively listings bottomed round 400,000 in early 2022. Since then, listings have been on the rise however are nonetheless half of their pre-2020 common. Knowledge from Realtor.com discovered that lively listings rose 3% MoM and 22% YoY in Could 2023.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

In line with Redfin, the 4-week rolling common of median days available on the market for offered houses had risen to 51 days in February, the best since February 2020 when it was above 60 days. Median days available on the market was 49 in April 2023 which compares to 32 in April 2022 and 40 in April 2020. Previous to 2020, common days available on the market for April is about 60.

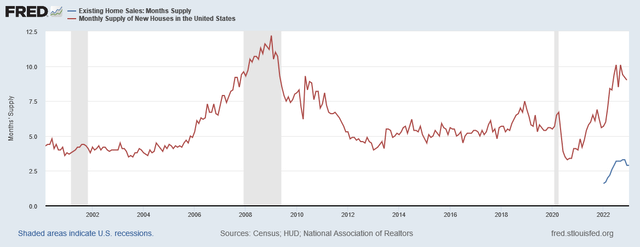

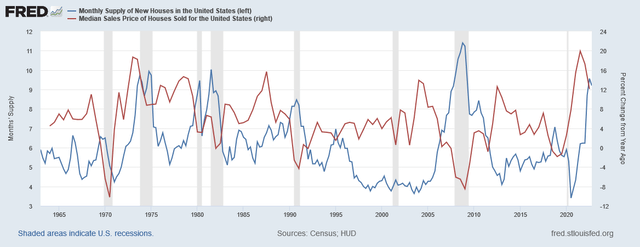

Housing stock is trending greater. The month-to-month provide of recent homes within the U.S. has surged greater, much like what occurred in 2006-07. The month’s provide of recent houses reached 10 in 2023 whereas the month’s provide of present houses proceed to lag at 3.0.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

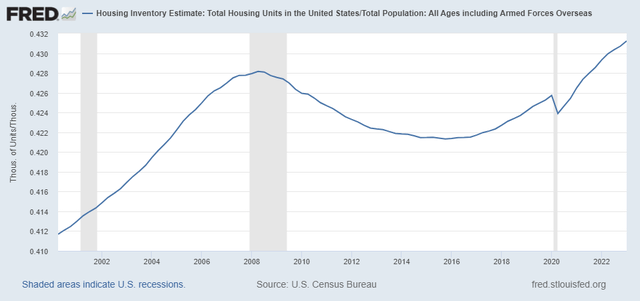

The information is obvious: few houses are altering arms. This is a matter of quantity. It shouldn’t be conflated as a difficulty of stock. Beneath is a chart of the variety of housing items within the U.S. per capita. This ratio has reached its highest mark since 2000 at 0.431 items per individual. Models per capita peaked in 2008 at 0.428 items per individual. One may conclude that housing items had been in brief provide throughout 2012-2018 when the ratio dipped under 0.424. However the ratio was as little as 0.414 previous to 2006.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

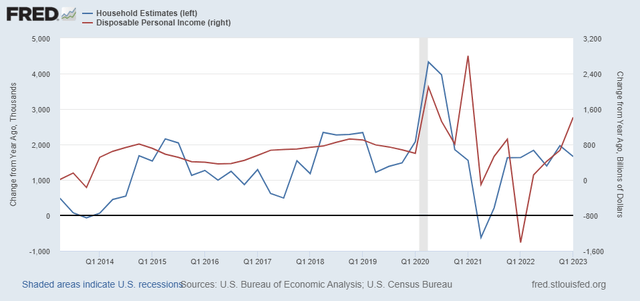

One distinction over these years is the variety of households within the U.S. Family formation is without doubt one of the most frequently cited elements to help market costs. Between 2019 and 2021, the variety of households within the U.S. grew by roughly 2.1 million, double the pre-2019 common. Knowledge from Statista reveals that the common family measurement has declined from 2.52 in 2019 to 2.5 in 2022. This development has been progressively declining for many years. The common family measurement in 2007 was 2.56.

U.S. Census Bureau information reveals that the variety of estimated housing items per family within the U.S. is 1.11. That is down from a peak in 2009 of 1.17. This ratio was final at 1.11 in 2002. We consider that whereas family formation has been sturdy and the ratio of housing items to households has declined, it doesn’t point out such a housing scarcity as to end in excessive affordability points. The quantity of housing provide per capita is at historic highs. Naturally, throughout occasions of financial weak spot, family sizes have a tendency to extend as people select to cohabitate with family or roommates to cut back shelter bills. The surge in disposable earnings, as mentioned earlier, is probably going the first contributor to this family formation. That is supported by the correlation between disposable earnings and family formation from 2020-2022.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

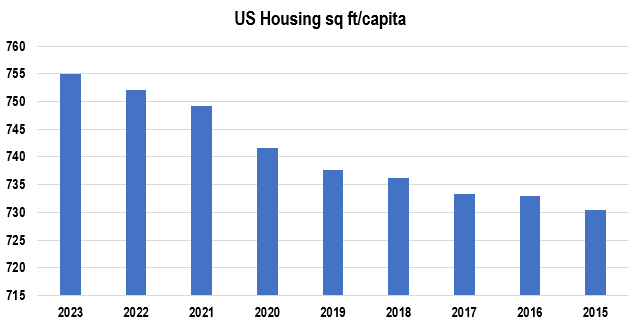

Our place is additional supported by the truth that housing sq. ft per capita within the U.S. has been rising since 2015. There may be now roughly 755 sq. ft of housing house per individual within the U.S. in comparison with 730 in 2015. Our conclusion is that housing stock will not be the basis explanation for dwelling worth appreciation. Above common family formation has contributed to the tightness in obtainable provide, an element that’s easing and liable to reverse throughout financial turmoil.

