カメラ付きLEDセンサーライト CSL1000

(税込) 送料込み

商品の説明

センサーライトにカメラを搭載 スマートフォンから映像確認 カメラ付きLEDセンサーライト

CSL-1000商品スペック

| 電源 | AC100V 50/60Hz |

|---|

基本情報

| 商品名 | カメラ付きLEDセンサーライト CSL1000 |

|---|---|

| 型番 | CSL1000 |

| メーカー | キャロットシステムズ|CARROT SYSTEMS(メーカーサイトへ) |

| 商品コード | 6624394 |

| メーカー希望小売価格 | オープン価格 |

| メーカー保証年数 | 1年 |

商品の特徴

特長センサーライトに防犯カメラを搭載したモデルの登場!

照明機能による防犯と専用アプリで映像確認と録画が可能!

※ ご利用にはスマートフォンとWi-Fi(インターネット)環境が必要になります。

4G/LTEなどのWi-Fi接続以外でのご利用の場合、スマートフォンの通信料がかかります。

録画の際は別途、記録媒体(microSDカード)をお求めいただく必要があります。

全く新しいセンサーライト

優しい灯りの面発光LED

LEDならではのフラットなデザイン。

1000ルーメンの明るさを持ちながら面発光にすることでまぶしさを抑えたやさしい明かりで照らします。

日々の灯りとして活躍(常夜灯機能)

玄関先を照らす常夜灯として日々の灯りとして活用することもできます。

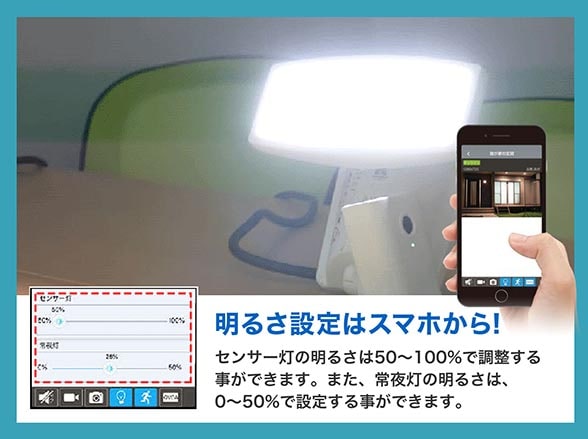

常夜灯は1%?50%の範囲で調光してお好みの明るさで点灯できます。

全てスマートフォンから

全ての操作はスマートフォンから行います。

最寄り駅に着いたらライトを点灯、家を出たらライトを消灯etc どこにいても操作できます。

映像の確認と録画

ご自宅のWi-Fi環境に接続することで家の外からライト周辺の映像確認ができます。

また、センサーの検知に合わせて録画も行えます。

iOS/Androidに対応

専用アプリ「InstaHome」

ご家族で異なるスマートフォンをお使いでも問題ありません。

本機の専用アプリ「InstaHome」はiOS/Androidの両方に対応。

それぞれの端末からご利用いただけます。

※ iOS版はApp Store、Android版はGoogle playからそれぞれ無償でダウンロードして利用することができます。

Wi-Fi接続時以外はスマートフォンのパケット通信料がかかります。

専用アプリ「InstaHome」は、iOS10以上、Android4.0以上に対応しています。

すべての端末での動作を保証するものではありません。

2つの接続モード

ダイレクト接続※1

カメラとスマートフォンを1対1で接続するモードです。

カメラの設定や映像の確認などを行いたいときに都度接続します。

通信距離は最大で12m程度となります。

Wi-Fi 接続ができるインターネット環境がなくても利用可能です。

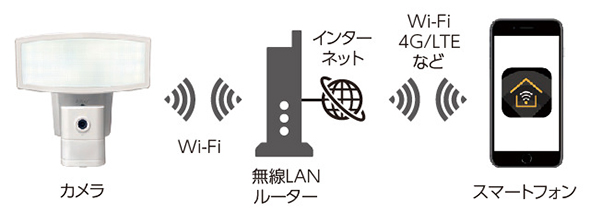

Wi-Fi 接続( リモートアクセス)※2

カメラをWi-Fiに接続しておくことで、外出先などの遠隔地から映像を確認したり、ライトの点灯、消灯を行うことができます。操作はお手持ちのスマートフォンに専用のアプリをインストールして行います。

