[ad_1]

I referred to as it!

I told my readers six months in the past that the U.S. authorities was on the point of make a completely traceable digital greenback, in any other case generally known as a central financial institution digital foreign money (CBDC).

The Federal Reserve simply introduced step one towards our new digital foreign money.

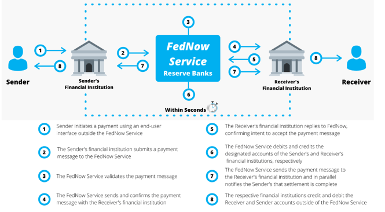

In July, the Fed will formally launch its FedNow Service. In line with the press release, this service will “facilitate nationwide attain of immediate fee companies by monetary establishments — no matter measurement or geographic location — across the clock, on a regular basis of the yr.”

That’s a flowery means of claiming that the federal government will be capable to immediately fund — or defund — financial institution accounts with the press of a mouse.

Underneath the guise of serving to shoppers get their tax refunds or future stimulus checks sooner, the Federal Reserve is seizing much more energy.

Because the Fed seems so as to add individuals to this community, it’s gearing up for its final purpose.

Shifting from a paper greenback … to a digital greenback.

At present, I’m going to put out simply what meaning for you…

The Central Financial institution Digital Forex Is Right here

FedNow is the precursor to the central financial institution digital foreign money.

The Fed’s latest venture creates a system for government-to-consumer and consumer-to-government funds.

(From Klaros Group.)

It additionally permits for person-to-person funds.

If you happen to suppose that sounds acquainted, it ought to — as a result of that’s precisely what bitcoin (BTC) was created to do. And but, FedNow is the precise reverse.

Whereas bitcoin transactions are processed by a decentralized community of computer systems, FedNow transactions will undergo the final word centralized management mechanism: the Fed’s personal server.

It provides the Fed management of the creation (and destruction) of cash. This may enable it to regulate who pays whom and who pays what.

Finally, the Fed needs a digital greenback as a result of it provides them extra energy to create cash. This may give them the flexibility to observe each transaction within the monetary system.

You see, for the Fed, a digital greenback solves a giant downside. It makes damaging rates of interest attainable.

Think about having cash in a financial savings account that loses a small proportion yearly. It’s as if there was an expiration date in your cash!

The Fed can’t do that now for one huge cause: Individuals would take their cash out of the banks and retailer it elsewhere.

However with a digital greenback, damaging rates of interest are attainable.

And the FedNow system is the start of this rollout.

It’s not simply occurring in America, both.

Twenty-nine international locations have already applied Central financial institution digital currencies or pilot packages. Amongst them are China, India, Nigeria, Jamaica, the Bahamas, UAE, Australia, Singapore and Thailand, with 114 more exploring them.

However all of us now have an choice to struggle again.

For the final decade, an alternate financial system has quickly grown. It’s one that may hold observe of who owns what without having a centralized middleman, like a financial institution or a authorities.

It’s so highly effective that governments are attempting to limit its possession by suing the exchanges that enable residents to purchase it.

I’m speaking about bitcoin.

The Key to Bitcoin’s Future: Fed Worry

The Fed’s most up-to-date transfer to launch the FedNow system is why bitcoin’s day has come.

As we’ve been discussing right here in The Banyan Edge, a banking disaster is unfolding all over the world.

Look what’s occurred over simply the previous few weeks:

- Silicon Valley Financial institution succumbed to a classic bank run, adopted by the shutdown of Signature Financial institution.

- One other regional financial institution, First Republic Financial institution, needed to be propped up.

- Credit score Suisse narrowly averted the same destiny when it was taken over by UBS.

- All informed, these financial institution rescues have value greater than $400 billion to date.

However the issue we face is totally different from different monetary crises of the previous. Whereas historical past may not repeat itself, it does typically rhyme.

Though the federal government has put out the fireplace for now, it wouldn’t take a lot to ignite one other run on small banks. On this new digital age, it takes only some minutes for a depositor to open an account at a bigger financial institution and make the transfer.

And what this creates is a system the place a greenback in a smaller regional financial institution may successfully be price lower than a greenback at JPMorgan. Just because the financial institution is seen as increased threat.

It’s similar to the European debt disaster of 2011, the place depositors had been making an attempt to get their cash out of Portugal, Eire, Greece and Spain and transfer it to banks in safer international locations like Germany and France.

This is the reason the digital greenback is so necessary to the Fed. It needs to make sure that a greenback in a single financial institution is price the identical as a greenback in one other financial institution.

A digital greenback would enable depositors to right away transfer them to the “Digital Financial institution of the Fed.”