Chart by creator (information from Statista)

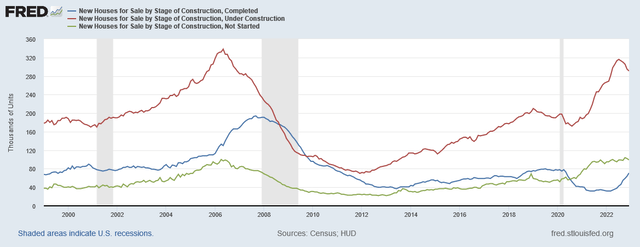

Development

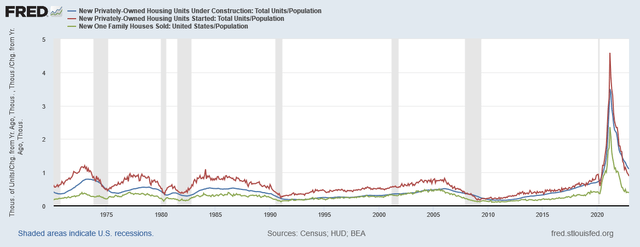

Tightness in stock is because of be supported by the amount of housing that’s below development. Properties below development and never began surged greater after 2020, spurred by the spike in demand. Properties below development has peaked at 320,000 and began to say no, at ranges that rival the highs in 2006. Accomplished homes, nevertheless, stays subdued at lower than 120,000. It takes a couple of yr for a median single household unit to succeed in completion. Most of those houses skilled development delays due to provide shortages in response to pandemic lockdowns throughout the globe. These provide chain disruptions are largely resolved and shortages are being abated. It will contribute a big quantity of provide over the approaching yr.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

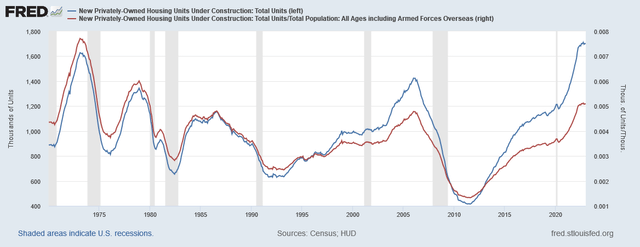

Beneath is new privately-owned housing items below development after which adjusted for inhabitants. The speed of recent development is greater than 2006 by each measures. There may be at the moment 0.005 housing items below development per capita.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

Equally, the variety of multi-family items below development per capita is close to the best fee in 30 years at 0.0014.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

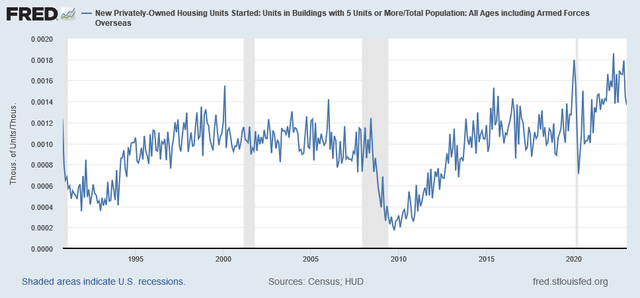

A extensively missed however nonetheless necessary measure to think about is the speed of development in relationship with the speed of inhabitants development. Beneath is a chart of the change in items below development, items began, and new single household homes offered divided by the change in U.S. inhabitants. That is once more, another excuse that the housing scarcity assumption is wrong, in our opinion. The long run common ratio of items below development development to inhabitants development is round 0.35. In March 2021, the ratio spiked to three.5. Between 2009 and 2012, the ratio was suppressed under 0.2. However previous to the nice recession, stock ranges had been extreme following years of development development above 0.4 per capita development. At the moment the ratio is above 0.98, a mark that has not been reached between 1970-2019. The ratio final peaked in January 2006 at 0.51.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

A decline of this magnitude, typically precedes recession. 5 of the final seven recessions skilled a decline in development development main as much as the recession. Extra importantly, no vital decline in development over the last 50 years has occurred with out recession. It will grow to be extra necessary in a second.

Housing Market Headwinds

Now that we have now a way of the place the market is at present relative to the previous and the way these situations got here to be, we are going to subsequent look at the elements that can affect the housing market going ahead. There are a selection of tailwinds for the housing market together with a big millennial era coming into dwelling shopping for age, the massive quantity of liquidity remaining on family and company stability sheets, and a robust market sentiment for actual property. Nonetheless, we consider that the headwinds outweigh the tailwinds. Subsequent, we are going to look at the important thing headwinds.

Value of Development and Builder Margins

Housing has an intrinsic worth which is most frequently measured through the use of the alternative price of the property. It isn’t affordable to anticipate the market to cost actual property property as an mixture under the price of development for greater than very transient intervals below extraordinary circumstances.

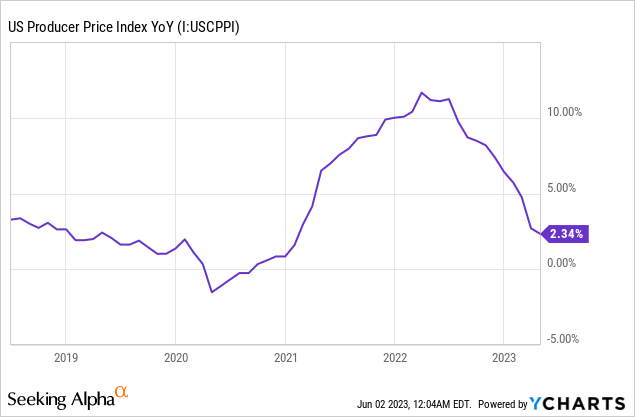

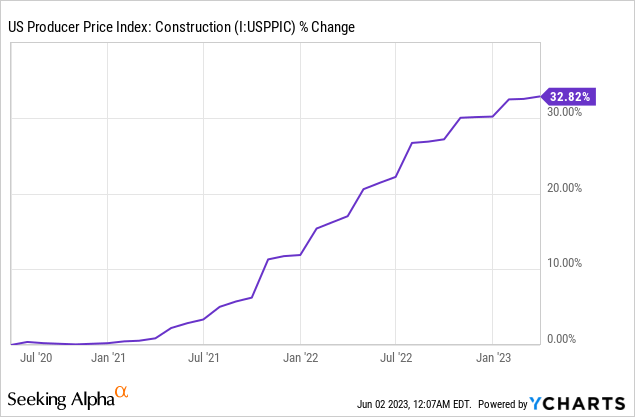

The price of development has risen significantly with inflation after the pandemic. Whereas provide chain constraints contributed to cost inflation, we strongly consider that the enlargement of cash provide was the first issue. The U.S. Producer Value index, one among our most popular measures of inflation, peaked over 10% YoY in 2022.

