[ad_1]

Yves right here. Whereas this submit describes flagrant fraud by Medicare Benefit insurers, which might appear to be an “previous individuals in America” downside, the deliberate abuse by AI is a threat everybody ought to fear everybody.

Additionally it is one more reminder that should you can afford the premiums, conventional Medicare is superior to Medicare Benefit. In case you are funds strained, I’d look exhausting on the impression of skipping Medigap v. being undercovered by Medicare Benefit.

This text is exasperating. Word that STAT is on the case and has requested for affected person reviews of Medicare Benefit unwarranted denials of care. However curiously they don’t present a hyperlink. However to not be deterred! Here is the page at STAT which lets you contact STAT editors and writers. The 2 authors of the underlying STAT article are Casey Ross (casey.ross@statnews.com) and Bob Herman (bob.herman@statnews.com).

By run75411. Initially printed at Angry Bear

Kip Sullivan has been writing concerning the points with Medicare Benefit. I’ve joined with Kip in bringing the problems of Medicare Benefit to the forefront. Indignant Bear has featured Kip and I’ve added to the dialogue. This subsequent commentary particulars how Healthcare Insurance coverage, largely Medicare Benefit has been utilizing synthetic intelligence within the type of an algorithm to restrict remedy or deny protection. STAT Investigation has been offering the element from its examine of the problems coming from the misuse of the nH algorithm. This can be a little bit of a rewrite.

Denied by AI: How Medicare Benefit plans use algorithms to chop off look after seniors in want, New York Progressive Action Network (nypan.org), Casey Ross and Bob Herman, March 17, 2023

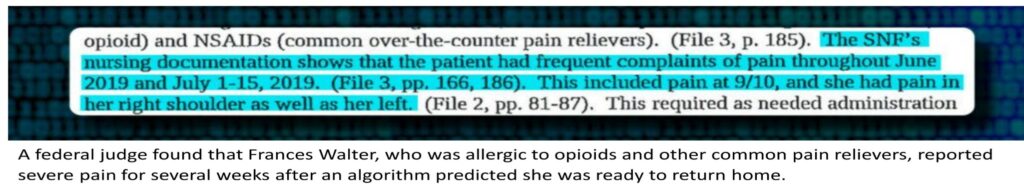

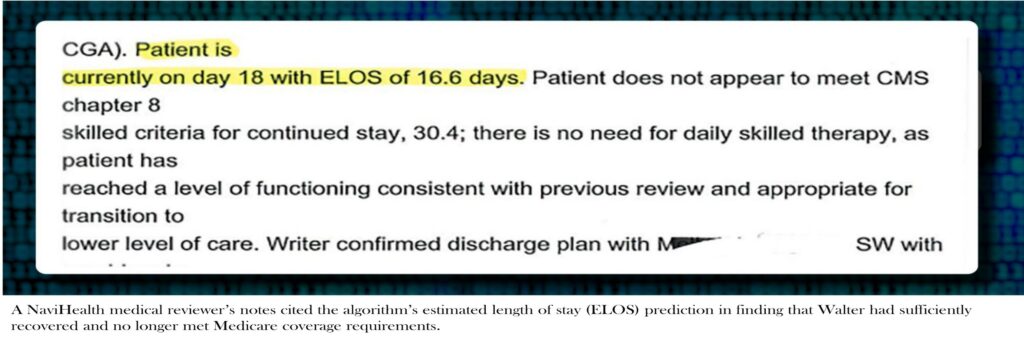

An algorithm (not a health care provider) was predicting a fast restoration of an previous Wisconsin lady with a shattered left shoulder and an allergy to ache drugs. In 16.6 days, it estimated, she could be prepared to go away her nursing house.

On the seventeenth day and following the algorithm, her Medicare Benefit insurer, Safety Well being Plan reduce off cost for her care. From the algorithm outcomes, Safety was concluding she was able to return to the condo the place she lived alone. Medical notes in June 2019 have been exhibiting Walter’s ache was maxing out the scales and that she couldn’t costume herself, go to the lavatory, and even push a walker with out assist.