The Fed can’t afford one other monetary disaster. That’s why it’s been engaged on its so-called “Project Hamilton” for years. It needs to regulate our greenbacks — and if it has to fake it’s making life simpler for us, it’s going to.

However this time, the central financial institution’s response will ignite the flame that spreads bitcoin possession all over the world.

Right here’s Why Bitcoin Will Revolutionize the World

I’m already beginning to see the seeds of a crypto revolution underway.

You see, bitcoin isn’t managed by any governments. (Though most want they may ban it!)

Its provide is capped, and it’s a hedge in opposition to extreme financial printing.

It could carry out all of the features of cash:

- A retailer of worth.

- A unit of account.

- A method of trade.

And persons are catching on to bitcoin as an alternative choice to the mainstream.

Bitcoin has run up 20% over the previous month.

As of this writing, over 44 million individuals own bitcoin. That’s up 10 million only a yr in the past!

It’s all enjoying into what I see as backlash in opposition to authorities overreach.

With bitcoin, you may really work together peer-to-peer — with out worrying a couple of centralized entity operating in to take their piece of the pie.

It’s the Fed’s biggest concern.

That’s why crypto has reached its “turning level.” I consider it is going to be essentially the most disruptive power of the last decade.

And it doesn’t finish with bitcoin. There’s a strong decentralized monetary system underway that recreates all of conventional finance on the blockchain.

If you happen to’d prefer to be part of this revolution, just click here. It’s so simple as clicking a button.

Regards, Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

Do Banks Ever Truly Make Cash?

“No financial institution ever really makes cash.”

Generally you hear a remark that actually makes you cease and suppose. My pal Carlos has a expertise for delivering them.

He was on the town over the weekend, and we had been having a drink in one of many dozen cafes that line Lima’s Avenida Miguel Dasso. It’s at all times after the second or third Negroni that the dialog will get fascinating.

“They by no means really earn a revenue,” Carlos continued. “Each 10 years, they’ve a disaster and find yourself shedding every thing they made in that point. Then, they begin over with contemporary capital, and do the very same factor once more.”

You understand, Carlos has some extent. It’s not essentially each 10 years on the nostril, and a few banks clearly do a greater job than others in avoiding main blowups. However at the very least on the trade stage, general, it holds true.

Main Crises within the Monetary Sector

The monetary sector actually has simply been one disaster after one other. There was the epic savings and loan debacle (1986 to 1995) that wrecked my native Texas economic system once I was a child. Finland and Sweden each had main banking crises within the early ‘90s.

Mexico had a disaster in ‘94 that worn out a number of Mexican banks earlier than spreading to Chile and Brazil. Economists, ever the comedians, referred to that one because the “tequila hangover.”

There was a banking disaster in a lot of growing Asia in ‘97, adopted by the Russian disaster in ‘98. That one blew up Lengthy-Time period Capital Administration, and practically took down most of Wall Road with it.

I’ve misplaced depend of what number of banking crises Argentina has had. If it had a brand-new one subsequent Tuesday, would anybody be shocked?

After which, after all, there was the 2008 meltdown, which prompted financial institution failures all over the world and gave us the deepest world recession for the reason that Nineteen Thirties.

These are simply those I bear in mind. Only for enjoyable, I looked for a listing of those occasions, and I discovered that there actually is nothing new beneath the solar. There was a serious banking disaster in 33 A.D., by which banks throughout the Roman Empire failed.

Evidently we’ve made no actual progress in organizing a worldwide banking system up to now 2,000 years.

This begs the query: Do banks ever really become profitable?

Or was Carlos proper, and the “earnings” merely borrow in opposition to the following inevitable disaster?

Let’s get rather less philosophical and a little bit extra sensible. I’ve been writing for weeks now that in an abundance of warning, it is smart to maintain your checking account balances beneath the FDIC insured quantity of $250,000. I additionally suppose it additionally is smart to personal a small place of physical gold — locked away someplace secure.

Ian lately wrote about bitcoin, calling it your No. 1 hedge against the Federal Reserve. Even he would agree that you simply in all probability don’t need to dump your complete liquid internet price into cryptocurrency.

In his Next Wave Crypto Fortunes service, he recommends a selected allocation quantity to his subscribers, alongside together with his high trades within the crypto area.

FTX’s collapse and the latest SEC investigations into Binance and Coinbase have proven that that is nonetheless the Wild West in some methods. However as Albert Einstein is alleged to have mentioned, the definition of madness is doing the identical factor repeatedly and anticipating a unique end result.

Maybe we must be rather less insane, and never assume our banking system received’t inevitably fail once more.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge

[ad_2]