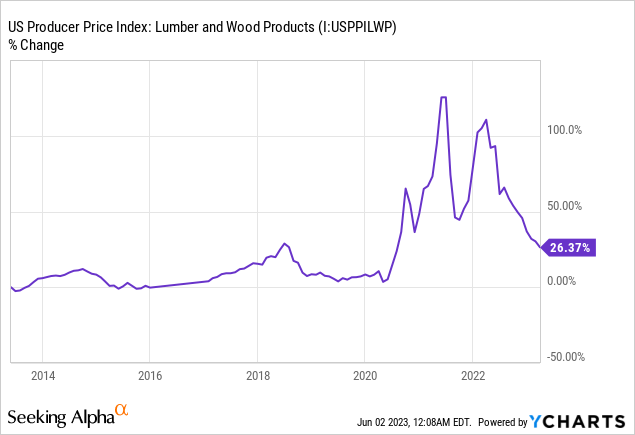

Since 2020, the PPI Index for development prices has risen by 32%. Lumber and wooden merchandise, a significant enter price for residential development, spiked over 100% in 2021 earlier than falling by 75%.

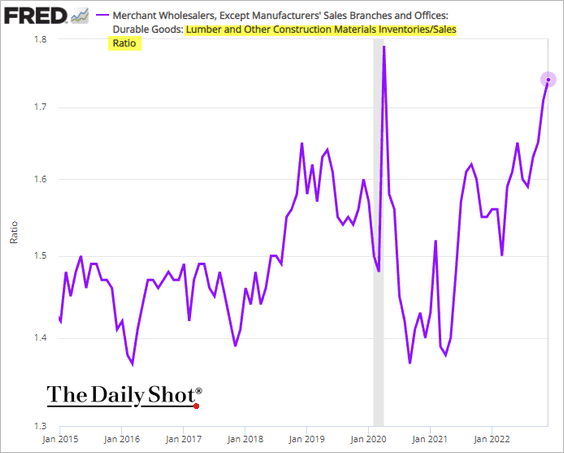

The inventories to gross sales ratio for lumber and associated supplies fell as worth rose, a operate of a surge in demand as dwelling begins and development numbers rose rapidly. Since then, the inventories to gross sales ratio has recovered to a stage final skilled through the starting of the pandemic. This information collaborates with worth that lumber materials shortages have been alleviated and contributed to decrease prices going ahead. Nonetheless, many of the new houses at the moment on the market had been constructed with lumber that was acquired at greater costs. These decrease costs are anticipated to contribute to decrease development prices within the yr forward.

The Every day Shot (used with permission)

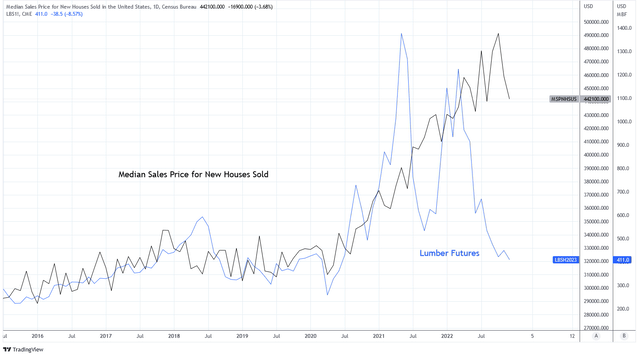

Beneath is the connection between lumber futures and the median gross sales worth for brand spanking new homes. The connection is carefully correlated till the second half of 2022, a operate of development delay. Lumber futures at present recommend that the worth of new houses may decline by as a lot as 25% within the years forward, offered that lumber costs don’t climb greater.

Charts by TradingView (tailored by creator)

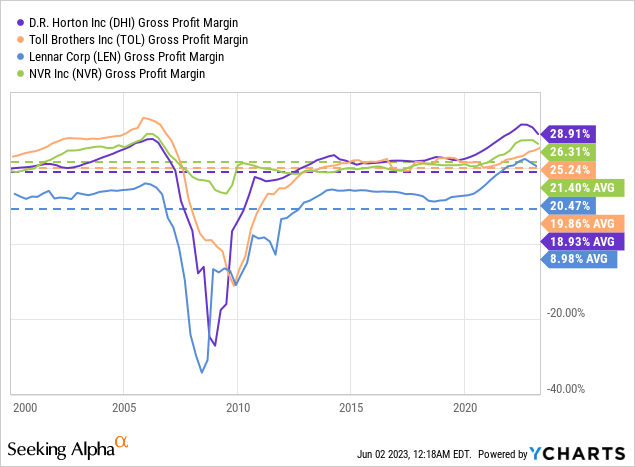

A whole article might be written exploring the price of development and alternative price of U.S. housing. We discover it extra helpful to look at the price of development within the context of dwelling builder margins. Beneath is a chart of the gross revenue margins for among the main U.S. homebuilders. Every homebuilder is experiencing elevated gross margins in comparison with its 20-year common. D.R. Horton, for instance, has a gross revenue margin of 28.9% in comparison with its common of 18.9%. Gross revenue margins for many dwelling builders has begun to say no over the previous yr. These margins are exhibiting related habits skilled between 2005-2007 after they grew to become elevated as dwelling costs peaked and turned down. For these revenue margins to return to their imply, it means that dwelling costs may decline by 5-10%.

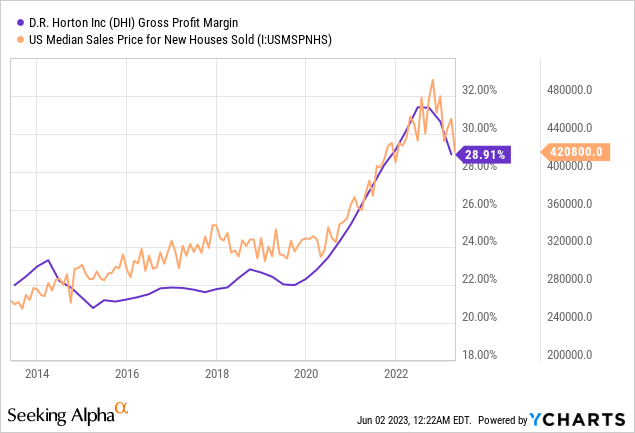

New dwelling costs transfer in unison with homebuilder margins. Utilizing DHI for example, a return to its common gross margin over the previous 10 years of twenty-two% implies that the median gross sales worth of recent homes may decline from $420,800 to $391,000, about 7%, with none want for the precise price of development to say no, as it’s with lumber.