Greater than a yr would cross earlier than a federal choose determined the insurer’s choice was “at greatest, speculative.” And as such, Walter was owed 1000’s of {dollars} for the greater than three weeks of remedy. She fought the insurer’s denial and whereas doing so, spent down her life financial savings to enroll in Medicaid and was capable of progress to the purpose of placing on her sneakers together with her arm nonetheless in a sling.

Immediately’s insurers are utilizing unregulated predictive algorithms, beneath the guise of scientific rigor, to pinpoint the exact second after they can reduce off cost for an older affected person’s remedy. The denials for remedy are setting off heated disputes between docs and insurers. Denials which may delay remedy of critically in poor health sufferers who’re neither conscious of the algorithms, nor capable of query their calculations.

Older individuals who spent their lives paying into Medicare, are actually going through amputation, fast-spreading cancers, and different devastating diagnoses. They’re left to both pay for his or her care themselves or get by with out it. In the event that they disagree, they will file an enchantment, and spend months attempting to get well their prices, even when they don’t get well from their diseases.

“We take sufferers who’re going to die of their ailments inside a three-month time frame, and we pressure them right into a denial and appeals course of that lasts as much as 2.5 years,” Chris Consolation, chief working officer of Calvary Hospital, a palliative and hospice facility within the Bronx, N.Y., mentioned of Medicare Benefit. “So what occurs is the enchantment outlasts the beneficiary.”

The algorithms sit originally of the method, promising to ship customized care and higher outcomes. The affected person advocates say in lots of instances the algorithms do the precise reverse, spitting out suggestions, failing to regulate for a affected person’s particular person circumstances, and battle with primary guidelines on what Medicare plans should cowl.

David Lipschutz, affiliate director of the Heart for Medicare Advocacy, a nonprofit group, has reviewed such denials for greater than two years in its work with Medicare sufferers.

“Whereas the corporations say [the algorithm] is suggestive, it finally ends up being a hard-and-fast rule the plan or the care administration corporations actually attempt to observe. There’s no deviation from it, no accounting for modifications in situation, no accounting for conditions through which an individual might use extra care.”

Medicare Benefit has turn out to be very worthwhile for insurers as extra sufferers over 65 and other people with disabilities flock to plans providing decrease premiums and prescription drug protection initially. MA additionally provides the insurers extra latitude to deny and restrict services.

Round these plans and over the past decade, a brand new {industry} has shaped utilizing a theoretical means to foretell what number of hours of remedy sufferers will want, which sorts of docs they may see, and precisely when they are going to be capable to go away a hospital or nursing house. Besides the algorithm ignores the difficulty of no two individuals with the identical dysfunction will reply in a less complicated method to the identical remedy. The straightforward reality of individuals being people has not stopped the healthcare insurance coverage corporations from pigeon – holing individuals into the quantities of time wanted to a treatment or a return to normalcy.

The predictions have turn out to be so integral to Medicare Benefit. the insurers themselves have began buying the makers of essentially the most broadly used instruments. Elevance, Cigna, and CVS Well being (which owns insurance coverage large Aetna) have all bought these capabilities lately. One of many greatest and most controversial corporations behind these fashions, NaviHealth, is now owned by UnitedHealth Group.

It was the NaviHealth’s algorithm suggesting Walter may very well be discharged after a brief keep. Its predictions about her restoration have been referenced repeatedly in NaviHealth’s assessments of whether or not she met protection necessities. Two days earlier than her cost denial was issued, a medical director from NaviHealth once more cited the algorithm’s estimated size of keep prediction — 16.6 days — in asserting that Walter not met Medicare’s protection standards as a result of she had sufficiently recovered, in keeping with information obtained by STAT.

Her insurer, Safety Well being Plan, which had contracted with NaviHealth to handle nursing house care, declined to answer STAT’s questions on its dealing with of Walter’s case, saying that doing so would violate the well being privateness regulation often known as HIPAA.

