[ad_1]

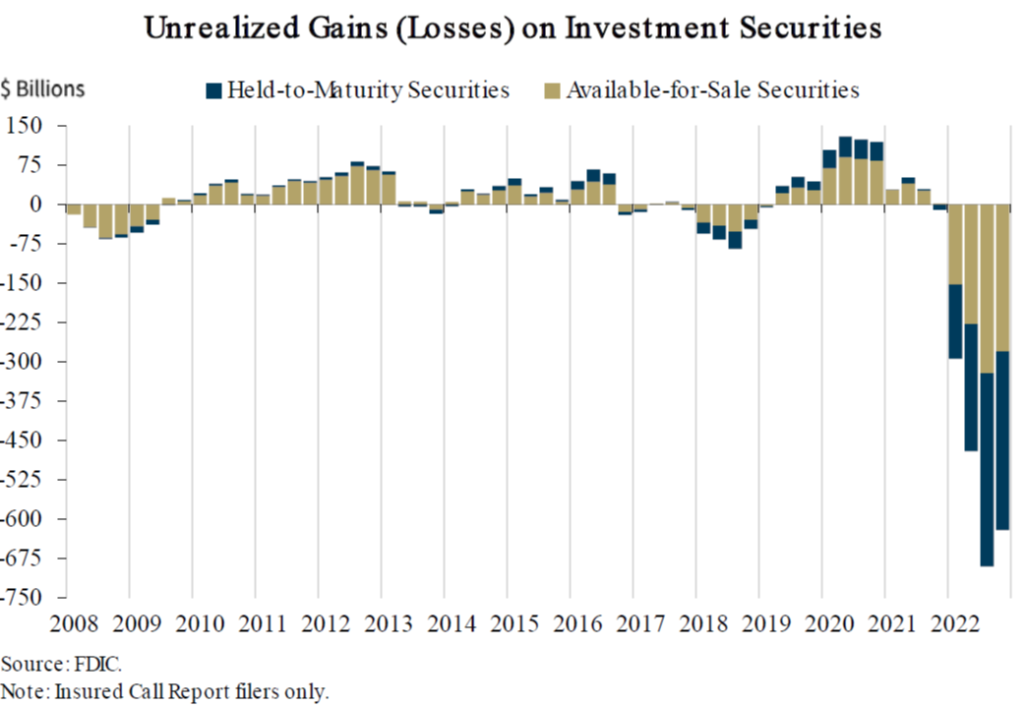

Think about the next graph of unrealized losses on securities held by reporting banks (from Rupkey/Financial Markets This Week):

Supply: Rupkey, “Monetary Markets This Week,” March 20, 2023.

This made me marvel what would make these unrealized losses go to zero? Clearly a discount in rates of interest. I don’t have the info to do the calculation available, however I’ve marketable federal debt at par worth and at market worth. I can take a look at the ratio of these two and the way that ratio strikes with a given rate of interest.

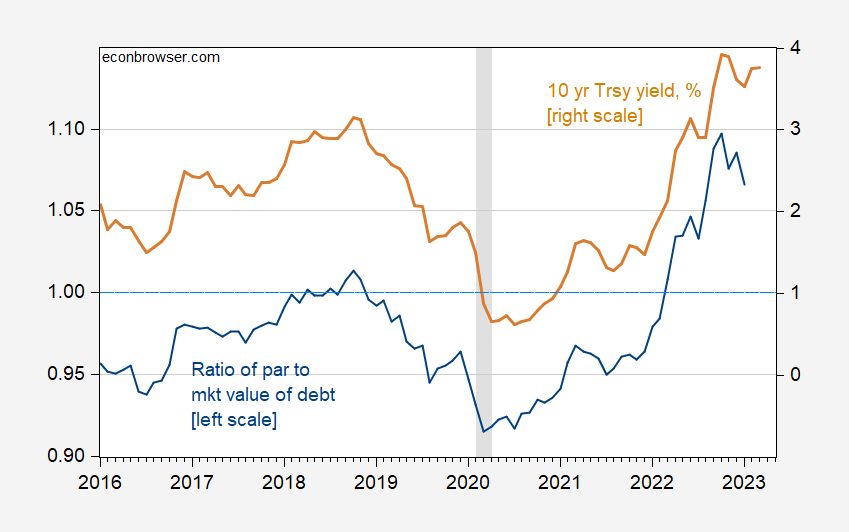

Determine 1: Ratio of par worth of marketable debt to market worth (blue, left scale), and ten yr Treasury yield, % (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: Dallas Fed, Treasury, NBER, and creator’s calculations.

There’s an apparent correlation. From the regression:

ratio = 0.8817 + 0.0455(gs10)

adj-R2 = 0.83, NObs = 85, DW = 0.20

Utilizing this correlation, it seems a ten yr yield of two.6% will do the trick (to date by March, they’re 3.8%, roughly the identical as February). Clearly, that is back-of-the-envelope (and the ratio of par to market is just not the identical because the ratio of bought worth to market worth), however you get the concept if yields fall, a number of the unrealized losses will disappear.

How affordable is that this final result? Not very, however I’ll word that the ten yr price has fallen by half a share level because the starting of the March…

[ad_2]