At first, homebuilders reported dramatic will increase to their cancellation charges as mortgage charges climbed. In 2022, DHI reported a 24.7% improve of their cancellation fee, Pultegroup reported a 122.8% improve, and MDC holdings a 97.9% improve. However latest optimism available in the market and a recognition of upper mortgage charges has brought on cancellation charges to get well. Homebuilders are reporting cancellation charges have fallen by half or extra between This fall 2022 and Q1 2023.

Investor Exercise

Buyers have been closely concerned on this housing market over the previous few years. We lined this matter within the Hypothesis part above. We consider that investor exercise is vital to understanding this housing market. There are various varieties of buyers together with construct to lease, flippers, quick time period rental homeowners, institutional buyers, iBuyers, and wholesalers, all of whom have been lively available in the market lately.

In line with Redfin, in Q3 2021 the variety of investor purchases in tracked metros reached an all time excessive of 95,124. On the time, buyers accounted for over 20% of all dwelling purchases. Buyers are primarily concentrating on starter houses, as 41.1% of their peak dwelling purchases had been within the low worth class.

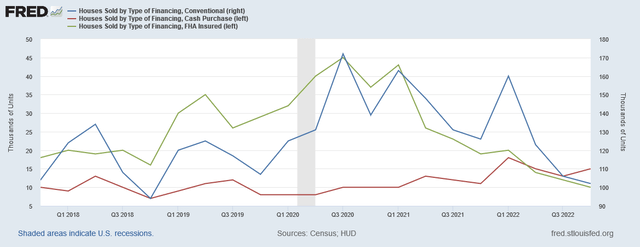

Whereas typical and FHA financing purchases have declined quickly in 2022, money purchases have really elevated. It is because buyers, who’re most frequently money consumers, have been much less impacted by mortgage charges than conventional dwelling consumers. These buyers use investor capital or exhausting cash strains of credit score to make aggressive presents on houses.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

The development, nevertheless, is starting to vary. Redfin reviews that in This fall 2022 buyers purchased 18% of houses, nonetheless excessive however off of the height. In Q1 2023, investor dwelling purchases had been down 49% YoY. Redfin additionally reviews that roughly 10% of houses at the moment on the market are owned by buyers. Many of those investments are actually underwater. The share of flipped houses that offered at a loss in Q1 2023 is reportedly 20%. Redfin estimates that in March 2023, 1 in 7 houses offered by buyers had been at a loss. Home flippers are essentially the most uncovered as a result of their tasks couldn’t end rapidly sufficient to reply to adjustments in mortgage charges that has lowered homebuyer buying energy.

We consider that investor demand was a main contributor to present housing market pricing. If this supply of demand continues to shrink, it would take away help from market costs. Turmoil within the commercial real estate space is rising tense. Giant properties are foreclosing or promoting at vital losses. Buyers have gotten smart and pulling their capital out of actual property investments. Because of this we consider that many non-public fairness companies, such because the Blackstone Real Estate Income Trust, are limiting withdrawals from their funds; to keep away from having to liquidate belongings at depressed costs.

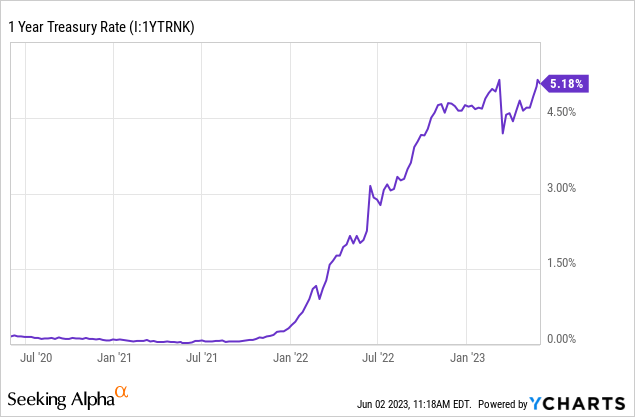

It isn’t clear if the identical points in industrial RE will develop in residential. There are various factors at work. Whereas residential has benefited from the shift to distant work, industrial has suffered from it. If this development reverses the identical may be anticipated on its influence. However what they’ve in widespread is that the price of financing and competitors for investor capital has risen dramatically. Rates of interest have elevated considerably with the 1-year Treasury fee rising from basically zero to over 5% in a yr and a half. Whereas most mortgage holders have low fastened charges for a particularly lengthy length of 20+ years, institutional buyers wouldn’t have the identical length. Estimates recommend that the common capitalization fee on residential property is roughly 4.63%. When rates of interest had been close to zero this yield was enticing, particularly when paired with the positive factors in appreciation. However now, Treasuries are providing greater than 5% which incentivizes many buyers to put money into fastened earnings over actual property, particularly in the event that they really feel that costs are in decline.

Foreclosures, Mortgage Requirements, DSCR Loans

We regularly like to explain the housing market as a stream course of. Always there’s a stream of individuals into houses and a stream of individuals out of houses. There’s a stream of individuals into larger/higher houses (upsizing) and a stream of individuals into smaller/less complicated houses (downsizing). Housing market sentiment and worth is basically a operate of dominant course of stream.

Listed below are just a few examples of constructive stream:

- First time homebuyers leaving college, a rental, or dad or mum’s residence to buy a house.

- Householders that commerce up their starter dwelling for a much bigger dwelling.

- Divorces and different relationship adjustments that end in one dwelling being cut up into a number of houses.

- Householders that buy a second dwelling.

Listed below are just a few examples of unfavourable stream:

- Householders are foreclosed, voluntarily or involuntarily, and transfer right into a rental, cohabitation scenario, or smaller dwelling.

- Dying of a sole home-owner.

- Transfer into retirement neighborhood or related dwelling scenario as a consequence of retirement, medical situation, or incarceration.

- Householders that promote a second dwelling.

When the pure stream of the market is disrupted it leads to distortions within the stability of market pricing. Such has been the case since 2020 when the Federal Authorities enacted foreclosures and eviction moratoriums nationwide. As anticipated, foreclosures and eviction charges plummeted, almost to zero.

The result’s a steep decline in emptiness charges for houses and leases within the U.S. Each emptiness charges are the bottom in many years.

This stoppage of unfavourable stream from foreclosures has helped to set a flooring within the housing market by limiting new provide from getting into the market. Whereas there may be nothing to admire about foreclosures, they’re a vital consequence in actual property. With out foreclosures, ethical hazard develops, resulting in poor finance choices.

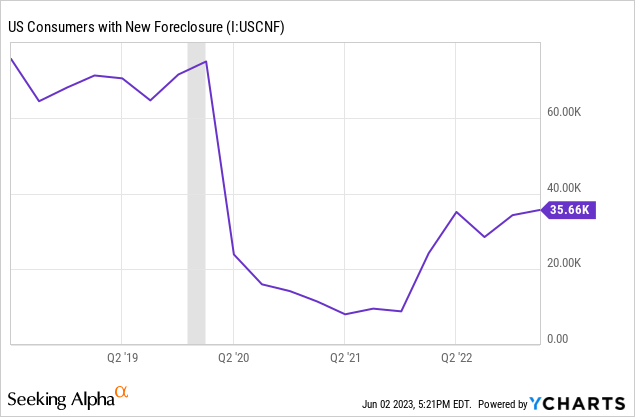

Foreclosures are nonetheless at a traditionally low fee however are within the strategy of normalizing. Foreclosures filings have doubled between 2021 and 2022. Residential foreclosures are up 30% YoY in This fall 2022. It takes appreciable time to course of this uptick in foreclosures filings as Courts are overburdened. Foreclosures in Q1 2023 are up 6% QoQ and 22% YoY. Unfavorable stream from foreclosures is slowly returning.

Householders, by and huge, have plenty of fairness of their houses. This can be a tailwind for housing because it prevents many houses from going to foreclosures. Nonetheless, if costs had been to fall, fairness would contract which places extra strain on foreclosures. This was skilled in 2008, primarily a results of very poor lending requirements together with the notorious NINJA loans, often known as “liar loans,” the place consumers did not want proof of employment or earnings. NINJA loans proved that if given the selection to make a poor shopping for resolution, lenders and consumers will typically make that selection.

New rules have prevented the return of NINJA loans in at present’s housing market, one of many many variations between at present and 2008. One other distinction being that the majority mortgage holders have fastened charges at present whereas many had adjustable charges in 2008, a situation that exacerbated the Nice Recession. Nonetheless, we might not describe at present’s lending practices as conservative.

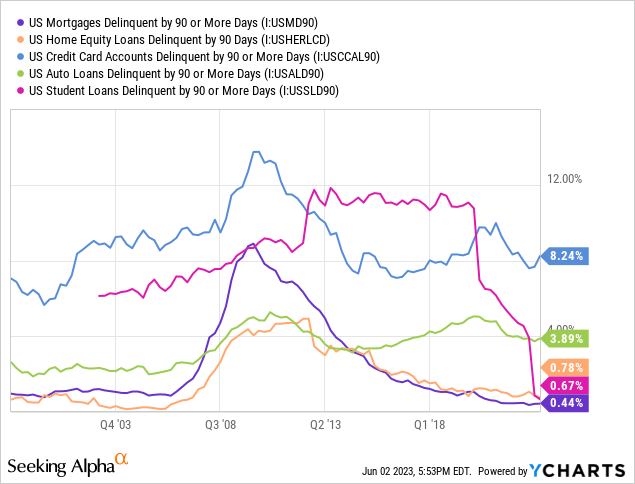

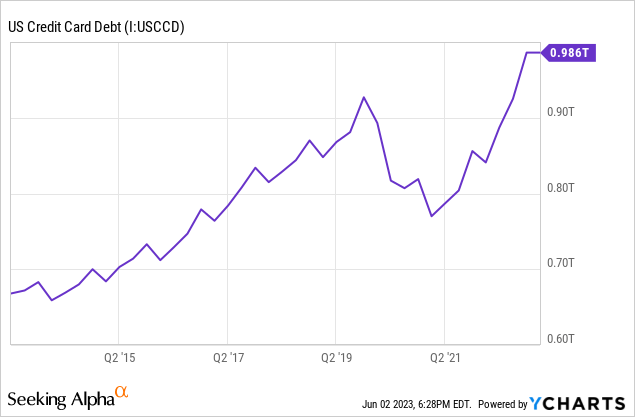

First, FHA loans require a minimal credit score rating of 580 to be able to borrow at a minimal down cost of three.5%. We have now already seen dwelling costs decline by 3.5% from the height. One other 3.5% decline would put 1000’s of those FHA loans underwater. The average credit score within the U.S. for low earnings earners is 658. Presently, delinquency charges for mortgages, bank cards, auto loans, and pupil loans are nonetheless low. Nonetheless, delinquency charges for auto loans are rising, up 26.7% YoY in December. Bank card debt within the U.S. shrank after the pandemic however is now again on its pre-2020 development. Bank card delinquency has been on the rise and TransUnion is forecasting that critical bank card delinquencies will rise from 2.1% to 2.6% by the tip of 2023.

One other mortgage sort to look at is Debt Service Protection Ratio Loans (DSCR). Starting in 2021, DSCR loans have risen in recognition, as represented by Google Traits information that reveals a surge for search time period DSCR over the previous 2-3 years. DSCR loans function through the use of the anticipated money stream of a property to qualify for the mortgage. Most DSCR mortgage debtors have an interest as a result of they don’t have a standard earnings supply to qualify for conventional mortgages. FitchRatings has expressed concern over non-qualified mortgages and expects greater losses from these loans sooner or later.

DSCR loans have been significantly widespread for brief time period rental buyers who’ve restricted capital and no supply of earnings apart from their STR investments. In line with data from a mortgage dealer, DSCR loans require a minimal credit score rating of 680, a mortgage to worth of 80%, and might shut in 12 days on a STR with none paperwork. The appraiser makes use of information from AirDNA to evaluate the anticipated earnings on the property.

Quick Time period Leases

Quick time period rental demand has been extremely popular over the previous two years. Anecdotally, individuals have expressed that they’re “making up for misplaced time” as their trip journeys had been paused by a lot of the pandemic. With additional disposable earnings, Individuals have been in search of out the privateness and enhanced expertise of STRs.

Social media platforms, together with Reddit, have grow to be inundated with social media influencers boasting about their wild successes in STR actual property. Buyers have been lively in changing SFH into STR to fulfill the elevated demand. Knowledge from AirDNA discovered that in January 2023 listings had elevated 21.9% YoY and bookings by 14.5% YoY. Common each day charges had been up 3.1% YoY. By March, common each day charges had been up 2.2% YoY. By April, they had been up 1.4% YoY, representing a slowing of momentum. Occupancy in Could was additionally 4.9% decrease YoY which is greater than March at 2.1% decrease YoY. Seasonally adjusted, that is the bottom Occupancy fee in three years. That is largely attributable to greater numbers of listings.

Progress is robust within the lodging sector. The U.S. Census Bureau construction spending report in June confirmed that yr to this point in 2023 development spending on lodging was $7.5 billion which is 40.6% greater than final yr. This compares to a 6.1% improve in whole development spending over this time interval. The variety of obtainable STR listings within the U.S. has elevated from 0.9 million in 2021 to 1.43 million in 2023. Lively listings had been up 18.9% YoY in April 2023.

Mortgage lenders focusing on trip dwelling DSCR mortgages have reported tremendous profits on account of this growth in demand, typically over $100,000 per 30 days. These lending practices are enabling buyers to afford costs that in any other case wouldn’t be attainable. This article describes one such scenario the place an investor bought a cabin in Tennessee with a month-to-month mortgage cost of $2,600. This month-to-month cost is simply too excessive to be lined by lease from a long run lease however it’s projected that as a STR the property can do $6,000 per 30 days in income. Mortgage lenders have reported that they anticipate to approve lots of of tens of millions of {dollars} of DSCR loans. It’s unclear what number of of those loans are being included in mortgage backed securities however it’s attainable they’re.

Patricia McCoy is a former assistant director on the US Shopper Monetary Safety Bureau. That is what she needed to say about STR buyers and DSCR loans:

The inflow of the starry-eyed inexperienced buyers is artificially boosting demand and inflicting the rental market to be overheated. This entire class of mortgage and, particularly, a few of these underwriting practices are an indication of market euphoria. That hardly ever seems nicely.

We are likely to agree.

This is the issue: although the variety of STR listings haven’t elevated by a big quantity over the previous three years, a reality typically cited by housing bulls, the development is having an outsized impact available on the market. It is because SFH being financed as STR properties have totally different lending parameters than SFH that’s bought for an owner-occupier. When an owner-occupier applies for mortgage on a house they use their family earnings to qualify. The median family earnings within the U.S. is about $70,000. Alternatively, when an investor applies for a mortgage on an STR, typically they’re utilizing the anticipated rental income to qualify for the mortgage.

Common STR each day charges within the U.S. are about $315. At 100% occupancy, this generates $115,000 of income. Take into account than many Airbnb listings usually are not a whole SFH, skewing the common. As well as, income from an STR enterprise has extra tax benefits than abnormal family earnings and isn’t topic to different debt service funds, like automotive funds, like abnormal family earnings. Subsequently, the efficient earnings for debt service is way greater for STR over owner-occupiers. For DSCR and different loans, when appraisers worth the house based mostly on the potential STR earnings it leads to the next appraised worth. As soon as just a few houses in a neighborhood are offered utilizing STR earnings to justify the worth it now turns into a comp for the entire neighborhood.

An estimated 60% of Airbnb customers are millennials. This massive client group is dealing with two distinctive monetary challenges. The primary, is that the affordability of housing is a significant obstacle in the event that they haven’t already bought a house at decrease costs and locked in a low fee. The second, is that they’ve benefitted from a pause in pupil mortgage funds for 3 years. That pause is because of finish in mid-2023. Whereas the political standing of pupil mortgage funds stays unclear, its trying extra seemingly that funds will resume as Congress has lately prevented extending the pause. It’s estimated that the common pupil mortgage cost for Bachelor diploma holders is $450 per 30 days. The potential for pupil mortgage funds to lower STR demand is substantial.

STR operators are starting to report weak spot in gross sales. The slowdown within the STR market has led to the popularization of the phrase “Airbnbust.” Some hosts have reported as much as a 50% decline in month-to-month revenues. To be clear, Airbnb continues to earn sturdy revenues and total bookings are up. However competitors has elevated inflicting occupancy charges to drop which is prompting some hosts to decrease their charges.

Cities have additionally taken discover concerning the influence of STR on the affordability and high quality of life of their neighborhood. A lot of which have begun to implement new ordinance to restrict or ban STR operations. Governments are additionally contemplating new taxes on STRs, together with California which is contemplating a 15% tax on STRs. This has the potential so as to add a brand new expense that was not factored into by buyers after they bought their property.

For all of those causes, some hosts are deciding to transform to long run rental property or promote their property. That is including to unfavourable stream.

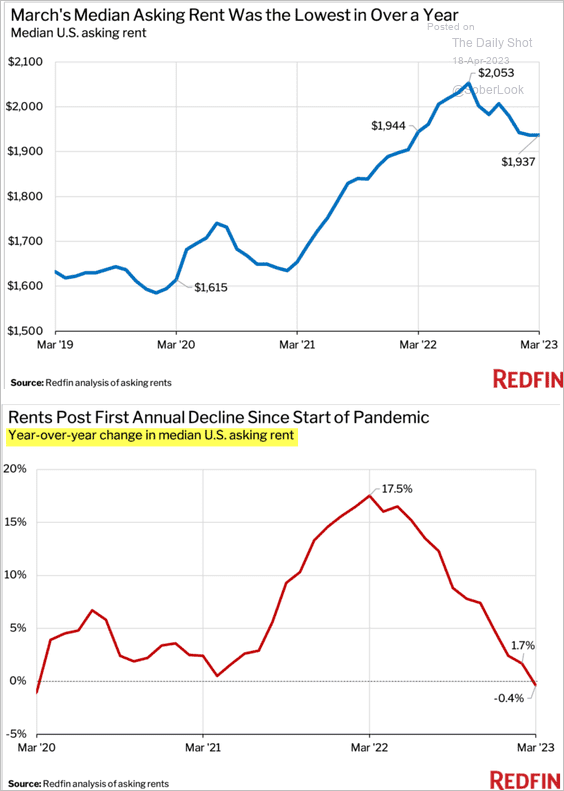

Hire Deflation

STRs usually are not the one funding properties experiencing declines in income, as rental property can also be seeing decreased costs. Redfin reported that the median asking lease in March 2023 was down -0.4% YoY. However in response to Redfin, shopping for a house prices about 25% greater than renting on common within the U.S. at present. It is because the median renter within the U.S. can solely afford 34% of the houses on the market in Q1 2023, in comparison with 45% in 2022. That is because the median month-to-month mortgage cost to purchase a house has risen to an all time excessive of $2,651 whereas the common price of lease is $1,850.