Walter died shortly earlier than Christmas final yr.

NaviHealth didn’t reply on to STAT’s questions on using its algorithm. However a spokesperson for the corporate in a press release mentioned its protection choices are primarily based on Medicare standards and the affected person’s insurance coverage plan. NaviHealth . . .

“The NaviHealth predict instrument is just not used to make protection determinations. The instrument is used as a information to assist us inform suppliers, households and different caregivers about what kind of help and care the affected person might have each within the facility and after returning house.”

Because the affect of those predictive programing has unfold, a latest federal inspectors examination of denials made in 2019 discovered that personal insurers repeatedly strayed past Medicare’s detailed set of rules. As an alternative, they have been utilizing internally developed standards to delay or deny care.

Because the affect of those predictive programing has unfold, a latest federal inspectors examination of denials made in 2019 discovered that personal insurers repeatedly strayed past Medicare’s detailed set of rules. As an alternative, they have been utilizing internally developed standards to delay or deny care.

However the exact position the algorithms play in these choices has remained opaque.

A STAT investigation revealed these instruments have gotten more and more influential in decision-making about affected person care and protection. The investigation outcomes have been primarily based on a evaluation of a whole lot of pages of federal information, court docket filings, and confidential company paperwork, and interviews with physicians, insurance coverage executives, coverage specialists, legal professionals, affected person advocates, and members of the family of Medicare Benefit beneficiaries.

It discovered, for all of AI’s energy to crunch information, insurers with large monetary pursuits are leveraging it to assist make life-altering choices with little unbiased oversight. AI fashions utilized by physicians to detect ailments similar to most cancers, or recommend the simplest remedy, are evaluated by the Meals and Drug Administration. Insurers utilizing instruments to determine whether or not therapies ought to be paid for or not, usually are not scrutinized in the identical method. Though additionally they affect the care of the nation’s sickest sufferers.

In interviews, docs, medical administrators, and hospital directors described more and more frequent Medicare Benefit cost denials for care routinely lined in conventional Medicare. UnitedHealthcare and different insurers mentioned they provide to debate a affected person’s care with suppliers earlier than a denial. Many suppliers are claiming makes an attempt to acquire explanations obtain clean stares and refusals to share extra data. The black field of the AI has turn out to be a blanket excuse for denials. Amanda Ford, who facilitates entry to rehabilitation providers for sufferers following inpatient stays at Lowell Basic Hospital in Massachusetts. . . .

“That’s proprietary. It’s at all times that canned response: ‘The affected person could be managed in a decrease degree of care.’”

Brian Moore is a doctor and advocate for a affected person’s entry to care at North Carolina-based Atrium Well being. He recollects visiting a stroke affected person who couldn’t transfer to a rehabilitation hospital for 10 days whereas ready for a choice.

“He was sitting there attempting to feed himself.

‘I simply by no means thought after I signed up for Medicare Benefit that I wouldn’t be capable to get the care I want.’

“He was drooling and crying.”

The price of caring for older sufferers recovering from critical diseases and accidents, often known as post-acute care, has lengthy created friction between insurers and suppliers. For many years, services like nursing houses racked up hefty profit margins by conserving sufferers so long as attainable — generally billing Medicare for care that wasn’t obligatory and even delivered. Many specialists argue sufferers are higher off with care at house.

The enactment of the Inexpensive Care Act in 2010 created a possibility for reform. As an alternative of paying for care after the very fact, coverage specialists suggest flipping the cost paradigm on its head. Suppliers could be paid a lump sum upfront. Incentivizing them to make use of fewer assets to ship higher outcomes.

On the time, most Republicans in Congress have been wringing their palms over the brand new regulation and its subsidies to assist low- and middle-income Individuals pay for medical health insurance. Tom Scully, the previous head of the Facilities for Medicare and Medicaid Companies beneath George W. Bush, shared these issues. However he additionally noticed one thing else: a possible billion-dollar enterprise.

