[ad_1]

London

CNN

—

Europe’s banking shares tumbled Friday as traders acted on their lingering worries that the current crises at some banks might spill over into the broader sector.

Europe’s Stoxx Europe 600 Banks index, which tracks 42 massive EU and UK banks, closed 3.8% decrease. The index is down 18% from its excessive in late February. London’s bank-heavy FTSE 100 index closed down 1.3%.

Shares in Germany’s greatest financial institution, Deutsche Financial institution

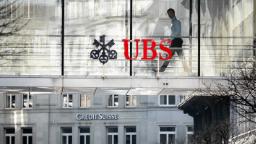

(DB), plunged as a lot as 14.5% earlier than paring its losses to shut 8.6% decrease. Shares in UBS

(UBS) and Credit score Suisse

(CS) had been 3.6% and 5.2% down respectively.

The price of insuring towards a attainable default by Deutsche Financial institution on its debt has soared in current days. Deutsche’s five-year credit score default swaps (CDS) skyrocketed to 203 foundation factors Thursday, in accordance with knowledge from S&P Market Intelligence. That’s their highest stage since early 2019.

The swaps rose once more Friday to commerce at 208 foundation factors at noon ET.

German Chancellor Olaf Scholz mentioned Friday that there was “no motive to be involved” about Deutsche Financial institution.

“It’s a really worthwhile financial institution,” he informed reporters in Brussels, the place EU leaders issued a joint assertion describing the European banking system as “resilient, with sturdy capital and liquidity positions.”

Deutsche Financial institution declined to remark.

“The rising value of insuring CDS senior debt is weighing on Deutsche Financial institution, in addition to different European banks, on considerations over the impression of rising charges on the broader economic system and banks’ stability sheets,” Michael Hewson, chief market analyst at CMC Markets, informed CNN.

Final week, the European Central Financial institution caught with its plan to hike interest rates by half a proportion level, judging that inflation posed a much bigger risk to the economic system than current turmoil within the banking sector.

Then, on Thursday, the Financial institution of England raised its principal rate of interest by 1 / 4 of a proportion level after knowledge confirmed a surprise spike in inflation final month.

However Susannah Streeter, head of cash and markets at investing platform Hargreaves Lansdown, informed CNN that market nerves had been out of step with actuality.

“Worries about contagion are once more rearing up although extra deposits seem to have been flowing into the German lender because the banking scare erupted, and it’s thought to have capital reserves properly in extra of regulatory necessities,” she mentioned.

Some analysts mentioned traders had been rattled by Deutsche Financial institution’s announcement Friday that it might pay again one among its bonds 5 years earlier than its maturity date. Buyers would often interpret such a transfer as an indication that an organization is in good monetary well being and capable of pay again its collectors early.

However — after two financial institution collapses in the USA and an emergency takeover of Credit score Suisse this month — some traders might have interpreted the announcement as an indication that Deutsche Financial institution is nervous concerning the state of the banking sector and attempting to overcompensate, Jonas Goltermann, deputy chief markets economist at Capital Economics, informed CNN.

Goltermann mentioned the financial institution’s choice “appears to have backfired.”

Deutsche Financial institution’s choice to pay again the bond forward of schedule was pre-planned and never a response to current market developments, a supply acquainted with the matter informed CNN. The bond would have regularly misplaced its eligibility as a type of regulatory capital in accordance with guidelines introduced in after the 2008 monetary disaster, the supply mentioned.

The financial institution changed the bond by issuing one other bond of the identical kind in February, they added.

Shares of Germany’s Commerzbank

(CRZBF) and France’s Société Générale additionally suffered heavy losses, closing 5.5% and 5.9% decrease respectively.

Final week, Switzerland’s greatest financial institution UBS purchased its embattled Swiss rival for 3 billion Swiss francs ($3.25 billion) in an emergency takeover brokered by the Swiss authorities.

That helped restore some calm to markets rattled by the failure earlier this month of two US regional banks. However traders had been on edge once more Friday.

The falls in UBS and Credit score Suisse come after Bloomberg reported Thursday that the US Division of Justice was investigating whether or not their employees had helped Russian oligarchs evade Western sanctions.

The DOJ had despatched subpoenas to these workers earlier than UBS took over Credit score Suisse, in accordance with the report.

Staff at some main US banks are additionally a part of the probe, Bloomberg mentioned.

Hewson at CMC Markets mentioned “the DOJ probe into UBS is definitely taking part in a component within the share value weak point” in European banks.

UBS and Credit score Suisse declined to remark to CNN.

[ad_2]