The Every day Shot (used with permission)

Partly, rents are falling as a result of renters are tapped out. Moody’s reports that the common American is spending about 30% of their earnings on lease which is the best in 20 years and better than 2020 when it was 25.7%. Steadiness is being restored within the housing market as hypothesis and enthusiasm is turning into tempered on account of greater mortgage funds and a stall in dwelling worth appreciation. As well as, eviction charges are rising because the finish of eviction moratoriums. Some jurisdictions, resembling Maricopa County, are already experiencing eviction charges that exceed the pre-2020 imply, seemingly a results of pent-up filings.

Like homebuilders, rental homeowners try to stave off worth deflation. The variety of incentive presents are climbing with many flats and leases providing 1-3 months rent-free for a 12-13 month lease. Rental homeowners usually are not required to reveal such a expense to lenders when qualifying for the mortgage.

Renters are sensing that it’s inexpensive to lease than purchase at current. Dwelling costs have appreciated a lot quicker than the price of lease since 2020. The identical phenomenon occurred in 2006-07. This isn’t a results of housing shortages however a shift in client sentiment that strongly favors shopping for over renting. After the housing bust in 2008 dwelling costs returned to equilibrium with rents and we anticipate that to happen once more. This suggests a decline in dwelling costs of 15-20%. Along with decrease month-to-month funds, renters even have the flexibility to make use of their saved down cost to earn curiosity in cash market funds or U.S. Treasuries of 5%+. This earnings helps to offset the price of renting. A 20% down cost on a $500,000 home can earn $5,000 a yr in Treasury curiosity at present. This might be 20% or extra of the fee to lease, making the chance price of shopping for appreciable.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

There’s a actual menace that many rental buyers had been forecasting particular rental earnings and earnings development to service their debt funds. If rents proceed to say no, some rental homeowners might have hassle servicing these money owed. As STR operators expertise hassle with weak demand, many of those will transition to long run leases or listing available on the market which provides competitors to leases additional pressuring rents.

Second Properties, Distant Work, and Unemployment

Low mortgage charges additionally prompted householders to purchase second houses. For some, the flexibility to work remotely allowed them to purchase a house someplace fascinating however they stored their unique dwelling. By 2020, roughly 15% of dwelling gross sales had been for second houses. On the time, second houses accounted for five.5% of all houses, demonstrating a surge in demand. At the moment, mortgage fee locks for second houses are 52% under pre-2020 ranges after being 89% above pre-2020 ranges in 2020, suggesting a pull-forward of demand.

This return to regular for second dwelling gross sales reduces constructive stream available in the market. If a big variety of second dwelling homeowners determine to promote their additional dwelling this might flip into unfavourable stream for the market. With extremely low rates of interest it might require vital financial misery to persuade them to do this. Such financial stress would want to return on account of rising unemployment.

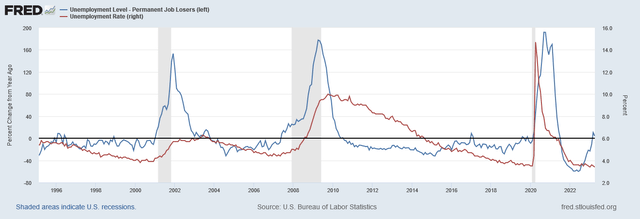

To this point, unemployment has not materially degraded since its restoration submit pandemic. The U.S. unemployment fee stands at 3.7% which is barely marginally off the lows of three.5%. Nonetheless, indicators are starting to point out that employment could also be due for weak spot. First, everlasting job loses as a YoY change has began to rise materially. Every of the final three main recessions had been preceded by a cloth rise in everlasting job losses.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