Scully drew up plans for NaviHealth simply as the brand new regulation was taking impact. Its cost reforms aligned completely with the Medicare Benefit program he had performed a pivotal position in creating through the Bush administration.

Scully knew how these insurance policy labored. He additionally knew they have been taking a monetary beating in post-acute care. On a podcast in 2020 . . .

“Look, I really like the nursing house guys, however there have been plenty of sufferers popping out of hospitals spending 20 days in a nursing house in MA,” as a result of that’s what Medicare’s guidelines allowed. It was similar to Pavlov’s bell.”

As a well-connected associate on the personal fairness agency Welsh, Carson, Anderson & Stowe, Scully heard of a small store referred to as SeniorMetrix that was engaged on one of these post-acute information and analytics. The agency rapidly received him over.

“That they had an algorithm,” Scully mentioned on the podcast. “I noticed it and mentioned, ‘That is it.’”

He wrote a $6 million test to purchase the corporate, which he rebranded to NaviHealth. Scully then raised $25 million from rich mates and corporations, together with the well being system Ascension and the rehabilitation hospital chain Choose Medical, and coaxed one other $25 million from Welsh Carson.

NaviHealth began making its gross sales pitch to Medicare Benefit plans: Allow us to handle every bit of your members’ look after the primary 60 to 90 days after they’re discharged from the hospital, and we’ll all share in any financial savings.

The sweetener was the know-how. One of many firm’s core merchandise is the algorithm nH Predict.

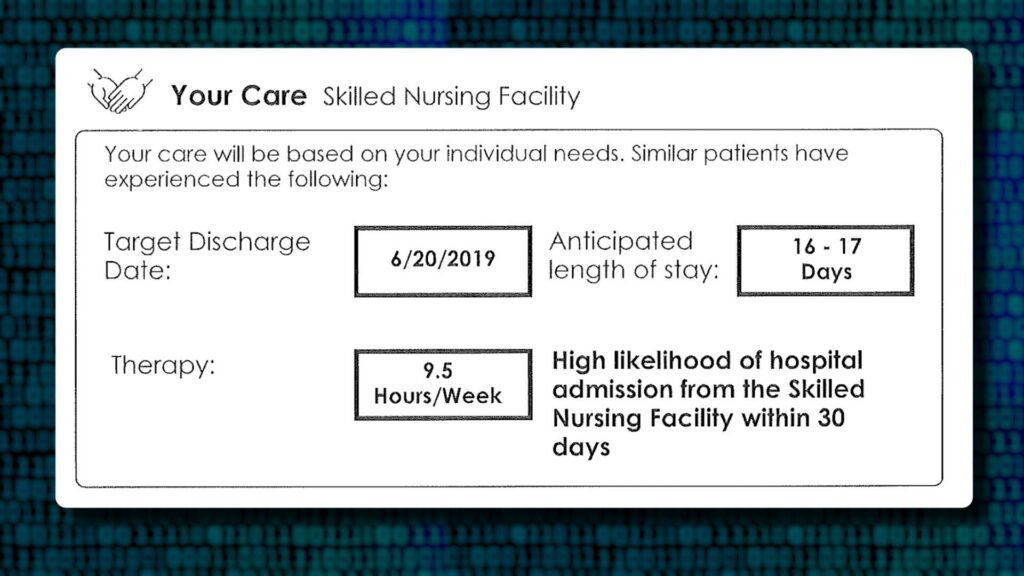

nH Predict makes use of particulars similar to an individual’s analysis, age, dwelling scenario, and bodily perform and compares these attributes to people with comparable attributes. It searches a database of 6 million sufferers compiled over years of working with suppliers. The algorithm generates an evaluation of the affected person’s mobility and cognitive capability, together with a down-to-the-minute prediction of their medical wants, estimated size of keep, and goal discharge date.

In a six-page report, the algorithm boils down sufferers, and their unknowable journey by means of well being care, right into a tidy sequence of numbers and graphs.