※1 遠隔地から本機の操作をすることはできません。

※2 リモートアクセス機能を利用するには、本機側にWi-Fi 接続ができるインターネット環境およびスマートフォンの通信料が必要です。

専用ブラケットでかんたん取付

それぞれの取付場所に応じた専用のブラケットを同梱。設置場所の選択肢が広がります。

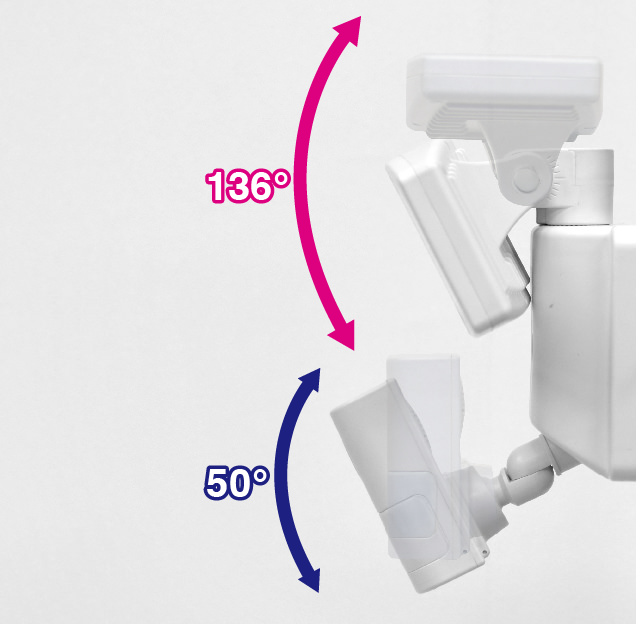

向き調整も自在

LEDライトとカメラ&センサー部分はそれぞれ独立可動する設計。

ライトの照射方向とカメラの撮影方向を個別に調整することができます。

配線は電源1本だけ

通常のセンサーライト同様、AC100Vコンセントに電源ケーブルを接続するだけで使えます。14508円カメラ付きLEDセンサーライト CSL1000工具・DIY・防犯・防災・金庫防犯用品センサーライト LED 防犯カメラ搭載型【CSL-1000】

CSL-1000 | 製品情報

キャロットシステムズ カメラ付きLEDセンサーライト CSL-1000 ホワイト 中

楽天市場】防犯カメラ付きLEDセンサーライト CSL-1000 スマートフォン

カメラ付きLEDセンサーライト CSL1000(CSL1000): ビックカメラ|JRE MALL

CSL-1000】キャロットシステムズ製 カメラ付きLEDセンサーライト(代引

CSL-1000 | 製品情報

CSL-1000 | 製品情報

センサーライト LED 防犯カメラ搭載型【CSL-1000】

スマホ対応Wi-Fi機能搭載カメラ付LEDセンサーライト CSL-1000 : csl

楽天市場】防犯カメラ付きLEDセンサーライト CSL-1000 スマートフォン

スマホ対応Wi-Fi機能搭載カメラ付LEDセンサーライト CSL-1000 : csl

CSL-1000 | 製品情報

カメラ付きLEDセンサーライト CSL1000 キャロットシステムズ|CARROT

LEDセンサーライト カメラ付き ダイレクト接続可能 キャロツト CSL

楽天市場】キャロットシステムズ カメラ付きLEDセンサーライト CSL

スマホから映像確認☆カメラ付き☆センサーライト☆ CSL-1000 - カメラ

![楽天市場】[100円クーポン] 送料無料 センサーライト 屋外 防滴 防犯](https://tshop.r10s.jp/aru/cabinet/thum/csl-1000.jpg)

楽天市場】[100円クーポン] 送料無料 センサーライト 屋外 防滴 防犯

CSL-1000 | 製品情報

スマホ対応Wi-Fi機能搭載カメラ付LEDセンサーライト CSL-1000

楽天市場】キャロットシステムズ カメラ付き LEDセンサーライト

スマホから映像確認☆カメラ付き☆センサーライト☆ CSL-1000 - カメラ

防犯カメラ センサーライト LED 一体型 電源 防雨 屋外 CSL-1000 : csl

スマホ対応Wi-Fi機能搭載カメラ付LEDセンサーライト CSL-1000

CSL-1000 | 製品情報

当日発送品 Alter csl-1000 LEDセンサー防犯カメラ付 | www

楽天市場】キャロットシステムズ カメラ付きLEDセンサーライト CSL

CSL-1000 | 製品情報

センサーライト LED 防犯カメラ搭載型【CSL-1000】: 販売終了商品

楽天市場】キャロットシステムズ カメラ付きLEDセンサーライト [CSL

スマホ対応Wi-Fi機能搭載カメラ付LEDセンサーライト CSL-1000 : csl

スマホ対応Wi-Fi機能搭載カメラ付LEDセンサーライト CSL-1000

楽天市場】メーカー直販 保証2年 センサーライト付きカメラ

防犯カメラ付きLEDセンサーライト CSL-1000 スマートフォンから映像確認

Amazon.co.jp : キャロットシステムズ カメラ付きLEDセンサーライト

純正クーポン 【未使用】 防犯カメラ付きLEDセンサーライト CSL-1000

![楽天市場】[100円クーポン] 送料無料 センサーライト 屋外 防滴 防犯](https://tshop.r10s.jp/aru/cabinet/page/csl1000_8.jpg)

楽天市場】[100円クーポン] 送料無料 センサーライト 屋外 防滴 防犯

スマホ対応Wi-Fi機能搭載カメラ付LEDセンサーライト CSL-1000 : csl

純正クーポン 【未使用】 防犯カメラ付きLEDセンサーライト CSL-1000

スマホ対応Wi-Fi機能搭載カメラ付LEDセンサーライト CSL-1000

CSL-1000】キャロットシステムズ製 カメラ付きLEDセンサーライト(代引

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています