ASN-009W シーリングファン [リモコン付き]

(税込) 送料込み

商品の説明

ホワイト塗装のシーリングファン

商品スペック

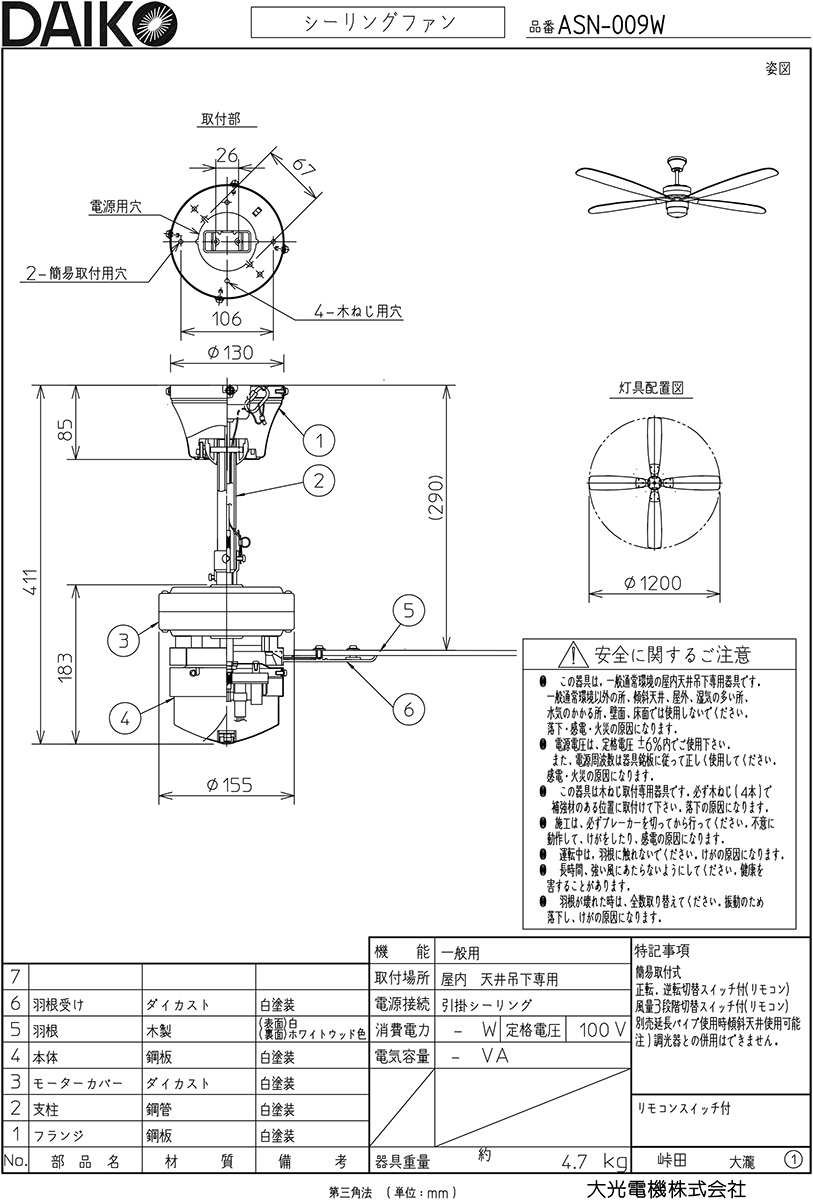

| サイズ | 径1200㎜ 高410㎜ |

|---|---|

| 本体重量 | 4.7kg |

| 明るさ切替え | 無 |

| リモコン | リモコン付き |

| 付属品 | リモコン |

| 仕様1 | ※ランプ取付不可 |

基本情報

| 商品名 | ASN-009W シーリングファン [リモコン付き] |

|---|---|

| 型番 | ASN009W |

| メーカー | 大光電機|DAIKO |

| 商品コード | 5954561 |

| メーカー希望小売価格 | オープン価格 |

| メーカー発売日 | 2018年10月16日 |

| メーカー保証年数 | 3年 |

商品の特徴

■簡易取付式取付け座の取り付けにはビスが必要になります。

■回転方向切替可能

冷房時・暖房時で回転方向を切り替え、快適な空調環境をお届けします。

■風量三段階切替可能

■別売延長パイプ使用時のみ傾斜天井使用可能>

■ランプ取付不可>

※リモコンに灯具操作の記載がありますが、当器具はランプ取付不可になります。6721円ASN-009W シーリングファン [リモコン付き]家電・照明照明器具大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