The product provides insurers, a strategy to mathematically monitor sufferers’ progress and maintain suppliers accountable for assembly remedy targets. By the summer season of 2015, NaviHealth was managing post-acute look after greater than 2 million individuals whose insurance policy had contracted with the corporate. It was additionally working with 75 hospitals and clinics looking for to extra rigorously handle contracts through which they shared monetary accountability for holding down prices. On the time, spending on post-acute care accounted for $200 billion yearly.

That very same yr, Scully offered NaviHealth to the conglomerate Cardinal Well being for $410 million a quantity roughly eight occasions the funding. In 2018, one other personal fairness agency, Clayton, Dubilier & Rice, upped the ante and paid $1.3 billion to take over NaviHealth. In 2020, UnitedHealth was the biggest Medicare Benefit insurer within the nation. It determined to make the new commodity its personal, shopping for NaviHealth in a deal valued at $2.5 billion.

In an interview with STAT, Scully mentioned the idea behind NaviHealth is “completely right,” as a result of it roots out wasteful spending. He didn’t imagine the algorithms restricted obligatory care. When offered with reporting exhibiting NaviHealth was on the middle of voluminous denials and overturned appeals, Scully mentioned he wasn’t able to touch upon what could have modified since he offered his stake.

“The NaviHealth choice instrument as I knew it — once more, that is eight years in the past — has a spot and is effective. If [it] overdoes it and is inappropriately denying care and sending individuals to the fallacious website of service, then they’re silly, they usually’re solely hurting themselves reputationally. I do not know what United is doing.”

Suppliers informed STAT. As NaviHealth was altering palms and enriching its buyers, they began noticing a rise in denials beneath its contracts. The pendulum had now swung too far within the different path in an effort to stop overbilling ensuring sufferers weren’t getting pointless providers.

Sufferers with stroke problems with signs so extreme they have been needing care from a number of specialists. They have been getting blocked from stays in rehabilitation hospitals. Amputees have been denied entry to care meant to assist them get well from surgical procedures and be taught to stay with out their limbs. And efforts to reverse what appeared to be dangerous choices have been going nowhere. Atrium Well being’s Moore, who leads a crew that makes a speciality of reviewing medical necessity standards, began taking a deeper take a look at the denials.

“It was eye-opening. The variation in medical determinations, the misapplication of Medicare protection standards. It simply didn’t really feel like there [were] excellent quality control.”

He and plenty of different suppliers started pushing again. Between 2020 and 2022, the variety of appeals filed to contest Medicare Benefit denials shot up 58%, with almost 150,000 requests to evaluation a denial filed in 2022, in keeping with a federal database.

Nevertheless, the database fails to seize numerous sufferers who’re unable to push again when insurers deny entry to providers, and solely displays a portion of the appeals even filed. It largely tracks disputes over prior authorization, a course of through which suppliers should search insurers’ advance approval of the providers they advocate for sufferers.

In feedback to federal regulators and interviews with STAT, many suppliers described inflexible standards utilized by NaviHealth. Standards which workout routines prior authorization on behalf of the nation’s largest Medicare Benefit insurers, together with its sister firm UnitedHealthcare in addition to Humana and a number of other Blue Cross Blue Defend plans.

Christina Zitting, a case administration director for a neighborhood hospital of San Angelo, Texas wrote;

“NaviHealth is not going to approve [skilled nursing] should you ambulate not less than 50 ft. Nevermind that you could be stay alon(e) or have poor steadiness.”

She added:

“MA plans are a shame to the Medicare program, and I encourage anybody signing up..to keep away from these plans as a result of they do NOT have the sufferers greatest curiosity in thoughts. They’re right here to make a revenue. Interval.”

Federal information present most denials for expert nursing care are finally overturned. The plan itself or an unbiased physique adjudicating Medicare appeals would accomplish that.

However even sufferers who win authorization for nursing house care should reckon with algorithms that insurers and care managers like NaviHealth use to assist determine how lengthy they’re entitled to remain. Below conventional Medicare, sufferers who’ve a three-day hospital keep are usually entitled to as much as 100 days in a nursing house.

