[ad_1]

When former Governor of the Financial institution of England, Mark Carney, warned that international financials had been systemically peddling the world’s most carbon-heavy tasks, the paving for the Partnership for Carbon Accounting Financials (PCAF) was laid.

“To realize net-zero, we want an entire financial system transition–each firm, each financial institution, each insurer, and investor must alter their enterprise fashions, develop credible plans for the transition and implement them. For monetary companies, meaning reviewing greater than the emissions generated by their very own enterprise exercise. They have to measure and report the emissions generated by the businesses they put money into and lend to.”

—Mark Carney, because the Prime Minister’s Finance Adviser for COP26 and observer to PCAF.

What’s the Partnership for Carbon Accounting Financials?

Originating with the Dutch in 2015, the PCAF is touted as a collaborative effort born out of the finance business to allow asset managers and homeowners, banks, and insurers to measure and disclose carbon emissions. However crucially, not the emissions from their personal enterprise actions, however these related to their lending, insuring, and funding actions.

The PCAF launched the Global Greenhouse Gas Accounting and Reporting Standard for the Financial Industry to facilitate transparency and accountability of monetary establishments to scientifically-founded targets, to align their portfolios to the Paris Settlement.

The usual is endorsed by the Greenhouse Gas (GHG) Protocol—essentially the most extensively used greenhouse gasoline accounting requirements. The GHG protocol (and certainly the Taskforce for Climate-related Financial Disclosure) advises {the marketplace} of the steps it ought to take to evaluate these emissions—tangible impact-data factors are the place the PCAF is available in. It gives a sensible methodology of implementation—basic accounting methodologies to standardise emissions-measurement approaches particularly for monetary establishments. Which is arguably, essentially the most essential step in making certain that each monetary determination takes local weather change under consideration.

The spectacular uptake is encouraging and can possible solely develop additional as extra central banks and governments proceed to make carbon-emission disclosures necessary for the close to future. On the time of writing, the initiative has greater than 150 signatories from main international monetary institutes, representing over 50 trillion USD in impactful property.

How does the PCAF customary work in observe?

The PCAF has offered the usual as open-source datasets, particular to monetary establishments so that every get together makes use of constant data for calculating the emissions related to totally different asset class. This allows the attribution of emissions from holdings or loans to different organisations in addition to investments in vital properties or tasks.

But, the usual doesn’t prescribe each information level for use—and that is deliberate. As a substitute, it gives the accounting methodology and shares finest observe in utilizing proxy and exterior information sources. Crucially, the PCAF understands that the strategy requires stringent uniformity, however—and that is the important thing to the partnership—not as far as to stifle sector-specific nuances by those that perceive them better of all. While all are categorised as monetary establishments—insurers, traders, and banks deploy capital in fairly other ways. And so, perception into the artwork of accounting these distinctions is fed again into the working group to proceed bettering the methodology and steering for each accuracy and practicality.

The methodology at present covers the asset courses depicted under, the classifications of that are aligned to the EU Sustainable Finance Taxonomy. This makes the PCAF customary as constant and extensively related as doable. The partnership continues to work so as to add extra asset courses to the methodology as we converse, growing the proportion of the market in a position to take part with every launch.

How does the PCAF match into wider carbon accounting?

As Mr Carney says, as soon as monetary emissions are measured, they show their worth to the market as soon as publicly reported (and no, that doesn’t imply being filed away in a darkish, Company-Duty nook of an organization’s web site).

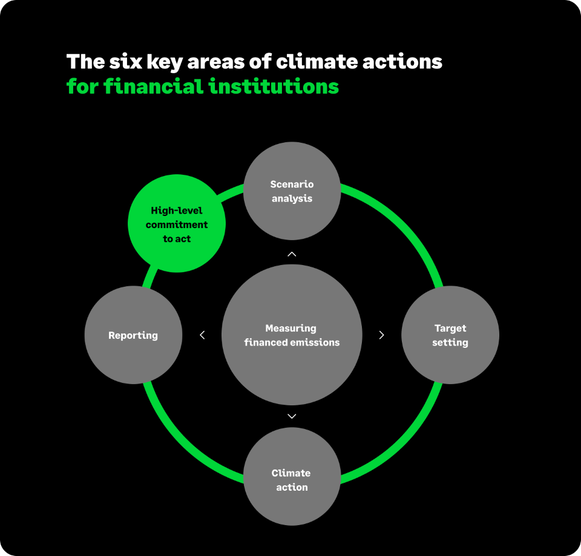

As we’ve explored, the UK treasury has stipulated that the TCFD steering will turn out to be principally necessary by 2023 and absolutely by 2025. So, as displayed under, these PCAF calculations would be the important basis in making these disclosures and different local weather actions doable.

Measuring the finance emissions of a portfolio of funding or loans is core in enabling monetary establishments to carry out:

- state of affairs evaluation

- goal setting

- disclosing progress reviews (to the TCFD and business stakeholders alike)

and, in fact, taking actual motion to succeed in net-zero.

Greatest observe between members of the PCAF: information, course of and tradition

The PCAF is absolutely funded by philanthropists and thus free for financials to hitch. As with many data-garnering initiatives—the measurements are solely nearly as good as these being inputted. The PCAF is conscious that the method to iterate and share finest observe is a useful one and so permits the usage of low-level estimates within the first launch. This permits members to establish the gaps in each their output and course of after which enhance upon every with each disclosure. And therefore the inclusion of a data- high quality rating—whereas, if full accuracy had been mandated, fewer signatories can be possible, and people taking part would possible be doing in order a virtue-signal train over a real dedication to alter.)

The collaborative nature of the PCAF additionally promotes the waves of tradition change to disperse to all areas of the monetary establishment concerned in pulling the submissions collectively. That’s, a climate-related mindset can be inspired all through these monetary establishments, not simply of the output they produce annually.

Strive our answer to answering the calls of monetary transaction environmental transparency

The Sage Earth carbon accountability platform gives a sensible answer that will help you to gather the enterprise information wanted to make such calculations and disclosures.

For enterprise, the device rapidly and simply hyperlinks as much as your accounting software program (or uncooked information) —this spend information is mixed with our in depth carbon depth database to transform kilos spent with a service provider into an estimated carbon-dioxide equal (see methodology right here).

We then take these information factors and construct them up in layers of accelerating element. All through the method, the device seeks so as to add accuracy, completeness, and specificity to your emissions estimate. The software program fills in gaps utilizing accredited exterior information sources, enabling your organisations to not solely adhere however act on the perception gained all through the method.

For asset managers, banks, insurers, and the like, the platform can function as a catch-all reporting dashboard. The info, measured utilizing the above methodology for every enterprise within the portfolio, sits inside a centralised Sage Earth reporting database permitting you, to take inventory of your danger and alternative areas.

Need to know extra about how Sage Earth will help you? Drop your query within the chat or electronic mail us straight.

Do you know that Sage has a brand new Carbon Accounting software program answer?

When you use both Sage Enterprise Cloud Accounting or Sage 50, Sage Earth will help you higher perceive your online business’s environmental influence and information you to web zero emissions.

[ad_2]