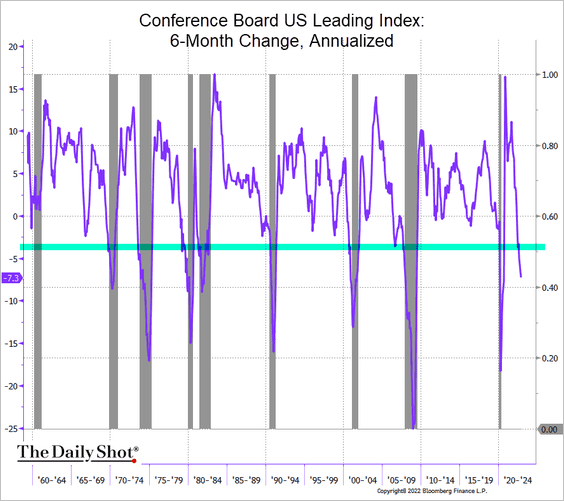

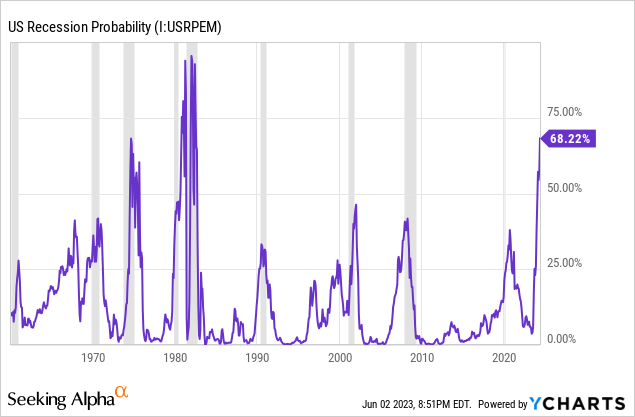

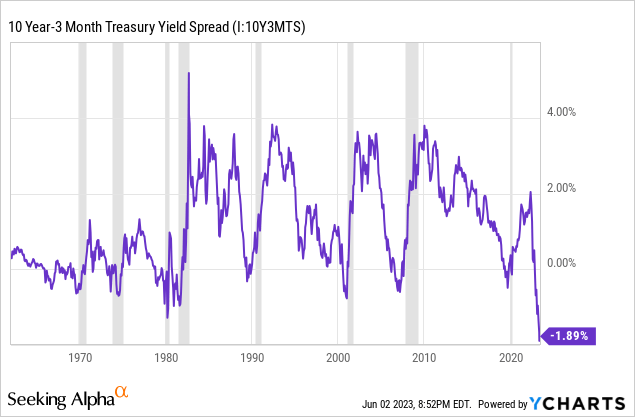

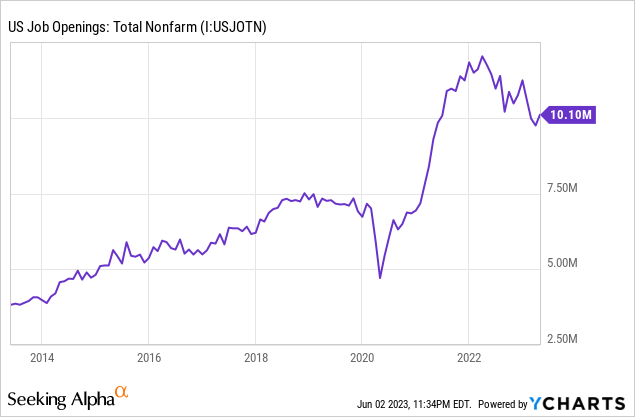

There are quite a few different main indicators that recommend that employment is due for weak spot. We cowl them intimately in our different publications. Three necessary indicators are under. These embrace the Convention Board US Main Index, US recession likelihood, and the 10Y-3M yield curve. Every of those indicators are pointing towards a recession. With recession we anticipate job losses.

The Every day Shot (used with permission)

For now, employment stays sturdy with over 10 million job openings. Regardless of this, US BLS information reveals that the common hours labored in Could 2023 was 34.3 which is decrease than April at 34.4 and decrease than March 2022 at 34.6. This decline in hours labored, though small by look, is definitely substantive as a result of employers are at all times extra apt to chop hours earlier than they reduce staff as a result of it prices much less and is simpler to reverse.

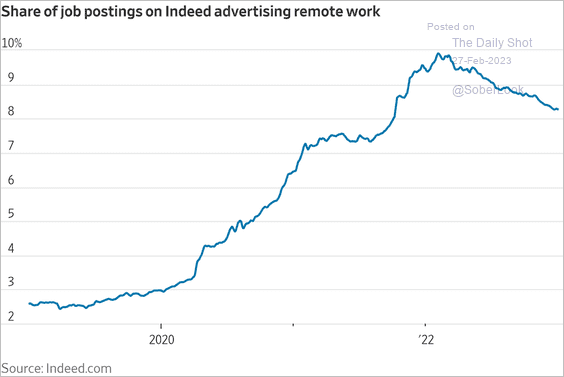

If employment materially weakens it would speed up the tempo of “return to the workplace.” The speed of distant work has appeared to peak in 2022. The p.c of staff which might be absolutely distant has declined from 17% in January 2022 to 11% at present. As this development unwinds, it would relieve the strain on extremely fascinating areas, together with rural and suburban neighborhoods.

The Every day Shot (used with permission)

Abstract

The 2008 housing crash was preceded by excessively free financial coverage, a frenzy in housing hypothesis, and irresponsible financing resulting in a crash. At the moment, we have now skilled extreme free financial coverage, a frenzy in housing hypothesis, and questionable financing practices. What’s totally different concerning the housing market at present is that extra mortgages are fastened fee, emptiness charges are decrease, stock is tighter, lending practices are stricter, and housing and trip preferences are totally different.

However essentially the most vital distinction is the cash. Beneath is the common worth per sq. foot of housing within the U.S. in comparison with the M2 cash inventory. Solely lately has the expansion in price per sq. foot exceeded the expansion in M2, which is now unfavourable. The divergence means that the fee per sq. foot may decline from $225 to $205 to align with M2, a 9% decline.

Federal Reserve Financial Knowledge | FRED | St. Louis Fed

There may be nonetheless much more cash in existence at present than pre-2020. This inflation units a flooring for dwelling costs. Nonetheless, there are numerous indications that houses are too costly. For the primary time since 2007, the share of the U.S. workforce that works as realtors has declined, from 0.97% to 0.93%. Homebuilder margins are elevated and might decline simply to succeed in their regular vary. The extent of curiosity in actual property investing is fever pitched and the concept that dwelling costs solely go up is cemented. That is primarily why dwelling costs started to rebound in Q1 2023 as consumers started to anticipate future rate of interest cuts and commenced to front-run the Fed by shopping for in now earlier than costs moved greater.

A yr in the past we described the U.S. housing market as a “lifeless man strolling.” We used this analogy as a result of all the things appeared to be high quality with the market however we may see that one thing wasn’t wholesome. After this era of discovery we have now discovered that the housing market has run out of steam. In Q1 2023, the median gross sales worth for homes offered within the U.S. declined at an annualized fee of -37%. That is quicker than 2009 when it maxed at -26%.

What occurs subsequent is dependent upon how far the U.S. enters into recession. Our bearish case state of affairs would contain a single digit rise in unemployment, a robust contraction in STR demand, quite a few STR operators failing to service their debt funds, the rental market turning into saturated with new development and STR conversions, and multitudes of dwelling sellers compelled or opting to promote their second dwelling and funding properties, a lot of that are underwater. Our base case state of affairs is a milder model of this with dwelling costs easing to the purpose that affordability equilibrates. Of the three elements recognized in our introduction, we consider that dwelling worth decreases and family earnings will increase will work collectively to enhance affordability. It’s our expectation that U.S. dwelling costs, as an mixture, will decline by single digits in 2023 and single digits once more in 2024. After which it would depend upon financial and financial coverage.

[ad_2]