With using the algorithms, nevertheless, Medicare Benefit insurers are slicing off cost in a fraction of that point. Christine Huberty, a lawyer in Wisconsin who gives free authorized help to Medicare beneficiaries . . .

“It occurs in each one of these instances.”

She mentioned Medicare Benefit sufferers she represents hardly ever keep in a nursing house greater than 14 days earlier than they begin receiving cost denials. Huberty typically solely finds a report after submitting a authorized criticism.

“However [the algorithm’s report] is rarely communicated with shoppers. That’s all run secretly.”

NaviHealth mentioned the findings of the algorithm, if not the report itself, are routinely shared with docs and sufferers to assist information care.

A Director at one post-acute facility mentioned denials from UnitedHealthcare and NaviHealth are actually the norm for a lot of of their sufferers, even when they’re clearly sicker than what the algorithm initiatives.

“They’re taking a look at our sufferers by way of their statistics. They’re not trying on the sufferers that we see.”

He requested to stay unnamed to keep away from jeopardizing relationships with Medicare Benefit plans. And when insurers deluge suppliers with denials,

“they’re hoping that their endurance is larger than ours.”

NaviHealth has not printed any scientific research assessing the real-world efficiency of its nH Predict algorithm. And to the extent it assessments its efficiency internally, these outcomes usually are not shared publicly.

Moreover, regulators don’t monitor these algorithms for equity or accuracy, however the industry-wide blowback has compelled the federal government to contemplate appearing. Federal Medicare officers proposed new rules in December saying Medicare Benefit insurers can’t deny protection “primarily based on inner, proprietary, or exterior scientific standards not present in conventional Medicare protection insurance policies.” Insurers additionally must create a “utilization administration committee” that critiques their practices yearly.

However even these proposals would nonetheless enable insurance coverage corporations to “create inner protection standards,” so long as they’re “primarily based on present proof in broadly used remedy tips or scientific literature that’s made publicly accessible.”

Main lobbying teams for medical health insurance corporations such because the America’s Well being Insurance coverage Plans, the Higher Medicare Alliance, and the Alliance of Group Well being Plans didn’t make anybody accessible for interviews. As an alternative, the teams referred to feedback they despatched to Medicare supporting some, however not all, of those authorities proposals. AHIP, for instance, urged Medicare “to not undertake insurance policies that might place limits on plan flexibility to handle post-acute care.” Closing laws are due this spring.

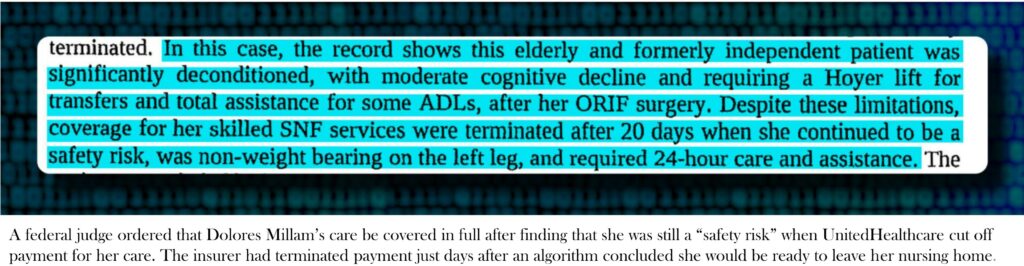

If issues concerning the algorithms have begun to floor in authorized filings and public letters to Medicare, they continue to be virtually completely out of sight for sufferers like Dolores Millam, who fell and broke her leg on a summer season day in 2020.

After surgical procedure, she started her keep in a Wisconsin nursing house on Aug. 3. Like many older sufferers, Millam arrived with a sophisticated medical historical past, together with coronary artery illness, diabetes, hypertension, and continual ache, in keeping with court docket information. Her physician had ordered that she keep off her leg for not less than six weeks.

Nonetheless, an algorithm utilized by her insurer, UnitedHealthcare, predicted she would solely want to remain for 15 days, till about Aug. 18, in keeping with information obtained by STAT.

Only a couple days after that date, Millam obtained discover the cost for her care had been terminated. It was 4 p.m. on a Friday. Millam’s daughter, Holly Hennessy, who additionally obtained the discover mentioned . . .

“I will need to have made — I’m not kidding — 100 cellphone calls simply to determine the place she might go [and] why this was occurring.”

She mentioned she couldn’t fathom UnitedHealthcare’s conclusion that her mom, who was unable to maneuver and even go to the lavatory on her personal, not met Medicare protection necessities. Hennessy added . . .

“You attempt to name and purpose with anyone and get explanations, and also you’re speaking to anyone within the Philippines. It’s merely a course of factor to them. It has nothing to do with care.”

UnitedHealthcare declined to debate its dealing with of Millam’s care, asserting that doing so would violate federal privateness guidelines.

When she obtained the denial, Millam couldn’t put weight on her left leg and was being moved with a Hoyer carry, a big, freestanding harness used to move sufferers who can’t use their legs. She additionally required 24-hour care to assist with dressing, consuming, and different primary duties, in keeping with court docket information.

In a observe filed after cost was denied, a speech therapist wrote.

“Pt. is just not but secure to stay independently. She is going to want help with treatment administration and supervision with ADLS [activities of daily living] because of reminiscence deficits making her unsafe.”

Hennessy mentioned she had no alternative however to maintain her mom within the nursing house, Evansville Manor, and hope the cost denial would get overturned. By then, the payments have been rapidly piling up.

Medicare guidelines name for a five-stage enchantment course of. The primary enchantment goes on to the insurer. If denied, the affected person can ask an out of doors entity often known as a “high quality enchancment group” to rethink.

Hennessy and her mom have been denied at each ranges, forcing them to contemplate an enchantment to a federal choose, a course of that takes months and requires filling out reams of paperwork. Someplace in her blitz of cellphone calls, Hennessy heard concerning the Larger Wisconsin Company on Getting older Sources, which agreed to take up her case.

In late October, Millam returned house from the nursing house after a virtually three-month restoration. The invoice was virtually $40,000. A number of days later, her enchantment got here earlier than a choose.

Hennessy, who was driving to Florida on the time, recollects pulling over for the listening to, which was held through Zoom.

The choose solely requested a handful of questions of the household and representatives from the nursing house. If there was any participation from UnitedHealthcare, its opinions weren’t talked about within the official file. Court docket paperwork solely reference a discovering from the standard enchancment group, Livanta, which had asserted that Hennessy’s mom had no “medical points to help the necessity for every day expert nursing care” when the cost denial was issued in early August.

The ultimate ruling, issued on Nov. 25, discovered as an alternative that it was the insurer that hadn’t given any good purpose to disclaim look after a affected person who was nonetheless “a security threat.” The choose mentioned her remedy ought to be paid for in full.

Within the months afterward, Hennessy herself crossed the age threshold into Medicare eligibility. She mentioned a good friend who offered Medicare Benefit plans had at all times anticipated to get her enterprise when she turned 65. Hennessy recalled.

“I simply informed him, ‘I can’t do it. I’ve lived this nightmare.’”

The dialog ended their friendship, till the neighbor referred to as again a pair years later following a battle along with his personal Medicare Benefit insurer over a knee substitute. Hennessy mentioned

“He referred to as me to apologize for having gotten so bent out of form. I’ve nonetheless bought mates who say, ‘Oh, I’ve bought UnitedHealthcare Benefit, and it’s fantastic.’”

She mentioned:

“Nicely, it’s. Till you want the massive stuff.’”

And also you become older . . .

When Synthetic Intelligence in Medicare Benefit Impedes Entry to Care: A Case Research – Center for Medicare Advocacy, C. St. John and E. Krupa

STAT is investigating denials and appeals in Medicare Benefit, and the position that know-how performs in these choices. When you have an expertise with Medicare Benefit denials, please share your story with us. We is not going to share your title or story with out your permission.

[ad_2]