![ASN-009W シーリングファン [リモコン付き]](https://image.biccamera.com/img/00000005954561_A01.jpg)

ASN-009W シーリングファン [リモコン付き]

大光電機 シーリングファン リモコン付 ASN009W : asn-009w : プリズマ

: ビックカメラ](https://www.jreastmall.com/img/goods/S248/L/00000005954561_A01.jpg)

ASN-009W シーリングファン [リモコン付き](ホワイト): ビックカメラ

![大光電機 シーリングファン [リモコン付き] ASN-009W 1台(直送品)](https://cdn.askul.co.jp/img/product/3L1/NW90325_3L1.jpg)

大光電機 シーリングファン [リモコン付き] ASN-009W 1台(直送品)

大光電機(DAIKO)シーリングファン 灯具なし 簡易取付式 ASN-010S

大光電機(DAIKO)シーリングファン 灯具なし 簡易取付式 ASN-009W

大光電機(DAIKO)シーリングファン 灯具なし 簡易取付式 ASN-009W

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

大光電機(DAIKO)シーリングファン 灯具なし 簡易取付式 ASN-010S

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

br>大光電機 シーリングファン ASN-009W - 天井照明

大光電機 シーリングファン リモコン付 ASN009W : y-asn-009w

大光電機(DAIKO)シーリングファン 灯具なし 簡易取付式 ASN-009W

: ビックカメラ](https://www.jreastmall.com/img/goods/S248/1/00000005954561_A02.jpg)

ASN-009W シーリングファン [リモコン付き](ホワイト): ビックカメラ

大光電機 シーリングファン リモコン付 ASN009W | 照明専門店 プリズマ

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

大光電機 シーリングファン ASN-009W - その他照明器具

![ASN-010S シーリングファン [リモコン付き] 大光電機|DAIKO 通販](https://image.biccamera.com/img/00000005954562_A01.jpg)

ASN-010S シーリングファン [リモコン付き] 大光電機|DAIKO 通販

Amazon.co.jp : Parrot Uncle シーリングファンライト 照明器具 DC

大光電機 シーリングファン リモコン付 ASN009W | 照明専門店 プリズマ

![ASN-009W シーリングファン [リモコン付き]](https://image.biccamera.com/img/00000005954561_A03.jpg)

ASN-009W シーリングファン [リモコン付き]

大光電機 シーリングファン リモコン付 ASN009W : asn-009w : プリズマ

大光電機 シーリングファン 簡易取付式 ASN-009W ホワイト - その他

オンラインネット #407 大光電機(DAIKO)シーリングファンASN-009W

Amazon | 大光電機(DAIKO)シーリングファン 灯具なし 簡易取付式 ASN

シーリングファン 大光電機(DAIKO)シーリングファン 灯具なし 簡易取付

DAIKO シーリングファン 簡易取付式 (リモコンスイッチ付) 本体白

Amazon.co.jp : Parrot Uncle シーリングファンライト 照明 ファン

楽天市場】DAIKO シーリングファン 簡易取付式 (リモコン

Amazon | 大光電機(DAIKO)シーリングファン 灯具なし 簡易取付式 ASN

DAIKO シーリングファン 簡易取付式 (リモコンスイッチ付) 本体白

楽天市場】DAIKO シーリングファン 簡易取付式 (リモコン

br>大光電機 シーリングファン ASN-009W - 天井照明

DAIKO シーリングファン 簡易取付式 (リモコンスイッチ付) 本体白

Amazon | 大光電機 DAIKO シーリングファン 灯具なし リモコン付 羽根

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています